Since whales have a tendency to accumulate massive quantities of Bitcoin, one particular holder only demands to transfer above $one.five billion in BTC from a single wallet.

Blockchain.com confirmed a transaction on October four that moved 31,306 BTC, really worth $one,500,784,730 at the time.

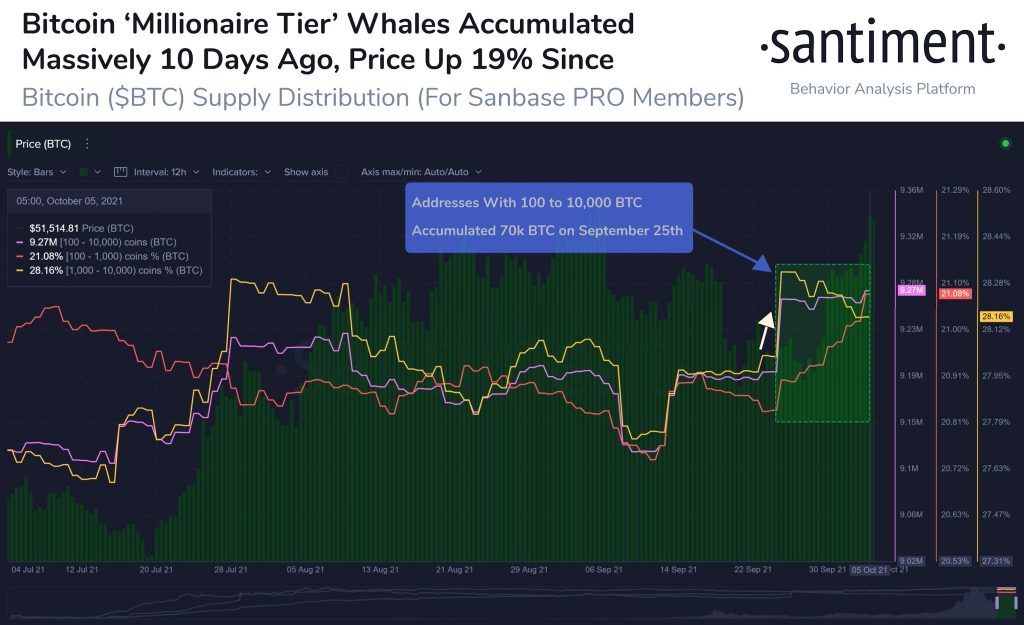

According to Santiment, whale traders lately amassed the biggest volume of BTC in a single day in above two many years. These whales also failed to promote, major the analytics company to think that was what drove BTC over $51,000.

“Bitcoin whale traders holding $a hundred-ten,000 BTC amassed 70,000 BTC ten days in the past, the largest accumulation day for this group due to the fact July 2019. It’s no shock that the rate is moving. progressively back over $51,000 as whales present no indicators of bearishness. “

Bitcoin whales piling up | The supply: mood

Bitcoin is at present trading at $54,717 at press time, up 14% from the October four whale trade, with a latest worth of above $one.seven billion.

Bitcoin wallet just after transaction | The supply: bitinfocharts.com

Bitcoin obtaining an epic week?

Santiment also mentioned that the important cryptocurrency could enter an essential week as it exhibits indicators of on-chain power that could pave the way for an additional important milestone in the coming days.

“Bitcoin targeted visitors exploded final week. One of the most trusted indicators is the amount of tokens circulating on the BTC network, which has hit a weekly substantial due to the fact May. If the index stays substantial, BTC could have an epic week. “.

BTC rate (green) and stock asking rate (orange) | The supply: mood

Token circulation density signifies the amount of coins utilised in a provided time period and offers an overview of the wellness of the asset.

Santiment also mentioned that the provide of Bitcoin on the exchange is at its lowest degree in extra than two many years.

“With the Bitcoin rate falling back to the $50,000 mark for the initially time in four weeks, the ratio of provide involving exchanges has now dropped to its lowest degree due to the fact June four, 2019. Opportunity to mitigate danger of a massive sale stays. lowest in thirty months. “

ETH rate (green) and stock market place bid (pink) | The supply: mood

The 2nd biggest cryptocurrency seems to be following in the footsteps of Bitcoin as the provide on the exchange continues to reduce.

“Despite the sharp drop above the previous two weeks, the provide of ETH in the stock market place continues to decline irrespective of rate movements and is at present at a six-month reduced. So far, the scenario seems to be good as it exhibits that market place gamers are moving into accumulation and HODL mode. “

Join Bitcoin Telegram Magazine to observe information and comment on this write-up: https://news.coincu.com

At dwelling at dwelling

According to AZCoin News

Subscribe to Youtube channel | Crypto News | Follow the Facebook web page

.