On August eleven, 2020, Microstrategy announced the order of 21,454 BTC for $ 250 million. At the exact same time, the business explained it will take into account BTC as a reserve asset. This marks a memorable milestone in cryptocurrency background: when a public business “accepted” Bitcoin for the initially time.

DCA techniques exemplary

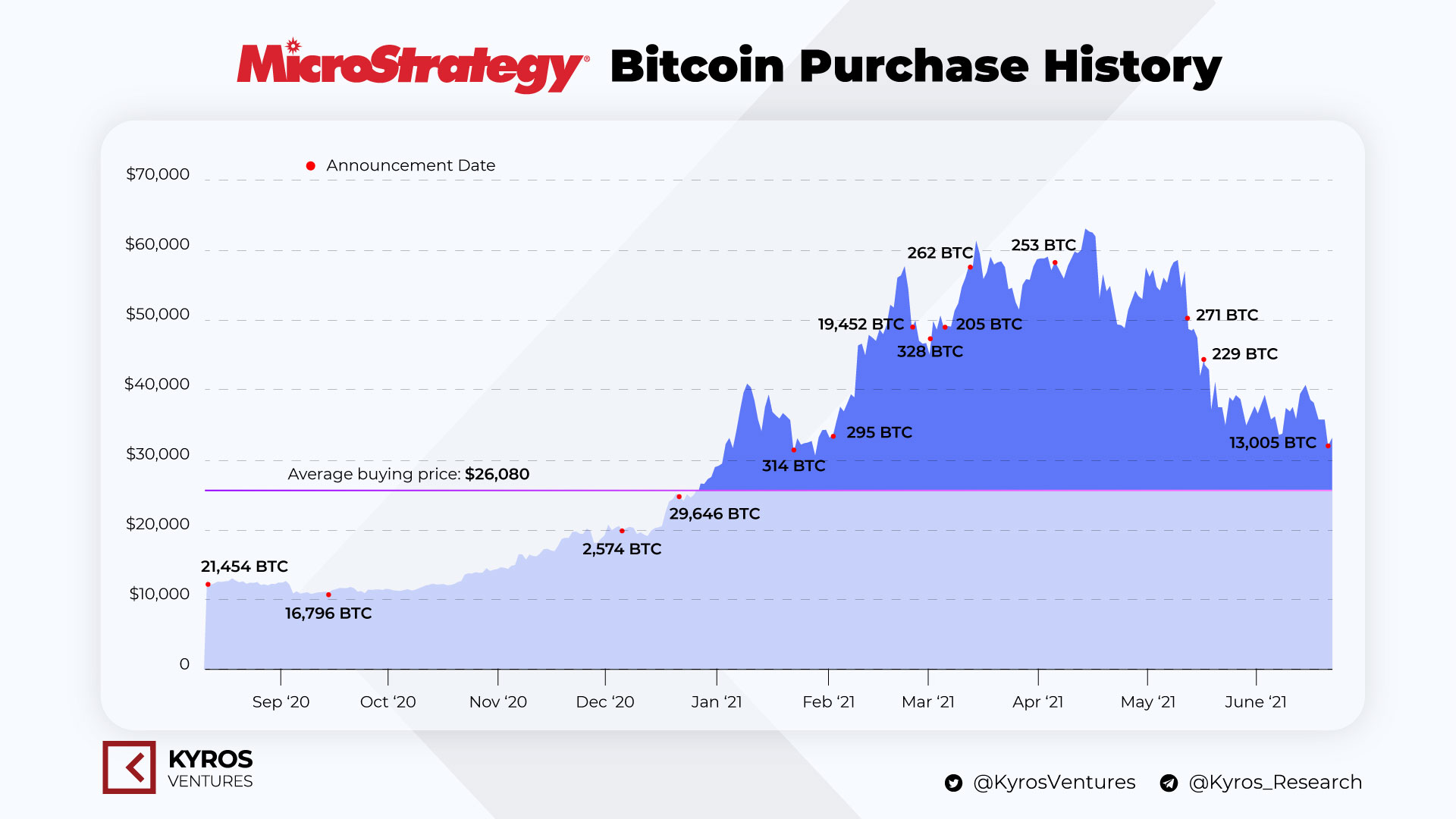

In other phrases, in the final one 12 months, Microstrategy has constantly created BTC purchases at a variety of costs. BTC order background Kyros Ventures summarized in the figure under:

As you can see, this is a DCA method incredibly successful and an exemplary lesson for this school’s traders. Currently, this business holds 13.005 BTC with an regular order rate of 26,080 USD / BTC. Meanwhile, the rate of BTC at the time of Coinlive’s reporting is all around $ 46,000!

MicroStrategy purchased an more 13,005 bitcoins for ~ $ 489 million in funds at an regular rate of ~ $ 37,617 per bitcoin. Starting from 21/06/21 us #hodl ~ 105,085 bitcoins acquired for ~ $ two,741 billion at an regular rate of ~ $ 26,080 per bitcoin. $ MSTRhttps://t.co/gLfnOxZEZc

– Michael Saylor⚡️ (@michael_saylor) June 21, 2021

The rate of MSTR shares has risen

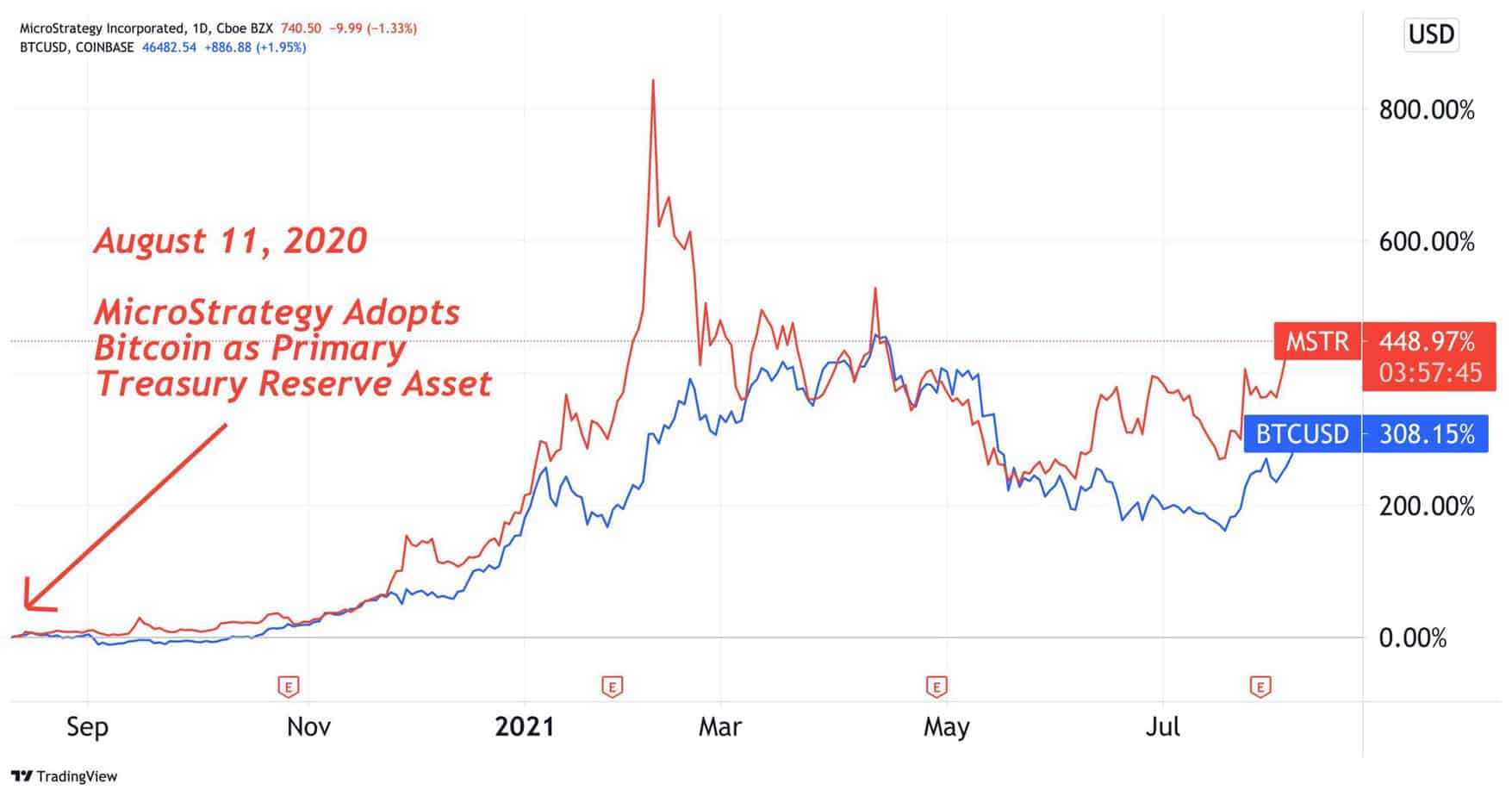

Not only benefiting from the DCA method, Bitcoin seems to have brought quite a few other useful added benefits to Microstrategy above the previous 12 months. Typically, MSTR’s share rate has risen 448.97%. While the rate of BTC has improved in a a lot more “modest” way with 308.15%.

If you participate in the stock marketplace, you almost certainly know what the development charge of virtually 450% per 12 months indicates. Not only MSTR, shares of providers associated to cryptocurrencies have outperformed the S&P 500, demonstrating the attractiveness of this marketplace.

Has Altcoin Season Really Come?

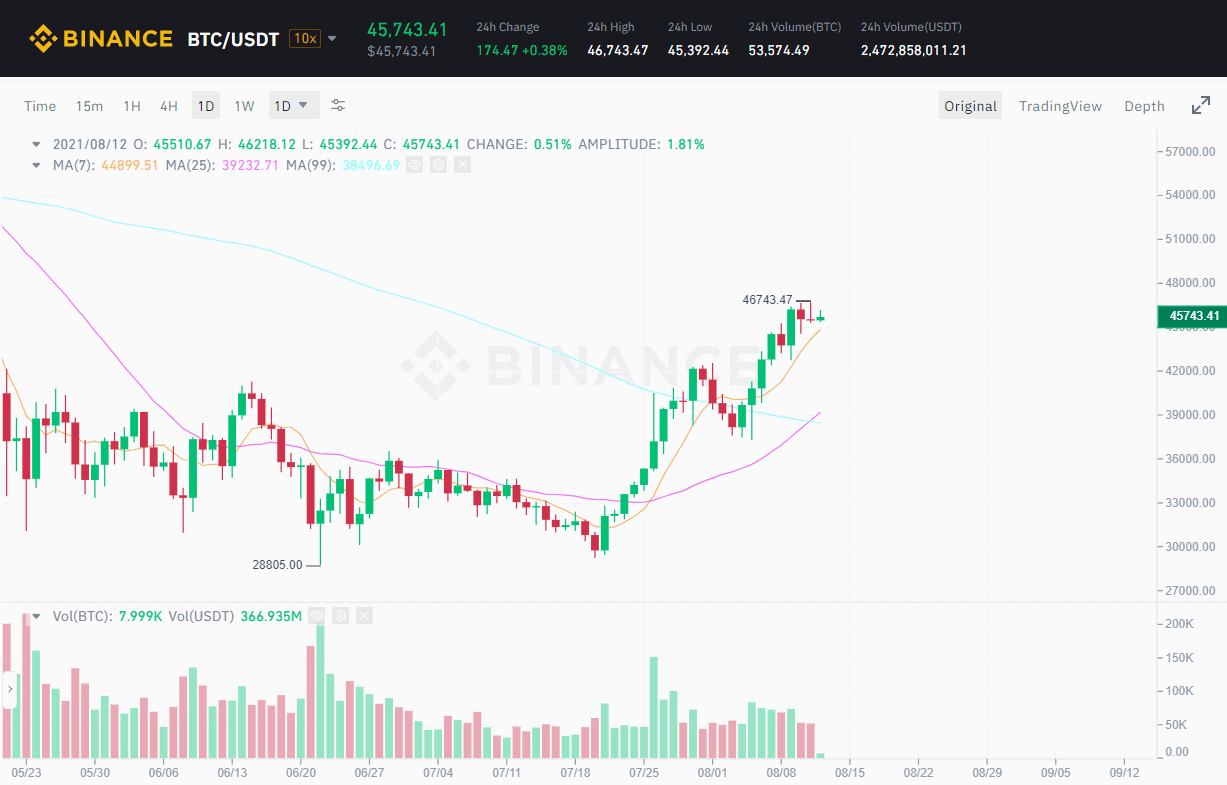

Not only that, the final 22 days are definitely the golden age of the complete cryptocurrency marketplace. When:

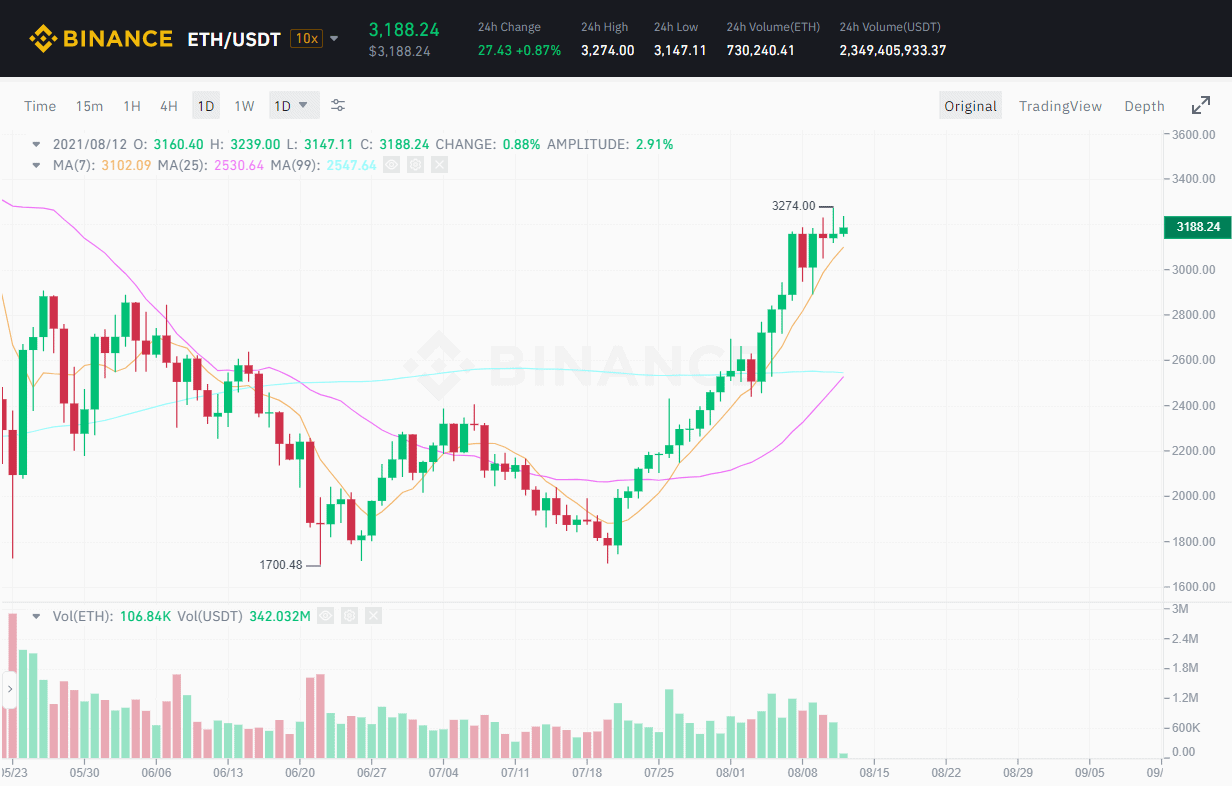

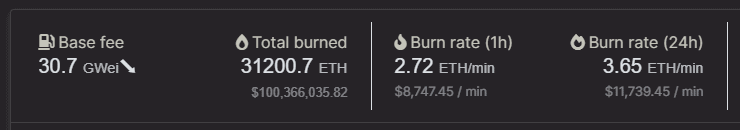

With the EIP-1559 update efficiently activated, Ethereum is nicely on its way to starting to be a “super currency”. Now there are a lot more than a hundred million bucks ETH taxes have been burned just after EIP-1559 and it is estimated that $ five billion can be burned every single 12 months.

The figures present that, a single season Altcoin season it actually commenced!

Jane

Maybe you are interested: