[ad_1]

The amount of Bitcoin (BTC) withdrawn from centralized cryptocurrency exchanges (CEX) continues to enhance. This suggests that the Bitcoin market place may possibly be in an accumulation phase.

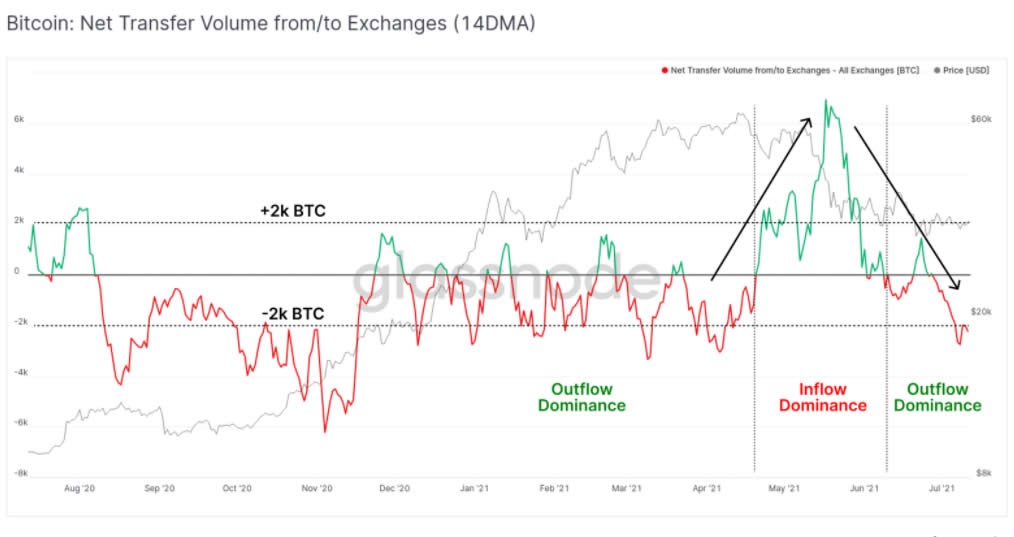

The volume of BTC held on centralized exchanges has been steadily reducing because the finish of May 2021. Up to now, it is estimated that about two,000 BTC are withdrawn from exchanges just about every day.

Glassnode on-chain information on July twelve displays that the volume of Bitcoin stored on exchanges is constantly reducing and has returned to the lowest degree because April 2021. This was also about the identical time that BTC spiked to $64,800 – an all-time substantial for the world’s No. one cryptocurrency.

According to Glassnode, the bulk of BTC has gone to the Grayscale Bitcoin Trust, as GBTC stock is about to have its greatest unlock of the yr. At the identical time, this BTC withdrawal can also be accumulated by institutions.

In mid-May 2021, when the Bitcoin cost dropped drastically, the volume of BTC reserves on the exchange enhanced drastically due to the fact several traders sent BTC right here to liquidate. Since then, the net transfer volume has the moment once more returned to the “negative zone” as the outflow has enhanced drastically.

“On a 14-day moving average basis, the past two weeks in particular have seen a more positive return of exchange inflows, at a rate of around 2,000 BTC per day.” – Glassnode wrote in the report on twelve/07.

The report also notes that more than the previous week, the on-chain transaction charge ratio as represented by the movement of deposits to the exchange has fallen to a dominant 14%, just under the 17% peak in May 2021 .

This July, on-line charges connected to withdrawals enhanced drastically, from three.seven% to five.four%. This displays that several traders have picked to accumulate rather than constantly get and promote.

Besides, the reduce in foreign exchange reserves also appears to coincide with an enhance in capital flows to decentralized finance (DeFi) transactions in the previous two weeks. According to DeFiLlama, complete worth locked (TVL) has enhanced by 21% because June 26, going from $92 billion to $111 billion, as of press time.

Maybe you are interested:

Join our channel to update the most valuable information and know-how at:

According to Coinlive

Compiled by ToiYeuBitcoin

.

[ad_2]