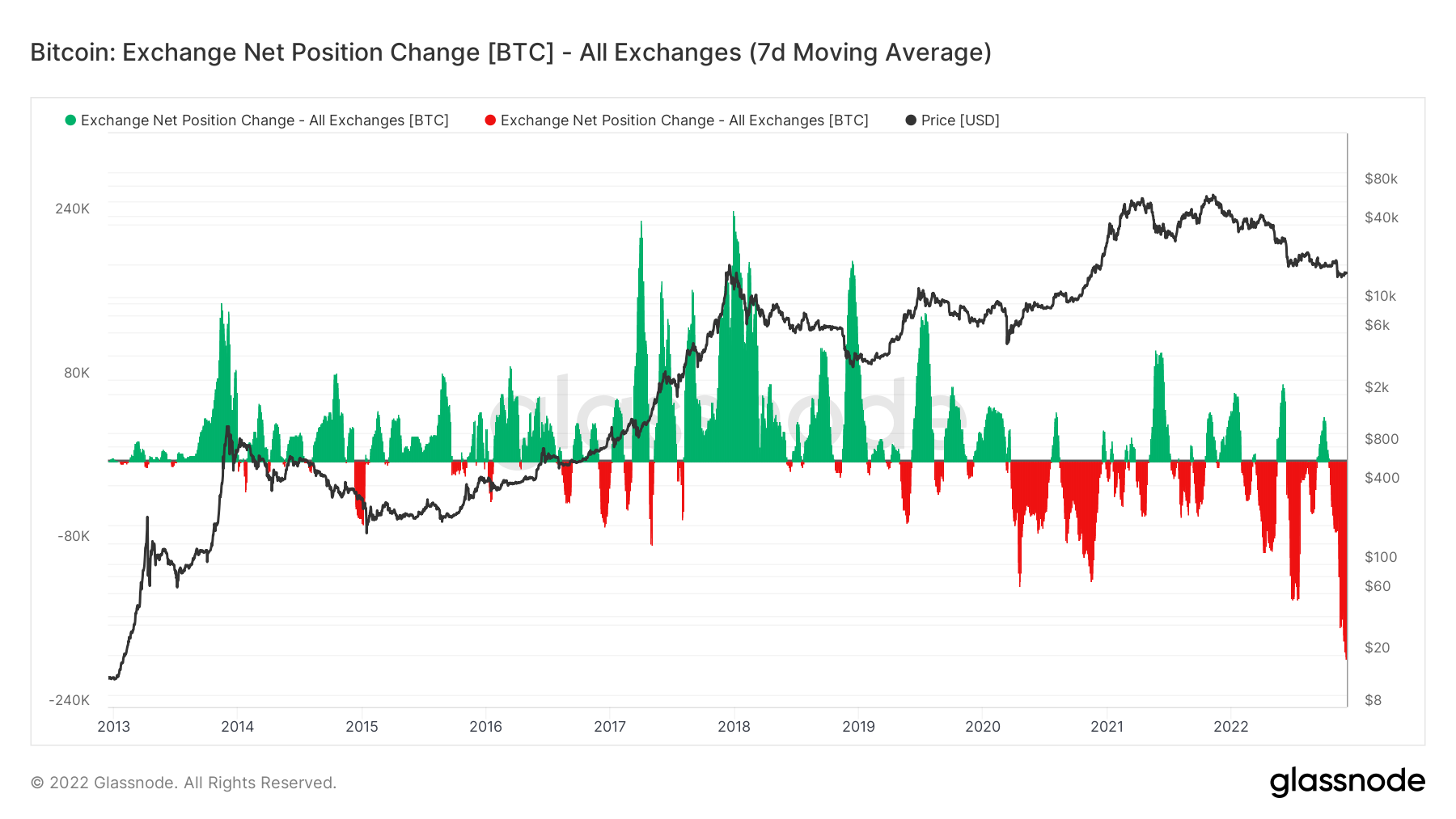

The significant migration of cryptocurrencies out of exchanges continues: traders are quickly closing most of their positions on trading platforms and moving their money to cold storage or wallets. sizzling due to the emerging crisis of believe in involving exchanges and their end users.

Cryptocurrency exchanges are dealing with a genuine crisis following the boom of FTX: unprecedented volumes of Bitcoin, Ethereum and other primary cryptocurrencies are leaving trading platforms centralized when traders are hunting to shield their assets. This trend is possible to carry on in the industry till the finish of the yr.

According to on-chain information, all over 200,000 BTC well worth $three.four billion and in excess of one million ETH have left many centralized crypto trading platforms, generating it the greatest remittance from CEXes as of 2021. Such trends are an indicator for a quantity of issues.

First, the declining quantity of assets on exchanges frequently correlates with a declining trend in open curiosity and general marketing strain in the industry. When traders move their money out of the open industry, they have a tendency to hold them longer than traders who shop their coins on exchange wallets.

How does this influence the industry?

If this trend prevails, the marketing strain we witnessed in November need to subside along with volatility. Money outflows from exchanges frequently herald a time period of accumulation, which takes place just just before the general industry recovery.

Despite the downturn in the macroeconomic sector, a recovery in the crypto industry is even now attainable, even devoid of a recovery in the tradfi industry. However, generating predictions and setting time frames is a difficult process to attain, particularly in direction of the finish of the yr.