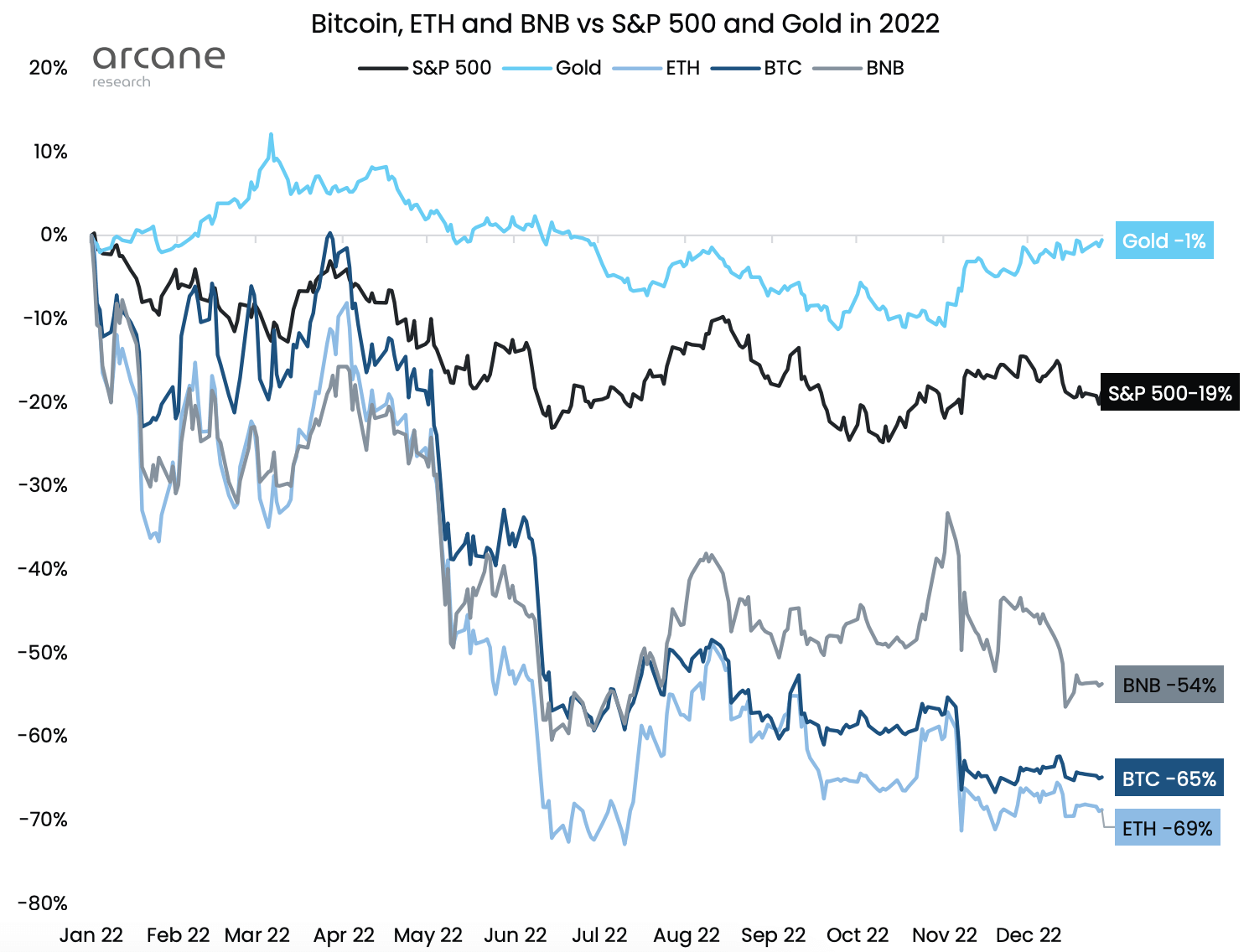

Arcane Investigation’s late 2022 report cited that 2022 was the 2nd-worst executing 12 months for Bitcoin (BTC), as the main cryptocurrency noticed a 65% drop all through the 12 months, only to beat by the 73% drop recorded in 2018.

BTC’s overall performance is the 2nd worst of the 12 months in contrast to Binance Coin (BNB), Ethereum (ETH), S&P 500, and Gold. ETH recorded the most substantial drop as it dropped 69%. Gold is the most resilient, recording only a one% drop.

exchanges

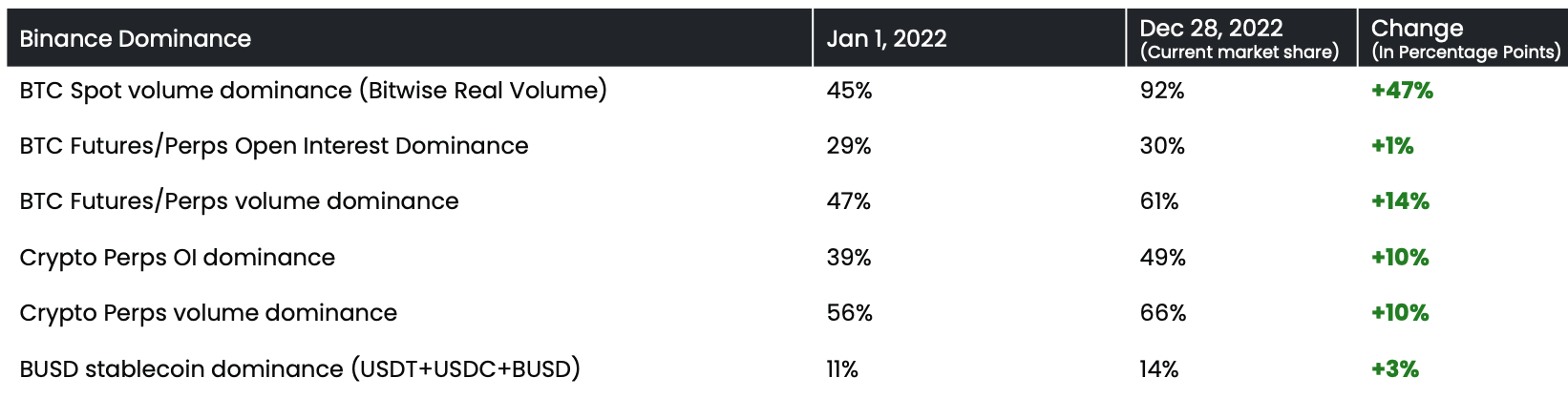

The development of cryptocurrency exchange Binance is one more highlight of 2022. Binance’s dominance in spot BTC volume has enhanced by 47% all through the 12 months, increasing to 92% with its present industry share. from 45% recorded on the 1st day of the 12 months.

Binance was accountable for 66% of crypto perp volume and 61% of BTC derivatives volume as the 12 months ended. The exchange recorded a ten% raise in each areas, in contrast with 49% and 56% at the starting of the 12 months.

The report predicts that Binance dominance in the spot industry will lower and BUSD dominance will raise.

Correlation amongst BTC and stocks

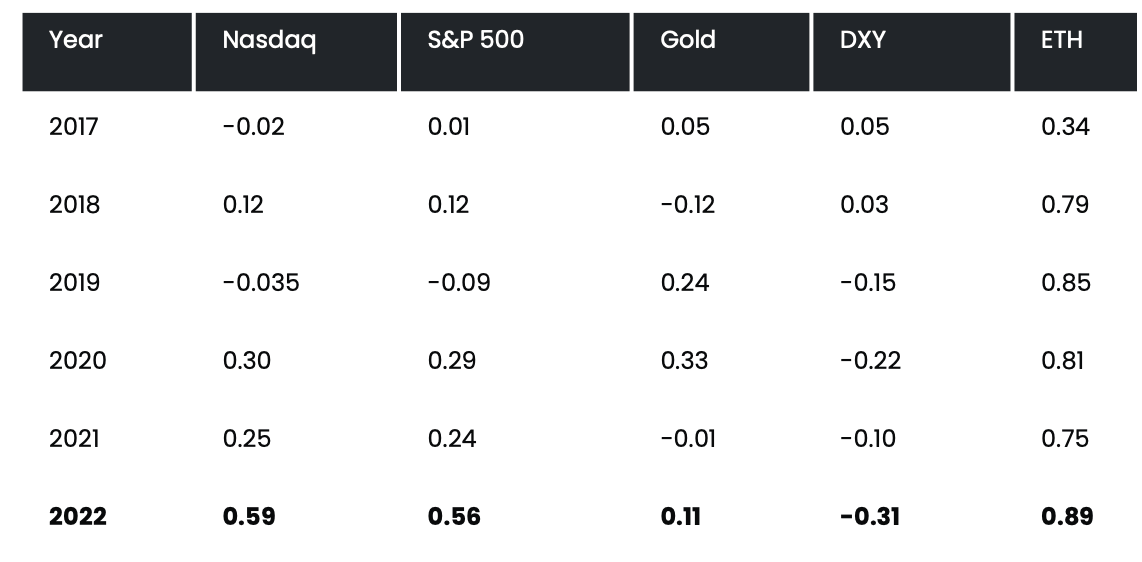

BTC’s correlation with other stocks is also substantially large in 2022. The report looked at BTC’s yearly correlation with Nasdaq, S&P 500, Gold, DXY, and ETH given that 2017.

The information demonstrates that BTC’s correlation with ETH has been sturdy given that 2017. However, 2022 is the 1st 12 months BTC has proven this kind of a sturdy correlation with other stocks.

BTC’s correlation with Nasdaq was sturdy all through the 12 months at .59, closely followed by the S&P 500 at .56. However, the report expects BTC’s correlation with other assets to decline in the following many years as crypto trading action declines.

Stable coin

The industry capitalization of Stablecoins relative to BTC is also increasing exponentially in 2022, increasing to 41% from 15% at the starting of the 12 months.

The report claims that the increasing dominance of stablecoins has a clear explanation. It stated:

“Cryptocurrency valuations have deteriorated this year and stablecoins are stable.”

The mixed industry capitalization of stablecoins accounts for 28% of the mixed industry capitalization of BTC and ETH and 17% of the complete crypto industry capitalization. The charges had been ten% and six% at the starting of the 12 months.