The cryptocurrency market will see $2.639 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today. This event could affect short-term prices, especially given the volatility that has been dependent on both assets over the past few days.

With Bitcoin options valued at $1.9 billion and Ethereum at $712 million, will the cryptocurrency market see continued volatility or will 2025 start 2025 on a steady note? What will happen to BTC and ETH prices with these expiring options?

2025 First Crypto Options Deadline: Over $2.6 Billion Options Expire

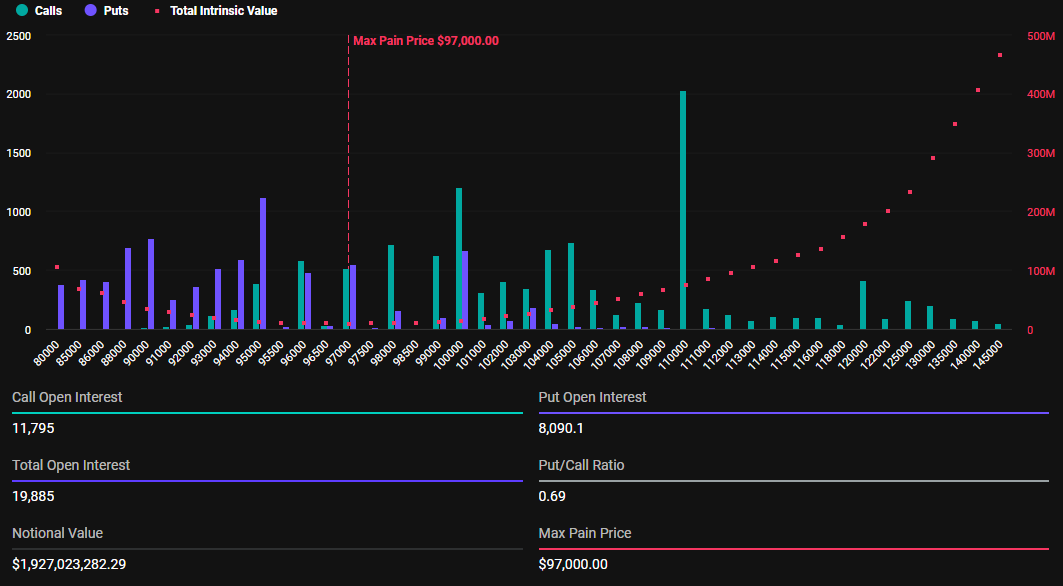

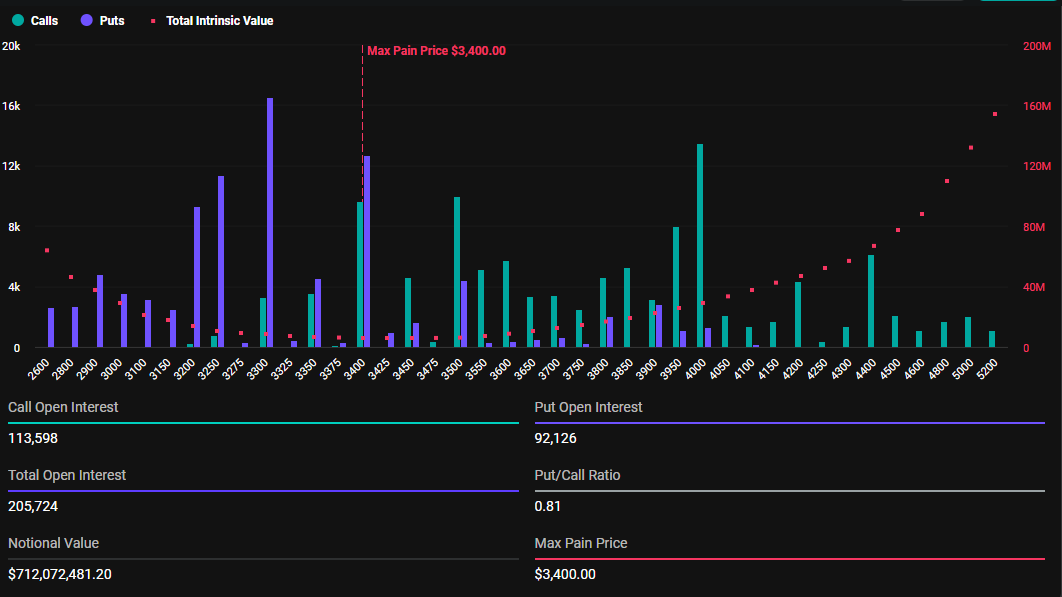

Data from Deribit shows that today’s Bitcoin options expiration includes 19,885 contracts, compared to 88,537 contracts last week. Similarly, Ethereum options ended totaling 205,724 contracts, down from 796,021 contracts last week. This difference stems from the signing of option contracts at the end of the year.

For Bitcoin, expiring options have a maximum pain point (strike price) of 97K USD and a put-to-call ratio of 0.69. This shows that the overall sentiment is optimistic even though the pioneer coin is still struggling to reach the $100K USD mark again.

Accordingly, the Ethereum contracts expiring today have the largest price of 3,400 USD and the put-to-call ratio is 0.81, reflecting a similar outlook for the market. When the put-to-call ratio is below 1, many traders are betting on price increases.

In options trading, the maximum price is an important indicator that often guides market behavior. It represents the price at which most options expire worthless, causing maximum financial pain for traders when options expire worthless.

Traders and investors should be prepared for volatility, as options expiration often causes short-term swings in price, creating uncertainty in the market. In particular, asset prices tend to move towards higher prices to optimize profits for option sellers, mainly large financial institutions or smart capital.

According to data from TinTucBitcoin, BTC was trading at $96,912 at the time of writing, while ETH was trading at $3,465. Movements towards their maximum value would represent a slight increase in the price of Bitcoin and a slight decrease in the price of Ethereum, thus potentially causing volatility.

“Volatility has remained consistent and balanced throughout the post-Christmas period. The year-end deadline for many of the market’s open options did not cause the boom that some expected. Instead, ETH volatility trades more than 5 points lower while BTC shows the same but slightly steeper pattern it has since Christmas day,” Deribit share.

Even with the potential for volatility, markets often stabilize after a while as traders adapt to the new price environment. With today’s high volume expiry, traders and investors can expect a similar outcome, potentially influencing the short-term trend of the market.