[ad_1]

ETH stored in trade has decreased substantially and is now reaching its lowest stage. Meanwhile, the quantity of ETH staking in Ethereum two. has improved.

ETH stored in trade continues to decline

Over the previous week, lots of cryptocurrency marketplace analysts have observed an exciting growth pertaining to the provide of Ether (ETH). Especially considering the fact that the London difficult fork of Ethereum is about to get location on August four, 2021.

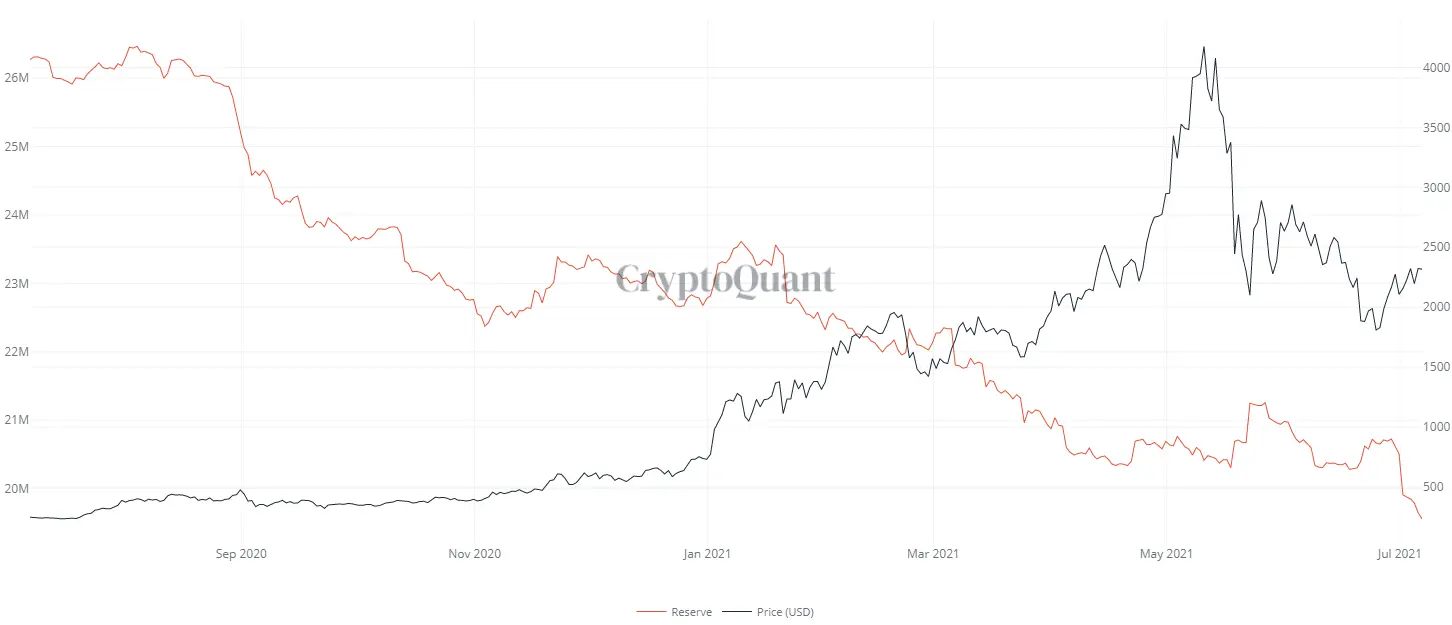

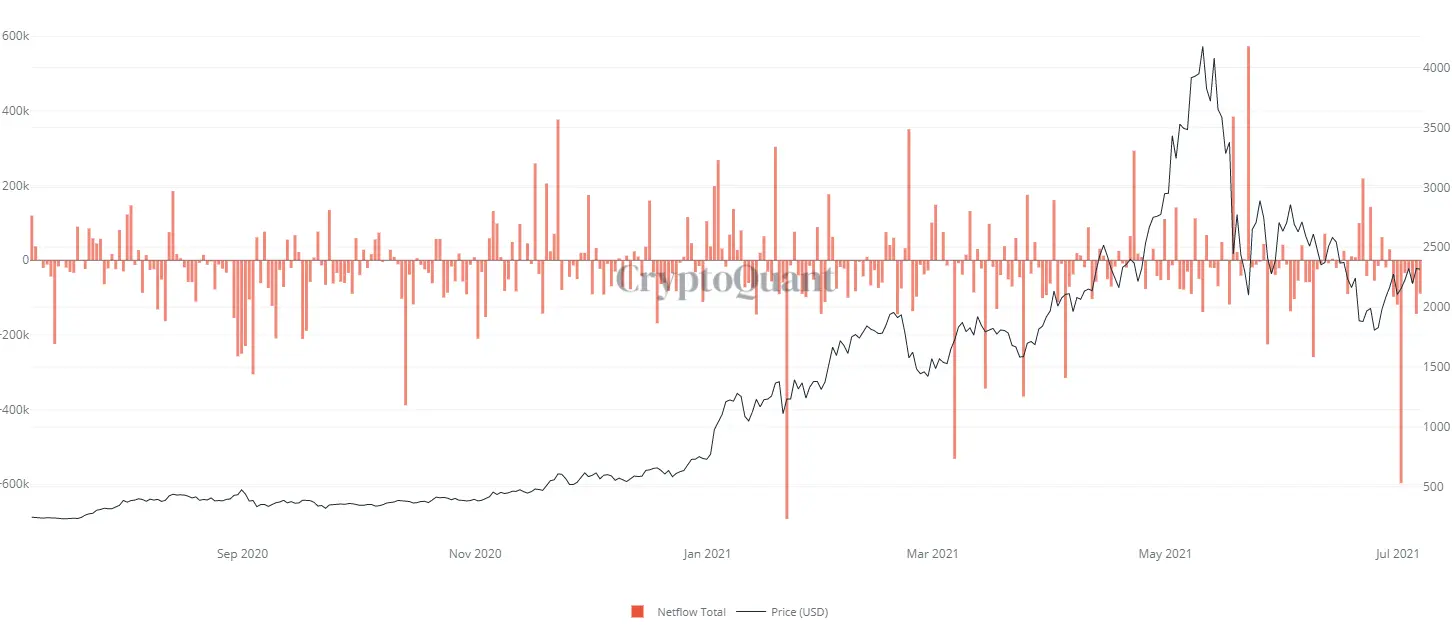

According to CryptoQuant information, from the starting of July to the existing, the quantity of ETH stored every single day on cryptocurrency exchanges has “found a new bottom”.

So is this a signal for a wave? bullish trend or downward trend of the very best altcoins? To response this query, we have to have to get a closer search at some of the vital components in expanding ETH demand.

These troubles contain Ethereum two. staking contracts, the development of the decentralized fiscal sector, and enthusiasm amid traders for the implementation of the Ethereum Improvement Proposal (EIP) 1559.

Here, let us do a a lot more in-depth evaluation with Coinlive on every single induce that substantially decreased the quantity of ETH in circulation

There are in excess of six million ETH staking in Ethereum two.

This is the initial cause why ETH reserves on exchanges have dropped substantially. On June thirty, the quantity of Ether transferred to the Ethereum two. staking contract passed the six million ETH milestone.

CryptoQuant information from July 1st also recorded a huge quantity, in excess of 596,000 ETH was withdrawn from centralized cryptocurrency exchanges. This is the biggest outflow of ETH considering the fact that late January 2021.

“Staking ETH” or “Ethereum 2.0” are the two extremely scorching search phrases in the crypto neighborhood at all instances. Especially when ETH had astounding development, lots of people today assume that betting ETH on ETH two. will also deliver a excellent supply of revenue.

Recently, the world’s major fiscal institution JPMorgan also stated that ETH two. will “trigger” a wave of staking revenue of up to $ forty billion by 2025. Realizing the prospective, Sygnum Bank has also taken action promptly launched the staking services. Ethereum two. and grew to become the initial financial institution to supply this product or service.

Ethereum two.0’s existing staking can be witnessed as a bundle of omachi noodles due to the fact it has an “irrefutable appeal”. For this cause, the quantity of ETH withdrawn from centralized exchanges is expanding.

However, a information from Eth2 Launchpad exhibits that the quantity of ETH staking at the time Coinlive reviews is six,166,661 ETH. This signifies that not all ETH withdrawals are staking. So wherever do they go? The response lies in the remaining two causes beneath!

The DeFi marketplace continues to increase

Another end in the quantity of ETH that is withdrawn is in decentralized fiscal ecosystems (DeFi Ecosystem). The previous time has witnessed a important boost in the worth of Token Value Locked (TVL) on DeFi protocols.

According to statistics, the worth of frozen ETH and BTC is even now expanding. However, the price tag of these two cryptocurrencies does not look to have modified a lot in the previous week. This implies that

Currently, ETH and BTC are even now the two most important cryptocurrencies caught on DeFi. Meanwhile, their costs do not look to have modified a lot in the previous week. This exhibits that an quantity of cryptocurrencies such as ETH and BTC are consistently staying pooled on DeFi protocols. This is also the 2nd explanation for the important decline in ETH reserves on centralized exchanges.

Investors are seeking forward to the London difficult fork

A third recognized induce is the approaching Ethereum London Hard Fork and the proposed EIP-1559. Some analysts assume the improve to have a good affect on ETH’s price tag. Because the switch of Ethereum to the Proof of Stake (PoS) consensus algorithm will make ETH mining a lot more environmentally pleasant. At the similar time, the scarcity of ETH will also boost by lowering the variety of tokens in circulation.

These components have also reignited the comparison amongst ETH and BTC. Indeed, even though Bitcoin (BTC) is even now the major cryptocurrency in the marketplace, lots of feel it will be “dethroned”. And the 1 who can do it is none other than Ether (ETH).

Leading Wall Street fiscal group Goldman Sachs thinks ETH is a cryptocurrency with extremely large useful worth in use and will quickly dominate the complete marketplace.

Sharing the similar viewpoint with Goldman Sachs professionals, Celsius Network CEO Alex Mashinsky believes Ethereum will quickly overtake Bitcoin in terms of marketplace capitalization in 2022 or 2023.

Synthetic currency 68

Maybe you are interested:

.

[ad_2]