In latest instances, China has been pretty solid in suppressing Bitcoin in unique and cryptocurrencies in common. This partly induced a important drop in the selling price of BTC. It can be explained that the cryptocurrency industry has gone by way of a time period of “pain” and “red fire”.

However, just after a hefty rain, a rainbow will seem. And the recovery of the Bitcoin hashrate p2p transactions continue to be steady Spot trade volume of trade from Asia even now dominates are three aspects that make up the rainbow.

Summary of the persecution of China

As talked about over Coinlive, the cryptocurrency industry has gone by way of a hard time with China’s rigid repressive policies. To make it a lot easier for readers to see, Coinlive will summarize the complete picture as follows:

China fired to start with on May 18 when it banned monetary organizations from dealing with cryptocurrencies.

– Then China ordered Internet giants to “scan” the keywords and phrases connected to Binance, Huobi and OKEx. Subsequently, Huobi also responded by restricting leveraged trading and blocking new customers from China.

– On June 18, Sichuan ordered the nationwide electrical power grid to prevent supplying the Bitcoin mining factory

– In the preliminary tightening time period due to repressive policies, traders started out switching to trading through OTC channels. But it was not lengthy prior to the People’s Bank of China (PBoC) ordered banking institutions to block the accounts of men and women believed to be trading OTC cryptocurrencies. This is also the information that induced BTC to “dump” to USD 32,000 on June 21st.

– On July 14, Anhui Province continued to shut down yet another cryptocurrency mining factory

– Recently, the PBoC announced that it will carry on its efforts to carry out the “crackdown on cryptocurrencies” to the finish.

However, it seems that all of China’s efforts are of short-term worth. Because a great deal of information has proven that the cryptocurrency and Bitcoin markets are on the path to recovery. In unique, invite readers to refer to the specifics under!

Hashrate recovered at one hundred million TH / s

After peaking at 186 million TH / s on May twelve, the Bitcoin network’s hash charge started to plummet. The to start with couple of weeks have been due to restrictions on coal use places. It is estimated to account for all over 25% of the mining capability. However, as the ban from China widened, the index bottomed out at 85 million TH / s. This is also the lowest degree in the final two many years.

Bitcoin hashrate is registering constructive indications of recovery (Source: Blockchain.com)

As proven over, we can see Bitcoin’s hashrate recovering lately. In significantly less than three weeks, the hash charge is back to one hundred million TH / s. This is due to the truth that the “miners” have resumed get the job done just after moving to Kazakhstan, Canada and the United States. You can refer to this posting for additional specifics:

See additional: Bitcoin and Ethereum hashrates are exhibiting constructive indications of recovery

The p2p industry continues

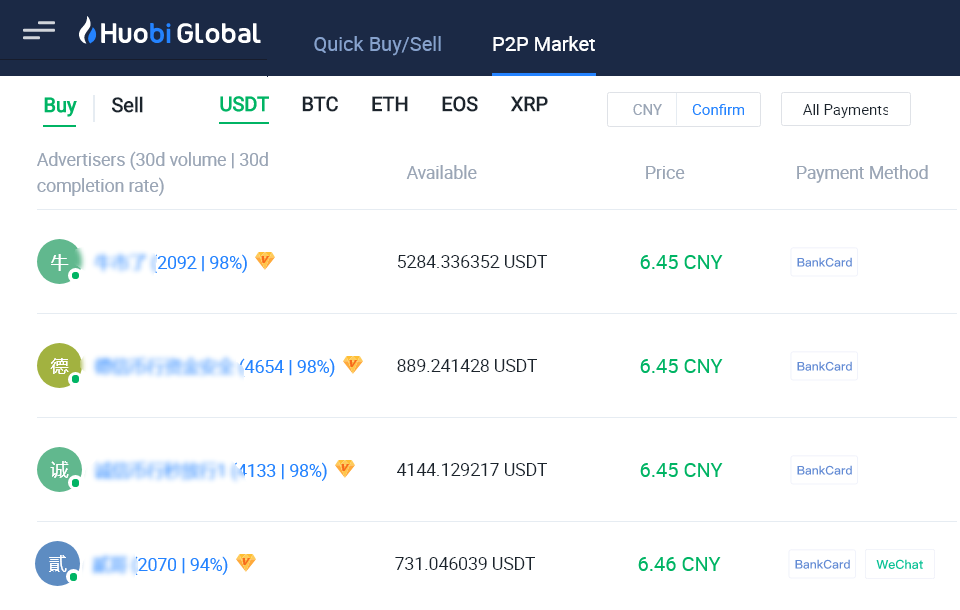

Although organizations engaged in cryptocurrency exchanges have been banned in China. However, men and women carry on to act as intermediaries. One of these also recorded additional than ten,000 thriving p2p transactions.

Both Huobi and Binance give a related industry. This is in which customers can trade numerous cryptocurrencies like Tether USD (USDT) Bitcoin (BTC), Ether (ETH)… After converting their fiat currency into stablecoin, trading can be performed on a typical exchange or on derivatives.

OTC trading of Chinese traders on Huobi is even now pretty energetic (Source: Huobi)

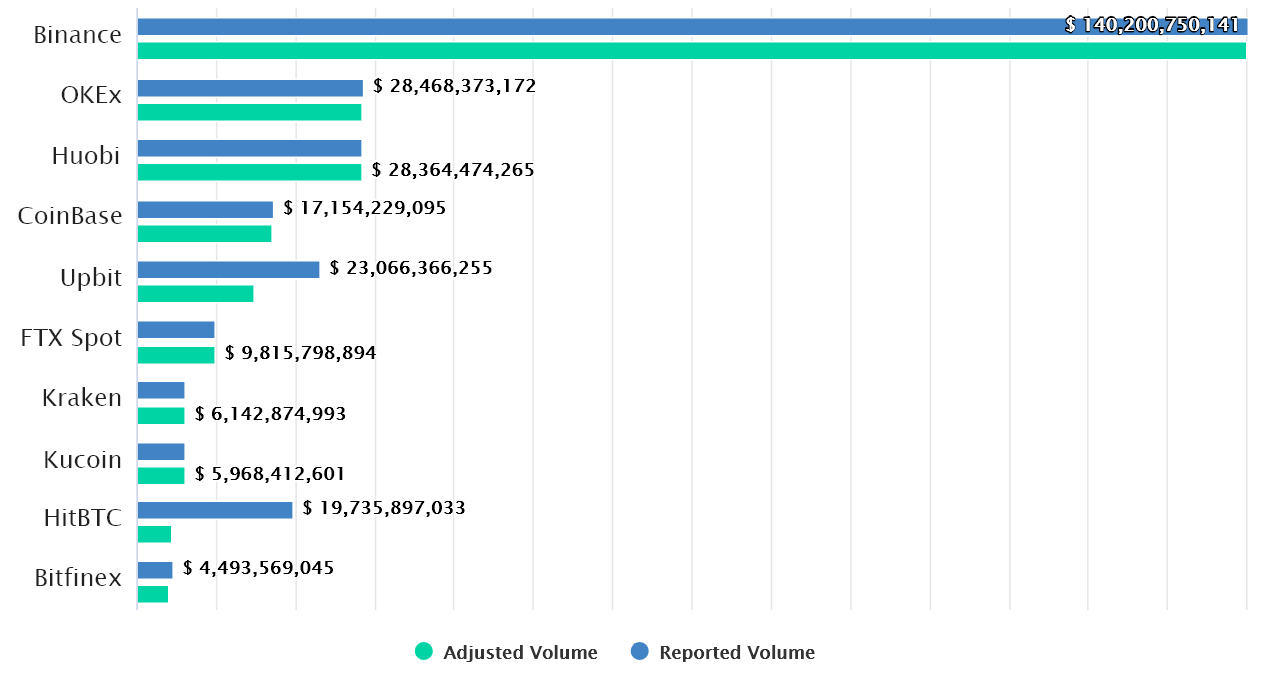

Asia-based mostly exchanges carry on to dominate spot volume

A total crackdown on trade from Chinese entities will probable be reflected in previously area-based mostly trading. Like Binance, OKEx and Huobi. However, when seeking at latest volume information, there is no important affect.

Weekly Spot Market Trading Volume Statistics (Source: Cryptorank.io)

Indeed, all 3 “Asian” exchanges even now dominate in terms of trading volume in the spot industry. This is evident in the top rated three positions in the chart over. Meanwhile, exchanges like Coinbase, Kraken, or Bitfinex are all far behind.

It can be noticed right here that China’s ban on cryptocurrency mining and trading might have impacted the industry. However, it is only short-term. With the three motives talked about over, the exact same BTC selling price and the complete industry recovering, it can be concluded that “China’s repressive efforts” have failed!

Synthetic currency 68

Maybe you are interested: