Crypto market participants are eyeing three US economic data this week that could affect Bitcoin (BTC) sentiment and cause massive volatility. This interest comes as US macro data has a strong impact on Bitcoin and the cryptocurrency market in general this year, after a dry period in 2023.

Meanwhile, Bitcoin price remained near $100,000, trading around $99K throughout the weekend.

3 US Economic Data That Could Affect Bitcoin Price This Week

This week promises to be eventful, with US economic data expected to drive volatility in the Bitcoin and altcoin markets.

US CPI

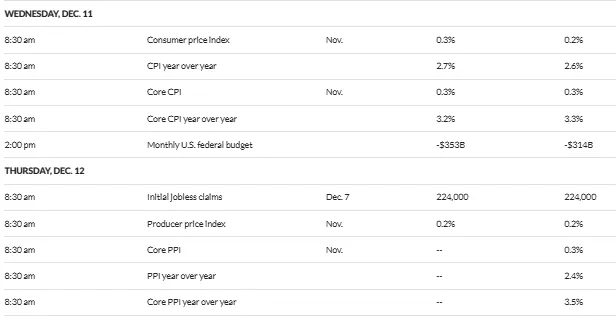

US CPI (Consumer Price Index) is one of the important economic data to watch this week. Expected release on Wednesday, December 11 at 8:30 a.m. Eastern time. Released by the US Bureau of Labor Statistics (BLS), this data measures the monthly change in prices consumers pay, effectively tracking inflation over time.

In the previous release of US CPI, BLS showed that inflation increased to 2.6%. Specifically, inflation remained steady at 0.2%, equivalent to September’s figure. However, the 2.6% annual increase marked the first increase in the past eight months.

This raises speculation about tightening by the US Federal Reserve (Fed). However, institutional investor interest in BTC has reinforced the value of the pioneering cryptocurrency, which continues to attract demand due to its status as a store of value.

The median forecast is 0.3%, meaning prices are expected to rise 0.3% on a monthly basis, according to economists. This was higher than the 0.2% monthly increase in September. Concurring with that was the 2.7% forecast by Wall Street economists.

All eyes will be on the Labor Department this Wednesday when US inflation data takes center stage. In addition to the headline data, core CPI inflation will also be a key factor to watch this week, providing a more stable reading of inflation as it excludes food and energy prices from the calculation.

Core CPI inflation is a key variable because commodity prices often see large and unpredictable monthly changes that have little to do with consumer demand. In November, core CPI is expected to increase 3.3% year over year. If this happens, it would mark the 4th consecutive month of a 3.3% reading.

Meanwhile, the monthly core price increase is expected to be 0.3%, also in line with October’s increase.

Due to its decentralized nature and limited supply, Bitcoin is considered a hedge against inflation. On Wednesday, BTC could benefit from the uptrend in US CPI and core CPI.

For the average person, if investors perceive rising inflation as a threat to the purchasing power of traditional currencies such as the US USD, they can turn to alternative assets such as Bitcoin as a place to store value. This increased demand could cause Bitcoin prices to increase.

Initial Unemployment Claim Number

The US unemployment claims report for the week ending December 7 will be released on Thursday. The data will provide insight into the health of the labor market as well as overall economic conditions.

Typically, high unemployment claims indicate economic stress and instability. Conversely, low levels indicate a strong labor market and economic stability.

In the week ending November 30, unemployment claims increased to 224,000. This level is higher than the initial prediction of 215,000. It was also higher than last week’s total, which was revised from 213,000 to 215,000.

According to data labor BLS, however, the US job market improved slightly in October January. The unemployment rate has increased to 4.2%.

Specifically, the US added 227 thousand non-farm jobs (NFP) in October after the labor market faltered in October. This happened after the Boeing strike and the aftermath of Hurricane Milton.

“The latest jobs data shows that the labor market remains strong. After bad numbers in October due to weather and worker strikes, October January returned with strong job growth along with upward revisions. On average, the economy added 173K jobs in the past 3 months,” said Elise Gould, Chief Economist at the Economic Policy Institute. share.

Thursday’s high level of unemployment claims may have contributed to negative market sentiment and uncertainty. This may cause investors to look to safe haven assets such as gold or Bitcoin. This increased demand for Bitcoin as a store of value could push its price higher.

Similarly, high levels of unemployment claims could indicate reduced consumer spending and weak economic growth. This could influence central banks to implement expansionary monetary policies. Such an outcome could increase concerns about inflation and currency depreciation, leading investors to look to alternative assets like Bitcoin to protect their wealth.

US PPI

Also on Thursday, the BLS will release the Producer Price Index (PPI), a reading of wholesale inflation. The data measures the average change over time in the selling prices that domestic producers receive for their products.

This week’s CPI and PPI price data will be the main factor determining the Fed’s interest rate decision this month. What the data will show will mark important milestones in the Fed’s policy adjustment calculations. Notably, this marks the final week of inflation data before the December Fed meeting.

“All eyes are on CPI and PPI inflation data as markets hope to cement a 25 bps interest rate cut,” Kobeissi Letter speak.

Meanwhile, TinTucBitcoin data shows the market is down today, with Bitcoin trading for $99,147 year to date, down 0.68%.