November has been a standout month with many assets hitting new highs. Real World Assets (RWAs) are no exception. Many assets have climbed to multi-year highs, and some appear poised to extend their gains.

Prominent tokens such as Avalanche (AVAX), Chainlink (LINK), Artrade (ATR), Ondo (ONDO) and XDC Network (XDC) have shown significant growth in recent weeks, worthy of being RWA altcoins Top things to watch in December.

Avalanche (AVAX)

AVAX, the native coin of the Avalanche layer one blockchain, has seen a 20% price increase over the past week, making it one of the RWA-based altcoins to watch in December. As of now, the altcoin is trading at $42.25.

AVAX’s Directional Index (DMI), evaluated on the daily chart, confirms the bullish trend. At this time, the currency’s positive direction index (blue) is above the negative direction index (red), reflecting the market’s upward trend.

The DMI determines the strength and direction of a trend. When the positive direction index is above the negative direction index (red), it signals that the market is in an uptrend, with the upward price move being stronger than the downward pressure. This suggests optimistic market conditions and is often a signal for traders to consider buying positions.

If this trend continues, the price of AVAX will increase to $47.02. A successful breakout of this resistance would boost the coin’s price to $55.10. On the contrary, if selling activity strengthens, the price of AVAX will fall to 35.66 USD.

Chainlink (LINK)

Leading oracle network Chainlink is powered by its LINK Token, the value of which has skyrocketed 24% in the past seven days. This makes it another RWA Token to watch in December. Currently, LINK is trading at $17.98, a price it last reached in June.

As of this moment, LINK is trading above the green line of the Super Trend indicator, confirming an upward trend. This indicator measures the overall direction and strength of an asset’s price trend.

The Super Trend indicator appears as a line on the price chart that changes color to reflect trend direction: red for a downtrend and green for an uptrend. As in the case of LINK, when the Super Trend line appears below the price of the asset, it indicates an uptrend, suggesting the upward move is likely to continue.

If this continues, LINK’s value will climb to $19.38. A successful breakout at this level would send LINK back to its yearly high of $22.87. However, if the market trends down, LINK price could drop to $17.22.

Artrade (ATR)

Artrade is an online exchange for real world works of art. Its native token, ATR, has recorded a 103% price increase in the past seven days.

On its daily chart, ATR’s 50-day Simple Moving Average (SMA) crossed above its 200-day SMA on November 23, triggering a trend called the “golden cross” – a A strong increase shows that price momentum is going up. After this crossover, ATR price increased 38%, reaching a six-month high of $0.032 at press time.

When a golden cross forms, the asset’s recent price momentum (over the past 50 days) is moving faster than its long-term trend (over the past 200 days). This pattern confirms the transition from a downtrend to an uptrend and hints at further price growth.

If this trend is maintained, the price of ATR will increase to 0.042 USD. Conversely, its value will fall to $0.026 if buying activity declines.

IOTA (IOTA)

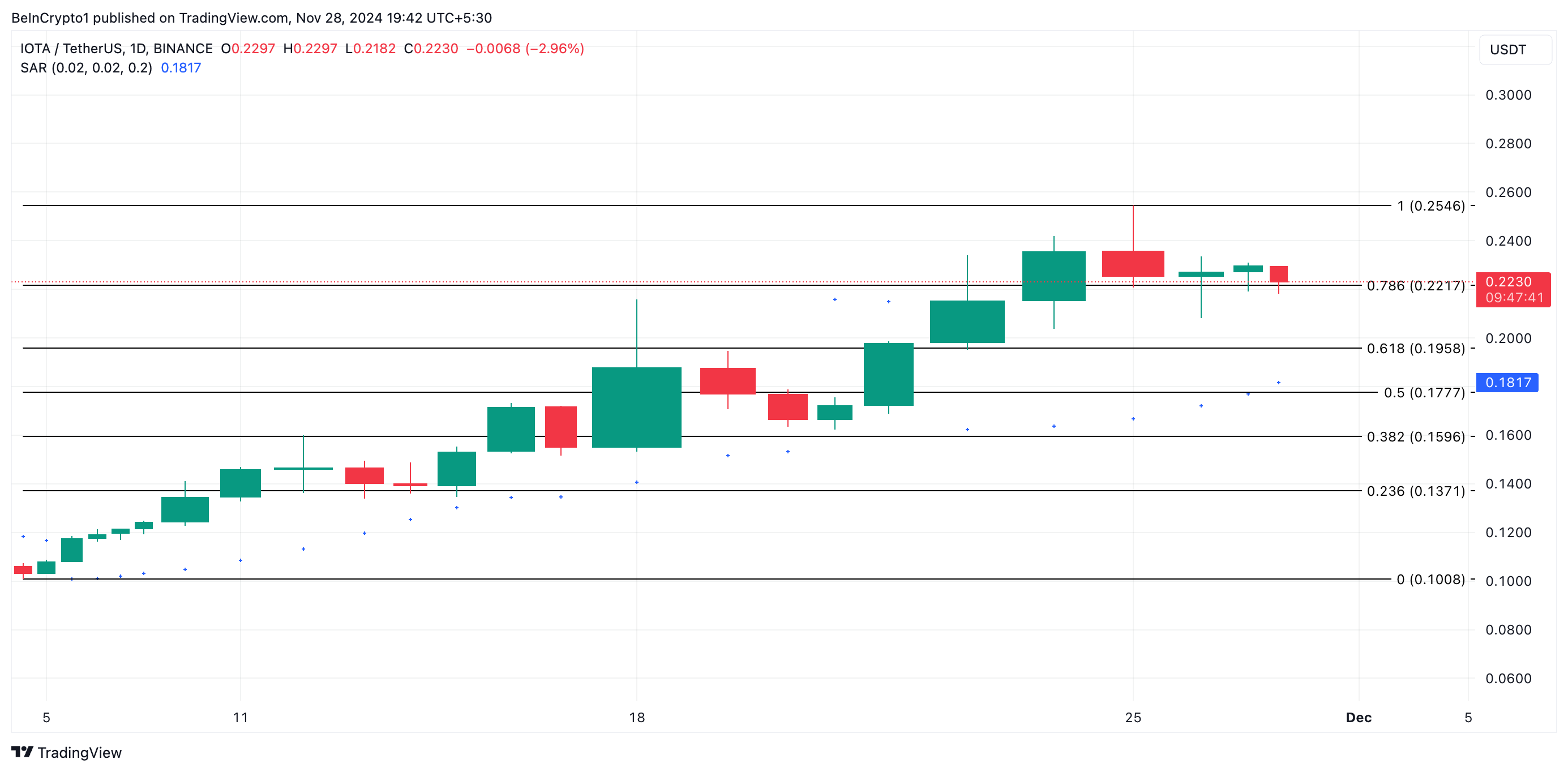

IOTA, the native token of the open, decentralized distributed ledger platform IOTA, is one of the RWA altcoins to keep a close eye on this December. Currently trading at $0.22, the altcoin has retreated slightly from its seven-month high of $0.25 reached during Monday’s trading session.

Despite retreating from these highs, the bullish trend for altcoins remains strong. The setup of its Parabolic Stop and Reversal (SAR) indicator confirms this. At this time, the dots of this indicator are below the price of IOTA.

This indicator helps identify potential price trends by placing dots above or below the price. When the dots are below the price, it signals an uptrend, suggesting bullish price momentum is underway and could continue.

If this trend continues, IOTA will rise to the $0.25 level and attempt to surpass it. Conversely, a decline in buying pressure will cause IOTA’s price to drop to $0.19.

XDC Network (XDC)

Powered by the XDC Token, the XDC network is an enterprise-grade blockchain platform for the tokenization of real-life financial assets and instruments. XDC is one of the RWA altcoins to watch out for in December, as the price increased 32% in the past week.

The increase in the Token’s moving average convergence (MACD) indicator confirms the bullish trend towards it. As of this moment, the Token’s MACD line (line) is above its signal line (orange).

The MACD indicator identifies changes in the strength and direction of an asset’s price trend. When the MACD line is above the signal line, it shows bullish momentum, suggesting the possibility of further price increases as the short-term trend is stronger than the long-term trend.

If this trend is maintained, the price of XDC will increase to $0.063. Conversely, if the token sell-off spikes, XDC’s price could drop to $0.047, disrupting this positive view.