This week is filled with important economic events that could have a significant impact on the Cryptocurrency market. These macroeconomic data come as traders prepare for the end of the year with the holiday season.

Meanwhile, Bitcoin (BTC) remains above $100K, with traders and investors expecting a Christmas bull run.

US Macroeconomic Data May Affect Bitcoin Sentiment This Week

Cryptocurrency market traders and investors will be watching US economic data this week to gauge price movements.

S&P Manufacturing and Services PMI Data

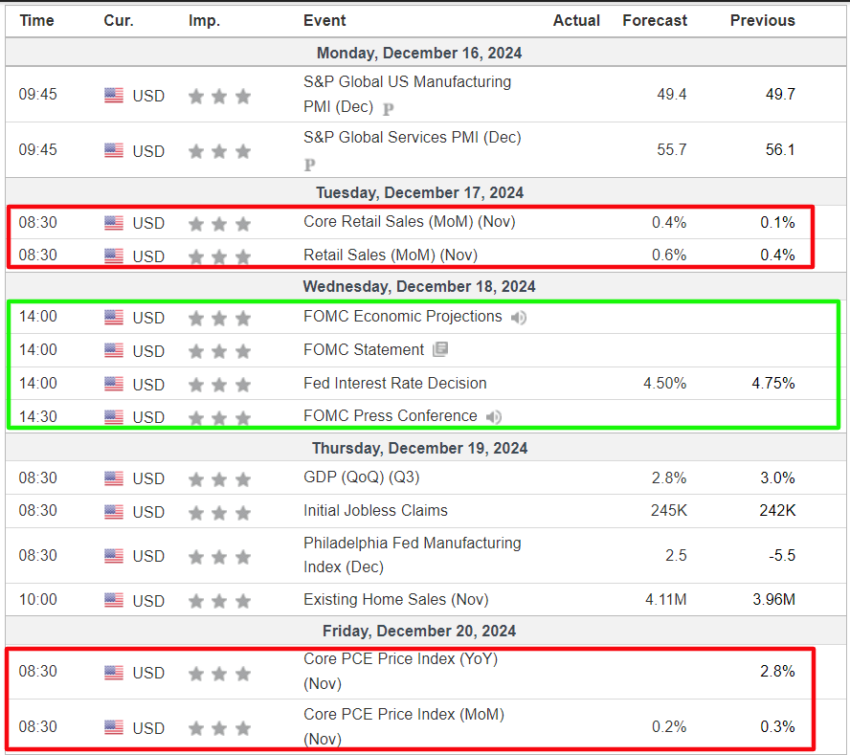

This week begins with the release of the S&P Manufacturing and Services PMI on Monday. The PMI, derived from monthly business surveys, is an important, often used measure of economic health. Used to predict market trends and evaluate business conditions.

The November services PMI was at 56.1, with a December forecast of 55.3. Meanwhile, the manufacturing PMI index, from 49.7 in November, is expected to decrease slightly to 49.6. A PMI above 50 indicates economic growth, while below 50 indicates contraction.

If the data shows strength in the services and manufacturing sectors, it could bolster overall economic confidence. This optimism may increase investment appetite for riskier assets, including Cryptocurrencies. However, economists remain cautious due to concerns about the broader economic outlook.

“The US economy is currently in chaos. We have had an inverted yield curve and a Manufacturing PMI below 50 for almost a year. Yield curve inversion has successfully predicted the last seven recessions. Before the COVID crisis and 2008, the Manufacturing PMI index was also below 50,” a famous user on X share.

Retail Sales Data

Another US economic data that Cryptocurrency traders are interested in this week is retail sales. After a 0.4% reading in October, economists expect the November reading to reach 0.6%. Retail data will provide insight into consumer spending patterns and overall consumer confidence.

If retail sales are strong, showing consumers spending more, it could be seen as a positive signal for the economy. This could lead to increased trust in traditional financial markets, which in turn could spread to the Cryptocurrency market.

Retail sales data can also influence inflation expectations. If retail sales are strong, it could signal rising demand and possibly higher inflation in the future. Cryptocurrencies like Bitcoin are often seen as a hedge against inflation, so any signs of rising inflation could drive investors to Cryptocurrencies.

“Strong sales = bullish market, weak = high risk,” noted analyst Mark Cullen speak.

Fed Interest Rate Decision (FOMC)

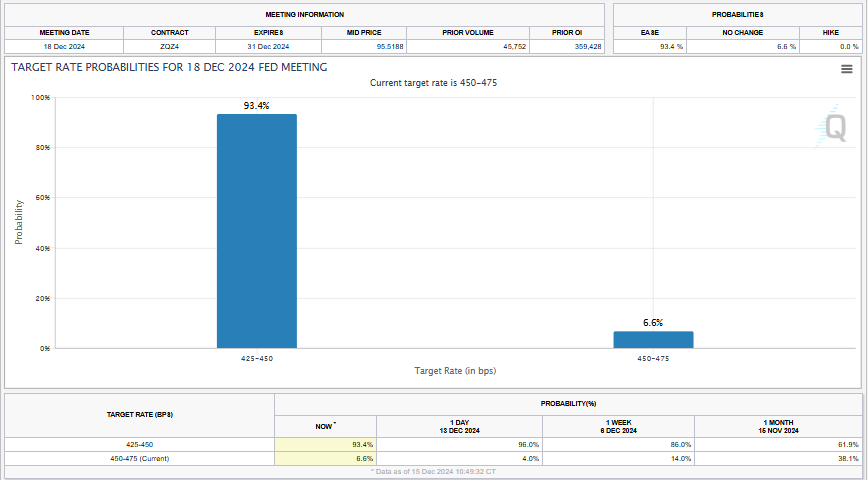

However, the focus of US macroeconomic data this week is the Federal Reserve’s (Fed) interest rate decision on Wednesday. The Cryptocurrency market prepares for strong fluctuations amid the long term. Expect to see if the Fed will raise or cut interest rates.

According to the CME FedWatch Tool, the market is predicting a 25 basis point (0.25% bps) rate cut on Wednesday. This compares to a 6.6% chance that the Fed will cut rates by 50 basis points (0.5%).

This suggests expectations that the Fed will adopt a more cautious approach to interest rate cuts next year amid signs that progress toward reducing inflation toward its 2% target is stalling. Given this backdrop, investors will also be watching the Fed dot plot to gauge whether the average interest rate forecasts indicate a sharp shift in the Fed’s outlook.

Immediately after the FOMC, Fed Chairman Jerome Powell will hold his press conference, marking another notable point for Crypto traders to follow.

“Markets are closely watching for signs of any future tightening or dovish comments. Any surprises here could trigger significant fluctuations across the board, especially in parts related to interest rates,” said a popular user on X (Twitter). comment.

The US Consumer Price Index (CPI) and Producer Price Index (PPI) released last week reinforced expectations that the Fed will slow down the rate-cutting cycle next year. Specifically, CPI increased again, while core CPI did not decrease. In addition, the unemployment rate is gradually increasing.

In this context, it is very likely that the FED will continue to reduce interest rates by another 0.25%. However, this move may be based on the hope that this is only a temporary situation and that inflation and unemployment rates will continue to decline in the near future.

GDP Data for the Third Quarter of 2024

On Thursday, the US Bureau of Economic Analysis (BEA) will release the second third quarter (Q3) GDP data. This data will provide insight into economic health as we approach the end of the year.

It is worth noting that this is one of the main indicators measuring the health of the US economy, with the average forecast being 2.9% after the previous level was 2.8%. This means US GDP grows at a 2.8% annual rate in Q3 2024, and markets will be watching to see if this trend continues.

PCE Inflation Data

To round off the week, November Personal Inflation (PCE) data will be released on Friday. This is a measure of consumer spending and includes all goods and services purchased by American households. This makes it an important measure for the Fed, meaning any surprises here could have a direct impact on the Fed’s future policy decisions and market sentiment.

According to The Kobeissi Lettera prominent commentator on global capital markets, one-month annual core PCE inflation now stands at 3.5%+ as traders await November data later in the week. At the same time, one-month, three-month and six-month annual core PCE inflation are all rising again.

Similarly, one-month annual PCE Supercore inflation is now approaching 5%. Meanwhile, headline PCE Supercore inflation is above 3.5% and rising again. Combined, this data shows that consumers are under severe inflation pressure in many categories.

Based on the above, this week could be very eventful, with the potential for increased volatility around these events. At the time of writing, BTC is trading at $104,991, a slight increase of 2% since Monday’s trading session opened.