As cryptocurrency continues to permeate the mainstream economy, its acceptance is expanding beyond specialized circles. A new survey from asset management firm Bitwise confirms this story.

The survey offers insights into how financial advisors in the United States are integrating cryptocurrency into their clients’ investment portfolios and planning for the future.

Cryptocurrency Goes Mainstream: 56% of Advisors Expect to Invest More

Survey lead from November 14 to December 20, 2024 revealed a significant shift in financial advisors’ awareness and actions towards cryptocurrencies.

The unexpected outcome of the 2024 US election has sharply increased advisors’ interest in cryptocurrencies. About 56% of advisors surveyed said that the election results make them more likely to invest in cryptocurrency in 2025.

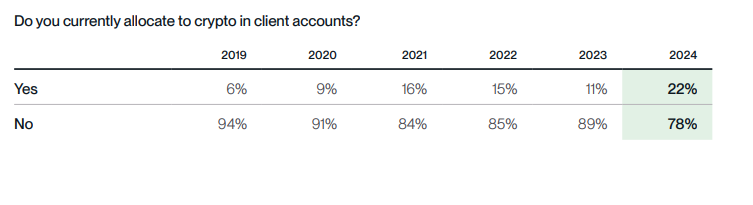

The number of advisors integrating cryptocurrency into client portfolios has skyrocketed. In 2024, 22% of advisors reported a cryptocurrency allocation in client accounts, a significant increase from just 11% in 2023.

According to the survey, demand for cryptocurrencies among customers is stronger than ever. Additionally, 96% of advisors say they have received questions about cryptocurrency from clients in 2024.

Among advisors already invested in crypto, 99% plan to maintain or increase their crypto allocation in 2025.

“If you had any doubts that 2024 was a major turning point for crypto, this year’s survey dispels that. Advisors are waking up to the potential of cryptocurrency like never before, and they are allocating like never before. But perhaps what’s most surprising is that there’s still plenty of opportunity when two-thirds of financial advisors — who advise millions of Americans and manage trillions of dollars in assets — still can’t access the money. digitally for customers,” commented Bitwise Chief Investment Officer Matt Hougan.

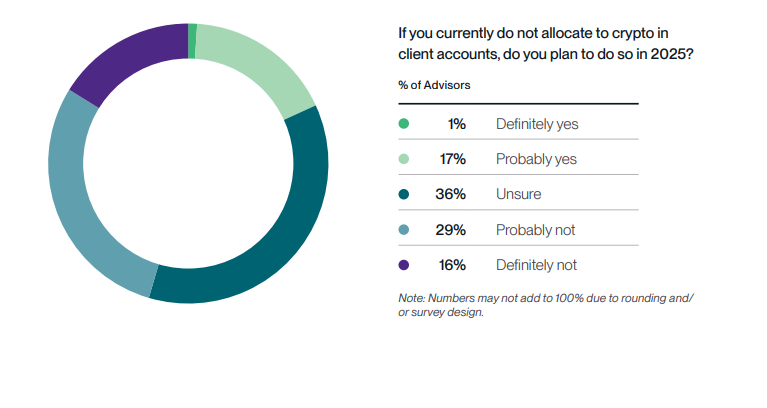

Furthermore, 19% of advisors who previously stayed away from cryptocurrency said they are now “definitely” or “probably” planning to invest in crypto assets for clients. This is a significant increase from 8% in 2024.

However, despite the growth in cryptocurrency adoption, there are still barriers to access. Only 35% of advisors can buy cryptocurrency directly in client accounts, highlighting a barrier to wider adoption.

Looking ahead to 2025, crypto stock ETFs remain the most preferred means of exposure to cryptocurrencies. This preference reflects growing interest in investment products that provide exposure to cryptocurrency markets rather than individual cryptocurrencies.

While concerns about regulatory uncertainty still exist, they have lessened compared to previous years. In 2024, 50% of advisors see regulatory challenges as a major obstacle, down from 60-65% in previous surveys, showing an improvement in clarity.

Additionally, Bitwise surveyed 400 financial advisors, including independent registered investment advisors, broker representatives, financial planners, and representatives from major financial firms across USA.