Hello lads. This is the finish of a uninteresting week with the compact margin side industry, currently we will sit down and strategy to trade Bitcoin and some altcoin pairs this week!

Bitcoin (BTC) examination and remarks.

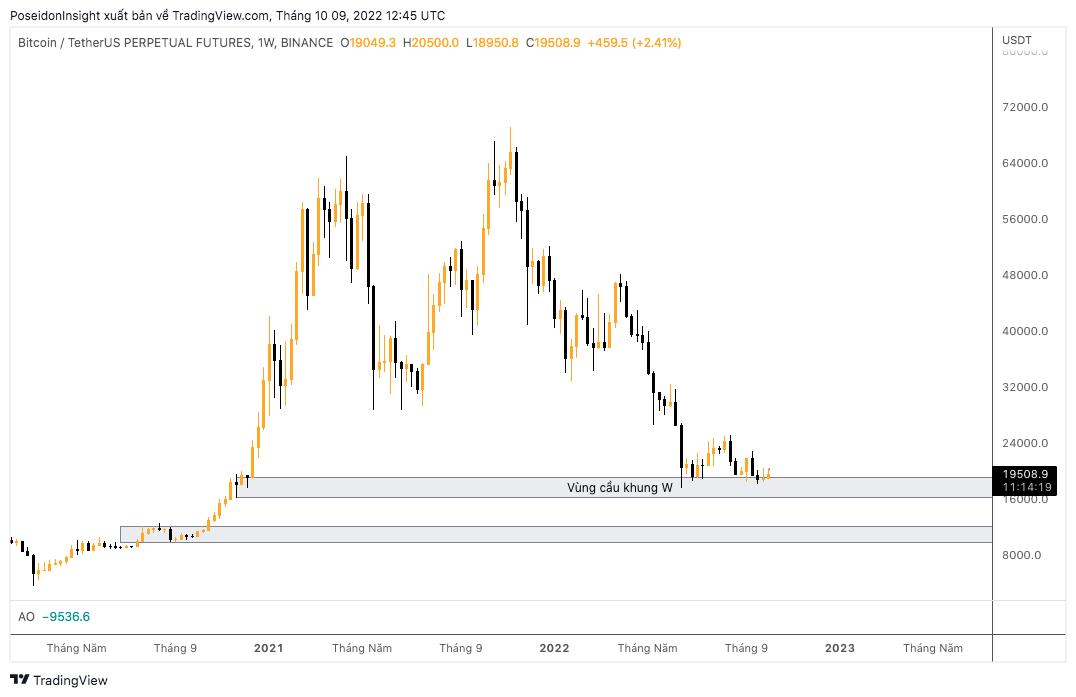

In the weekly frame, BTC is hitting the weekly demand zone and you can plainly see that the price tag has temporarily “held” all around the $ 18,000 – $ 19,500 zone. It can be argued that the acquiring energy in this demand zone, coupled with the reality that the price tag has fallen sharply for a extended time, has forced traders to temporarily cease marketing in this place. However, the price tag of BTC right after hitting this demand zone has not but proved that the shopping for force absolutely prevailed when the price tag was nevertheless only sideways.

You can quickly recognize the BTC sideways by way of the following indicators:

- Unable to make clear peaks and troughs to kind a trend.

- The trading volume is very low, specially in the final number of days.

- The candle physique gets to be smaller sized and smaller sized (very low amplitude).

Usually, right after this kind of a lateral time period, the industry will have a tendency rather strongly. Since BTC has been in a downtrend for some time now, we have the suitable to assume a retracement (note that this is a retracement, not an uptrend). For this to take place, you have to have a cease reduction sweep 1st (to clear away extended traders’ positions) and at the exact same time fill the purchase purchase at the greatest price tag (of the whales).

So I assume a situation like this:

This situation would begin with a somewhat powerful drop in BTC in direction of the $ 17,000 – $ 17,500 area, right after which the price tag could make reversal patterns this kind of as double bottom, head and shoulders and bullish, back to the upper finish of the variety (price tag variety 22,000 – USD 23,000).

A excellent indicator to strengthen the over strategy is that the RSI tends to break out of the downtrend line in the 3D frame.

If you have to have a lot more than confirmation, you can wait for the RSI to move out of this trend line.

BTC.D (Bitcoin Dominance)

Cash movement from the industry can make BTC.D quite very low, only all around 41%. We can search at BTC.D in the quick phrase, mixed with the over situation to predict that BTC.D can sweep the stoploss (go beneath the help place), then bounce and assist BTC enter the “bounce” state.

Some promising Altcoins

According to the strategy we talked about over, you may perhaps recognize some altcoins beneath:

OPERATION

OP has noticed a large distribution from the prime of $ two.two to date. The price tag is now approaching the demand zone which was previously also an crucial help place. You can spread out the shopping for capital progressively at excellent price tag amounts from .74 to .eight USD, cease the reduction beneath .64 and get revenue at one – one.one USD.

For shorter time frames and stoplosses, you can wait for the price tag response in the help place and spot orders when there is a set in the shortest time (4H-1H).

CHZ

CHZ in the 4H frame formed a downtrend, then sideways. The strategy for CHZ is rather clear and basic: wait for the breakout, then retest, then enter. However, as the four-hour trend is down, you really should recognize:

- It really should come in purchase when it breaks in the path of the trend.

- In situation the price tag breaks up, if you go extended, you really should shut early in the provide and resistance zones, so you can quick entry in these price tag zones if there is a excellent setup.

finish

Here are some trading strategies from my personalized stage of see. Hope you guys have a lot more prospective customers for much better referencing and trading subsequent week. Don’t neglect to join Coinlive Trading to trade and “cheat” with us!