Bitcoin (BTC) in the early morning of December 4th continued to set its lowest value in two months when the development momentum was gone.

* The post was up to date at noon on four/twelve.

Bitcoin “finds a new fund” once again

After a series of four consecutive days of sideways motion to the USD 56,000 – USD 59,000 region, the late evening Bitcoin (BTC) value of December 3rd and early morning December 4th was the moment once again strongly corrected, going from the peak of the 24 hrs from 57,600 bucks to 51,680 bucks, equal to a reduction of ten.three% of its worth.

The cryptocurrency market place also took a hit with its massive brother, with major coins like Ethereum (ETH) dropping from $ four,654 to $ four,032.

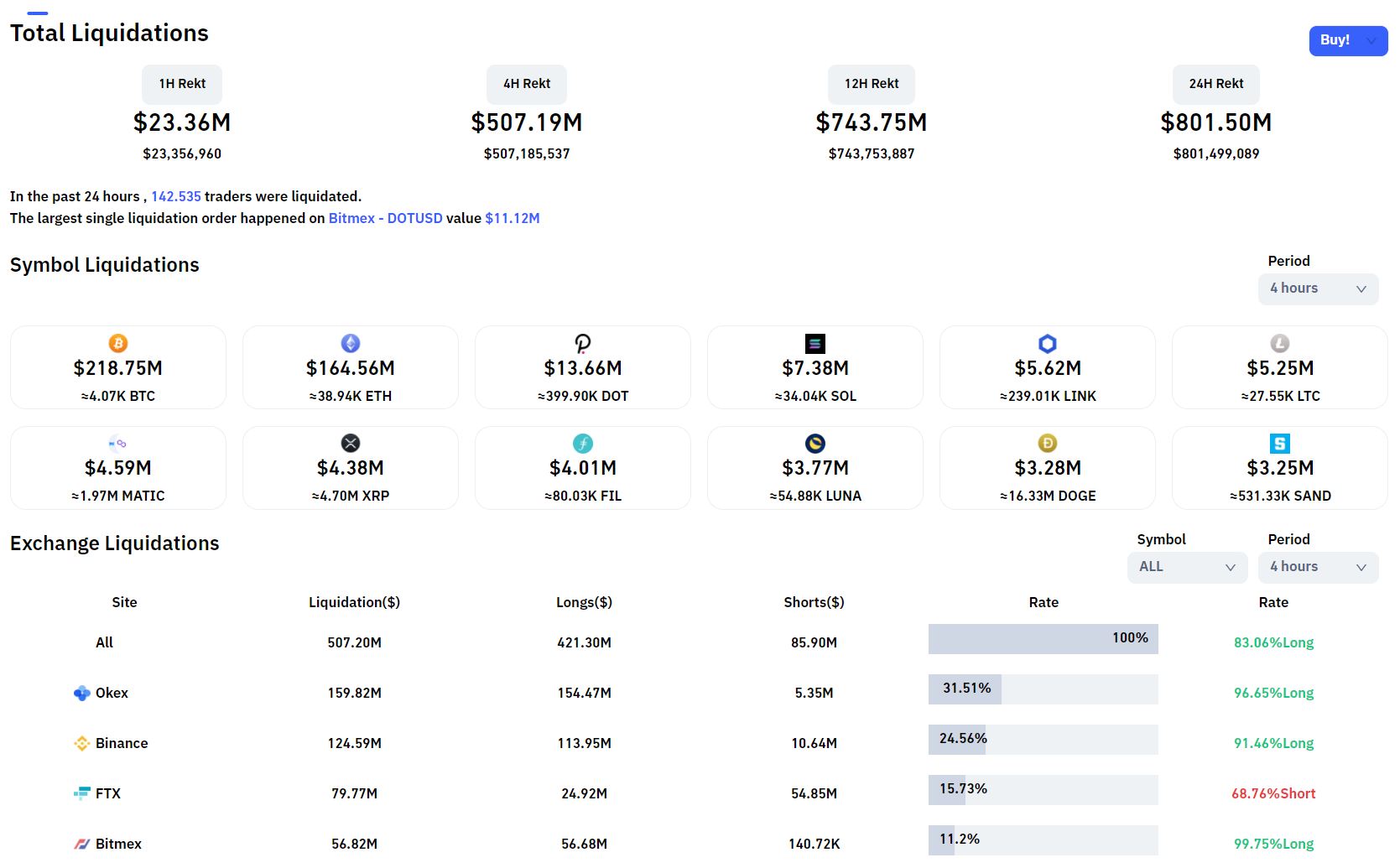

According to Coinglass statistics, the crypto derivatives market place the moment once again took a hit from the decline when up to half a billion bucks was liquidated in the previous four hrs, of which almost half are Bitcoin orders. Nearly 82% of the cleared orders had been extended orders, centered on OKEx and Binance exchanges.

The aforementioned value is also Bitcoin’s lowest worth considering that October five, when the coin recovered strongly following the Chinese ban and speedily broke the $ 50,000 mark for several factors.

When the inspiration is gone

However, it seems that the “moment of growth” is also the cause behind the downtrend of the greatest cryptocurrency in the planet from mid-November to now. As Coinlive commented, considering that Bitcoin ETFs went public in October and the BTC occasion successful implementation of Taproot – the only big update in the final four many years, Bitcoin would seem to have “lost faith” go past.

Currently, this currency’s record large is USD 69,000, set on November ten as the United States announced that the inflation charge has reached a thirty-12 months large. This is a message Good information for the total cryptocurrency marketplace in the quick phrase, as it demonstrates the dollar is depreciating, favoring substitute assets this kind of as cryptocurrencies and Bitcoin in distinct. However, as this is a cause for “macro” development and does not stem from BTC’s inner power, it are not able to ensure the stability of the value line, major to the correction of Bitcoin.

Positive information like MicroStrategy invested almost half a billion bucks to purchase extra Bitcoins El Salvador Even the planned issuance of $ one billion in BTC bonds is not adequate to revive the market place, due to the fact these “tricks” are merely as well previous or have no useful affect at the second.

There is no upside momentum, but News that crashes Bitcoin substantially extra. First, BTC final week had a substantial drop to $ 54,800 in accordance to the international stock market place following a new COVID-19 strain termed Omicron acknowledged and warned by a lot of nations as exceptionally unsafe. Many analysts worry Omicron could wipe out the world’s recovery from the 2020 pandemic due to the fact it is extra contagious and extra virulent than the Delta strain. However, there are no research exhibiting whether or not Omicron can be resistant to vaccines.

Later this week, US Federal Reserve (Fed) officials voiced the alternative to intervene in the market place for increase curiosity prices ahead of routine in 2022, cut down the inflation charge to pay out interest to Omicron. Although the head of the Fed at this time continues to be Mr. Jerome Powell, the president aims to continue to keep curiosity prices minimal to assistance the recovery of US assets and has just been appointed by President Biden to carry on taking charge. the financial institution the US central financial institution for yet another four many years, but possibly the Fed will not want to repeat the errors of the epidemic in 2020 and will actively cut down inflation with the aim of stabilizing buyer charges.

Also, other unfavorable facts this kind of as SEC continues to reject Bitcoin ETFs pleasant India modify “smoothly” the legal place on the ban on cryptocurrencies and if the venture Badger knife Recently hacked by hackers and stealing extra than $ 120 million well worth of Bitcoin-anchored tokens did not increase the scenario.

Over two,101 BTC has been stolen considering that @BadgerDAO . According to our investigation, the hacker converted the proceeds into renBTC in advance of transferring them to 14 diverse BTC addresses. And the ETH well worth about $ 700,000 was stolen. We will carry on to keep track of the stolen money. pic.twitter.com/2bnCCrfe1R

– SlowMist (@SlowMist_Staff) December 2, 2021

What are the prospective customers for Bitcoin in the close to potential?

At the second, what Bitcoin is carrying out is nonetheless locating a assistance region powerful adequate to assistance the value line. It could be $ 50,000, significantly less than $ 48,000, or even a drop to $ 43,000. Only time will give the proper solution.

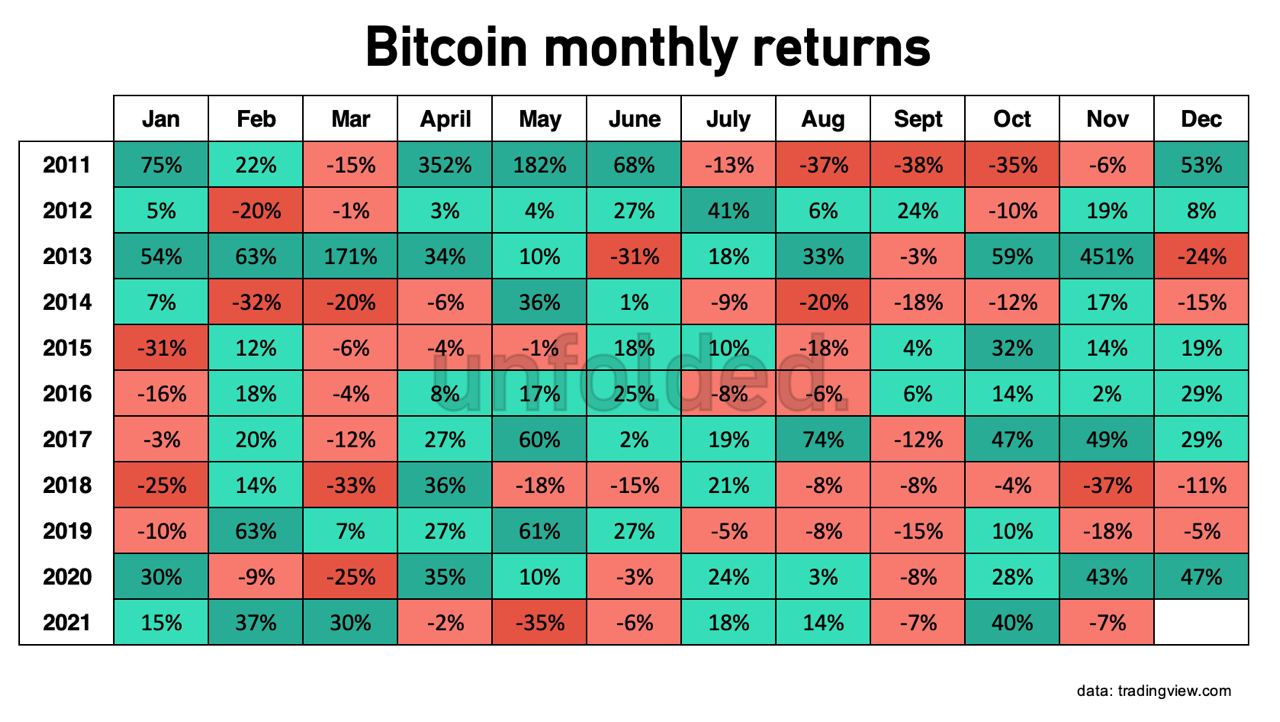

Even so, some analysts continue to be optimistic about BTC’s value outlook for December, the peak month of previous rallies. PlanB, an analyst who accurately predicted BTC’s value movements for 3 consecutive months from August to October, nonetheless argues that Bitcoin could hit a new large close to the $ one hundred,000 threshold in spite of the incorrect November forecast.

Stock-to-Flow model on track from March 2019, in one normal deviation band (dark blue), aiming for $ one hundred,000 https://t.co/Zem1teOmWp pic.twitter.com/YKSHesHIp

– PlanB (@ $ one hundred trillion) December 1, 2021

With Bitcoin’s value dropping seven% in November and exhibiting no indicators of turning back anytime quickly, the amount of people today who think PlanB’s examination is reducing.

Updated at noon on four/twelve

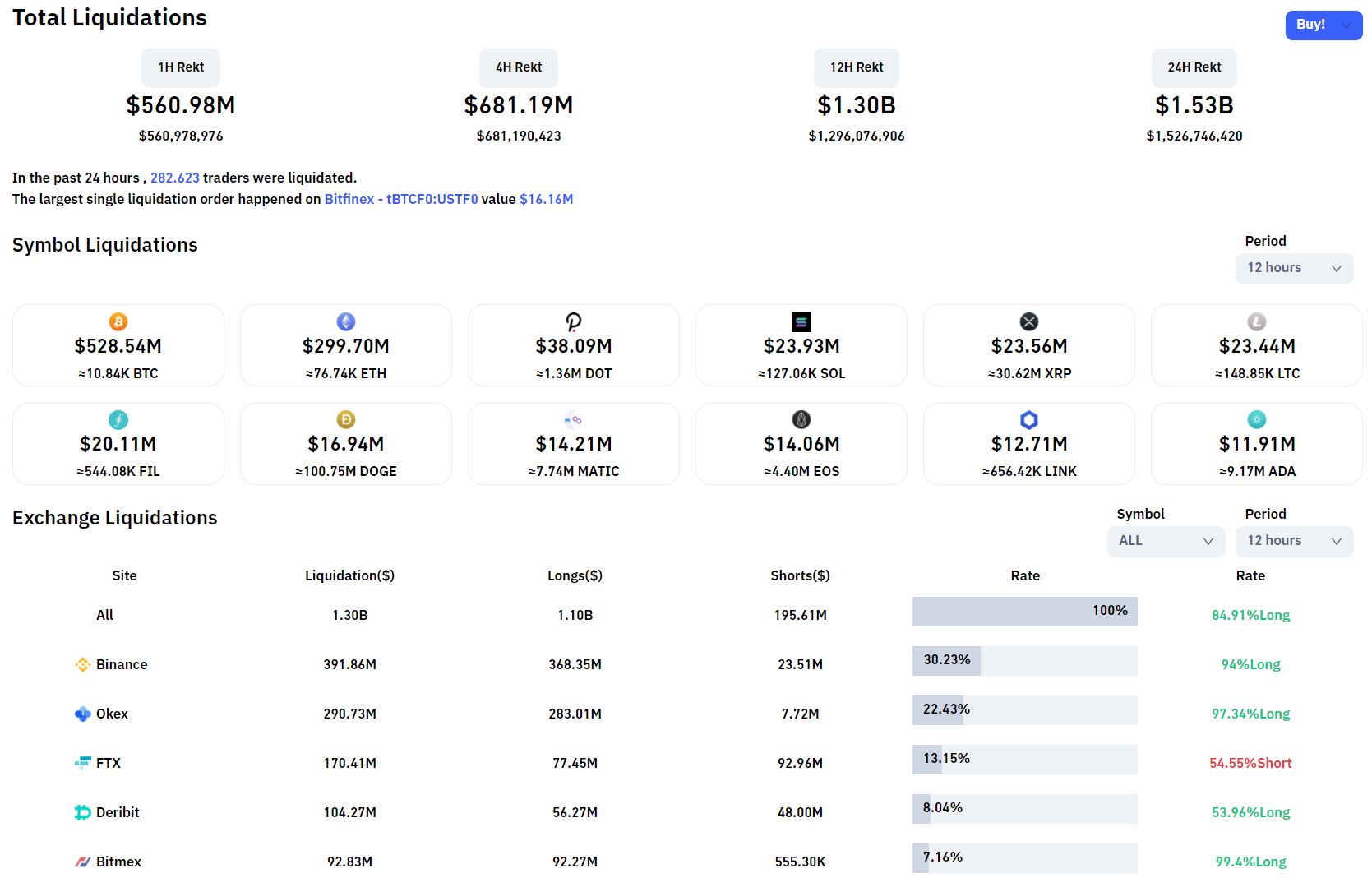

At noon on December 4th, Bitcoin’s value continued to move in the unfavorable course, dropping the $ 50,000 assistance degree and “crashing” to $ 47,757, setting a new 60-day minimal. Ethereum also fell to $ three,844, dropping extra than 13% of its worth from 24 hrs in the past.

In the previous twelve hrs, Bitcoin orders well worth $ 528 million have been cleared, in contrast to $ one.three billion for the total market place. Up to 85% of cleared orders are extended orders.

Synthetic Currency 68

Maybe you are interested: