A new examine from the International Monetary Fund (IMF) exhibits that cryptocurrencies are no longer outdoors the international money technique, but there are nevertheless quite a few worries to take into consideration.

Cryptocurrencies are no longer an obscure asset class in the international money ecosystem, but their correlation is rising with the stock market place, in accordance to a new examine by the International Monetary Fund (IMF): Shares are cutting down Bitcoin’s investment purpose. (BTC) and quite a few other altcoins on the market place.

The report is accompanied by a survey that highlights the new dangers connected with the rising connection amongst digital assets and standard money markets. Written by IMF director of dollars and capital markets Tobias Adrian and economist Tara Iyer, as very well as deputy director of exploration Mahvash Qureshi.

“Crypto-assets such as Bitcoin have matured from an underutilized asset class that is an integral part of the global financial revolution.”

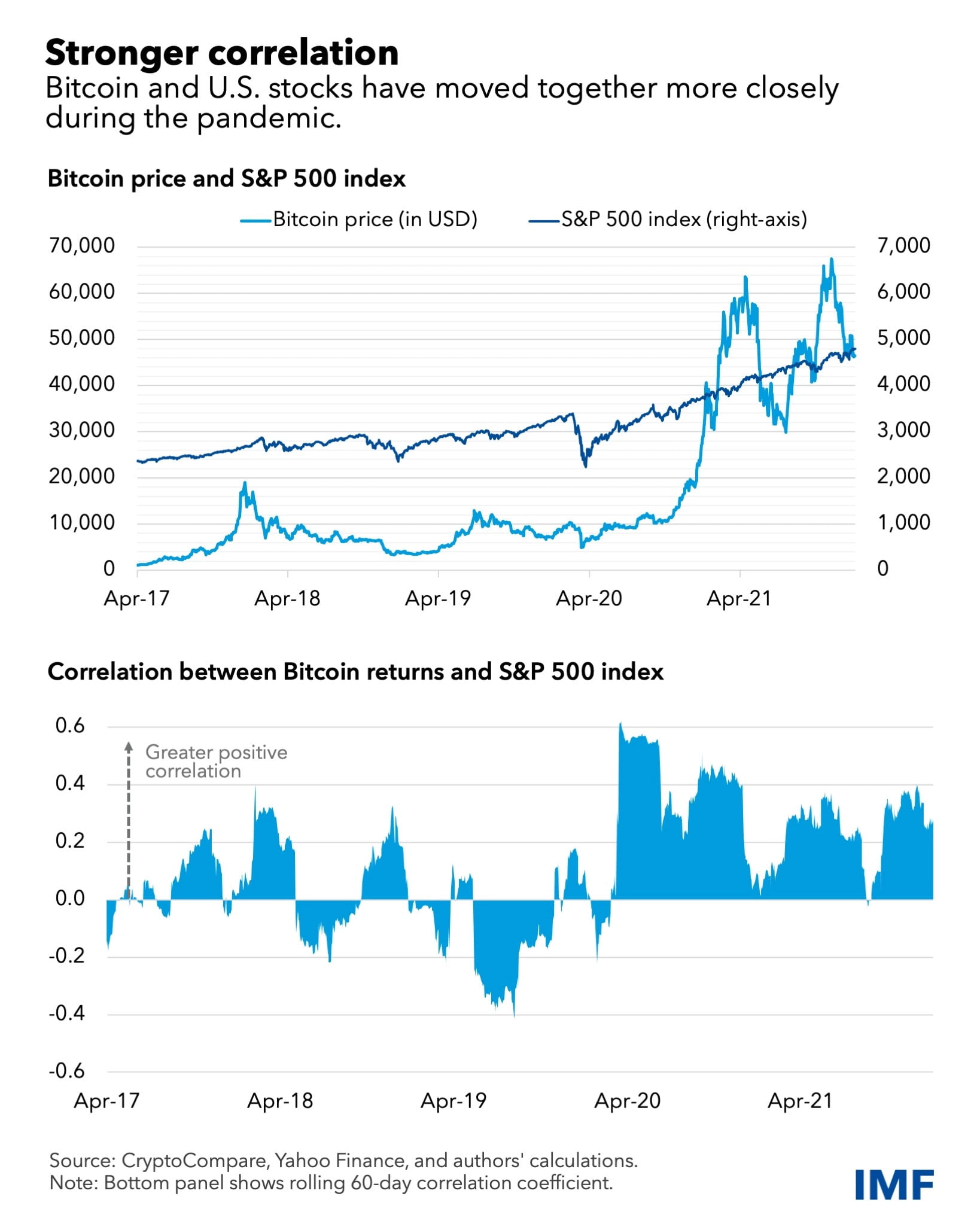

Furthermore, the IMF more mentioned that Bitcoin (BTC) and Ethereum (ETH) have been seldom correlated with main equity indices prior to the COVID-19 pandemic. But that transformed just after the uncommon reactions of quite a few central banking institutions in early 2020.

The correlation coefficient amongst BTC and S&P 500 improved by three,600%, from .01 to .36 just after April 2020. This implies that the two asset lessons have established a closer romantic relationship because the Great COVID-19 pandemic begun to flare up.

According to IMF specialists, the more powerful the correlation, the higher the danger to Bitcoin. The rising connectivity amongst cryptocurrency and equity markets will facilitate shocks that could destabilize money markets.

“Given its relatively high volatility and valuation, the increased consensus on cryptocurrencies will soon pose a risk to the financial landscape, especially in countries with widespread cryptocurrency adoption.”

Therefore, the IMF is actively calling for a a lot more coordinated international regulatory framework to guidebook the principle and increase nationwide oversight in buy to mitigate the aforementioned worries stemming from the cryptocurrency ecosystem.

Overall, the IMF gave some recognition of the value and worth of cryptocurrencies by its hottest report. Something that has under no circumstances occurred just before in the IMF ideology. Especially the reality that the IMF has repeatedly issued “ultimatums” warning El Salvador to accept Bitcoin as fiat currency and the program to “strengthen” cryptocurrencies launched in July 2021.

Additionally, the potential IMF Deputy Chief Executive did not express any intentions to ban cryptocurrencies final month. He mentioned that folks are working with cryptocurrencies as an investment asset, which implies that the principles relating to other varieties of investing really should apply to this location as very well. Therefore, the prohibition action will pose quite a few issues to policy makers.

Synthetic currency 68

Maybe you are interested: