Cybercriminals laundered more than $ eight.six billion in cryptocurrencies in 2021, which include 17% via DeFi protocols.

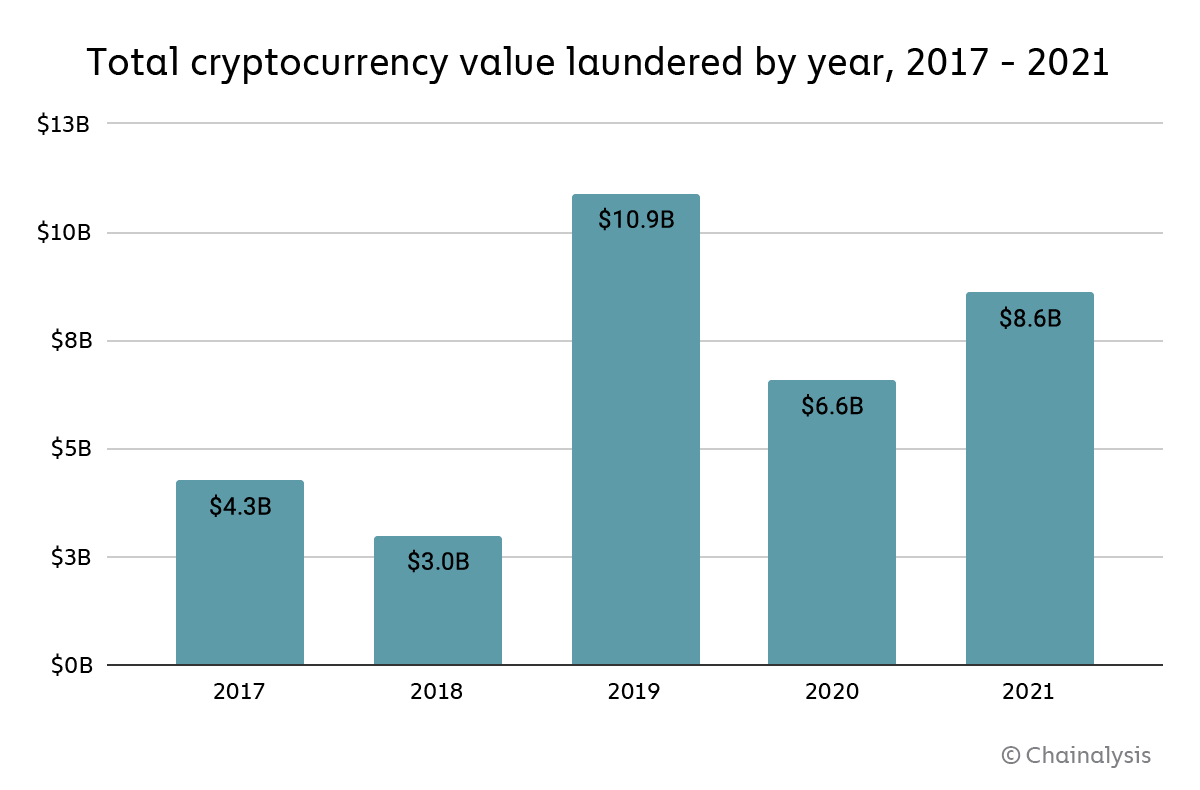

According to the most recent statistics from the cryptocurrency market place exploration unit Chainalysis, in 2021, up to $ eight.six billion really worth of dirty funds was effectively laundered via the cryptocurrency sector, a thirty% boost more than six. $ six billion in 2020. However, that variety is even now beneath the record of $ ten.9 billion in 2019.

In complete, $ 33.four billion has been laundered via the cryptocurrency market place from 2017 to date, just a drop of salt from $ two trillion a yr in conventional small business sectors. The Chainalysis report states that it is a lot simpler to keep track of funds laundering in the cryptocurrency sector than in conventional finance.

“The most contrasting difference between crypto money laundering and fiat money laundering is that, thanks to the transparent nature of the blockchain, we are able to trace the illegal flow of criminal money moving between the wallets and the project in the process of erasing the funds. traces of the source of money “.

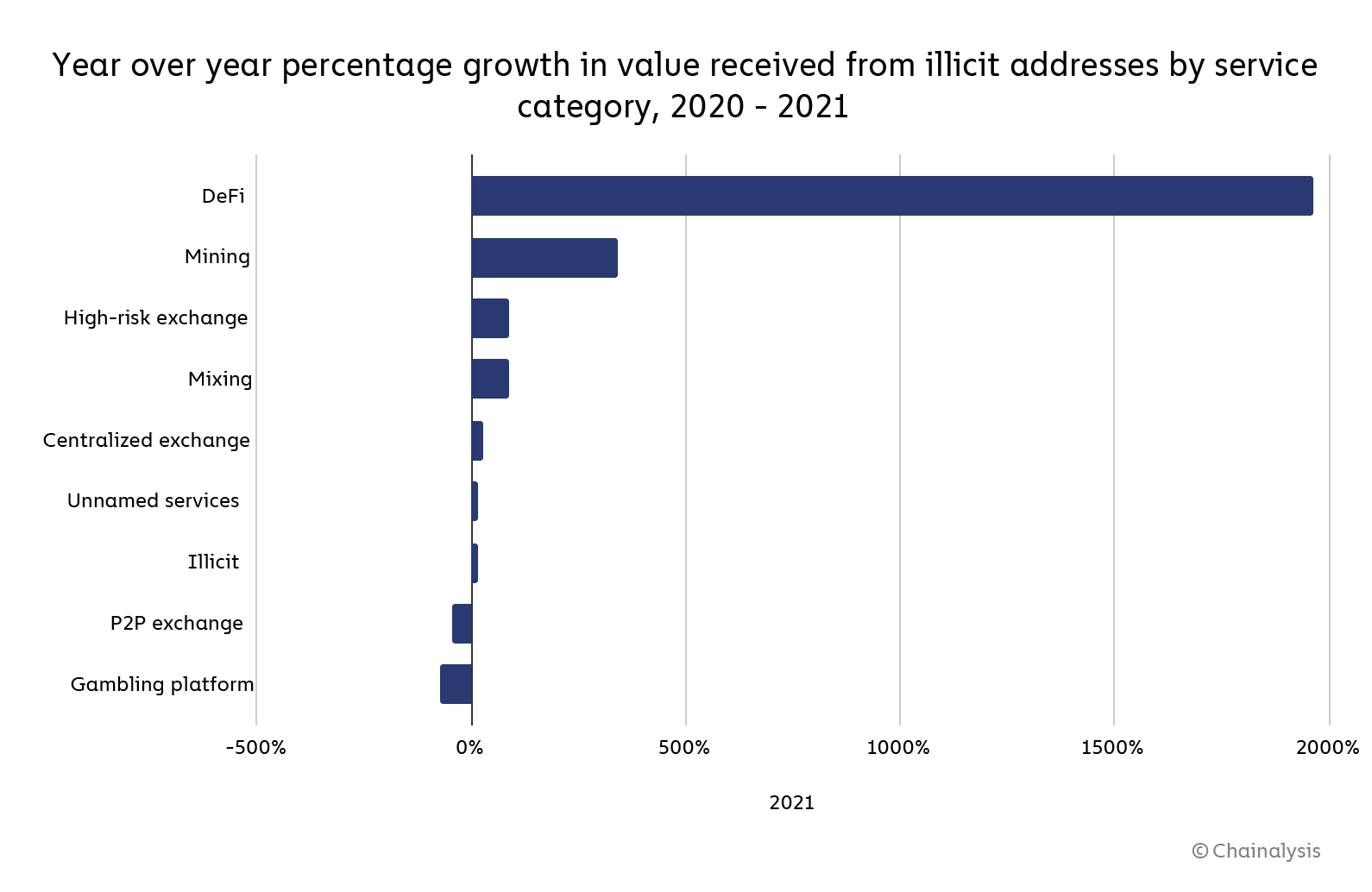

While cryptocurrency exchanges with weak purchaser identification and anti-funds laundering mechanisms are even now the most important locations utilised to launder funds, a worrying trend is the sum of funds “licensed” via exchanges. DeFi platforms have also grown more than two,000% in the previous yr. Other facets this kind of as mining pools, trading mixer platforms, and so forth. they obtained bigger quantities of dirty cryptocurrencies than the prior yr.

Chainalysis says most of the funds laundered via decentralized finance tasks comes from DeFi attacks, which brought on $ one.four billion in harm in 2021. Criminals seldom use them. DeFi has sources outdoors of DeFi to take away traces of unlawful action, but rather Bitcoin is their most common currency.

Furthermore, hackers (this kind of as North Korean ones) have a tendency to decide on DeFi, although frequent scammers even now decide on massive cryptocurrency exchanges.

Chainalysis exploration chief Kim Grauer commented:

“There is no denying the truth that criminal routines have begun to notice the probable of DeFi. However, the datasets we gather all come from scenarios that have been exposed. “

Chainalysis additional notes that their report is also restricted to criminal acts “originating in the field of cryptocurrency,” but can not enumerate other varieties of crimes that transfer funds into cryptocurrency.

This is most likely why Chainalysis notes that the worth of funds laundering via cryptocurrencies represents only .05% of the complete volume of cryptocurrency trading for the entire of 2021, although the real variety could be larger than estimates.

By asset, altcoins are the most concerned coin group with unlawful addresses with 68%, followed by Ethereum with 63%, stablecoins with 57% and remarkably Bitcoin only has 19%.

Synthetic currency 68

Maybe you are interested: