As a monetary instrument, futures are also a double-edged sword. Beginners need to study the know-how, pick out the proper broker and have an understanding of the simple trading method. In this post, we delve into the varieties of trading and simple operations on CoinEx Futures.

The critical distinction amongst spot trading and futures trading

Spot cryptocurrency trading refers to the method of purchasing and promoting crypto assets this kind of as BTC and ETH with quick delivery.

Cryptocurrency futures trading refers to a method by which customers and sellers acquire / promote futures contracts on an exchange and acquire / promote a particular sum of cryptocurrency at a time, specified in the potential based mostly on the agreement they have signed.

Buying a futures contract does not suggest owning the corresponding cryptocurrency. What the consumer has bought is a contract that specifies the acquire or sale of a particular crypto-asset at a potential date.

For illustration, the price tag of BTC is at this time trading at $ thirty,000 and if an individual believes the price tag will rise, they can acquire “Long” futures contracts. However, soon after purchasing the futures contract, he will not very own the BTC as he would in the spot trade and only owns a contract that enables him to revenue by promoting it when the BTC price tag rises.

Therefore, fundamentally the two varieties of transactions talked about over vary in the following factors:

Various underlying assets

In spot trading, the underlying asset is a cryptocurrency, this kind of as BTC or ETH, though futures trading is emphasized by futures contracts which consist of specified regular details, involves the agreed cryptocurrency to trade, date, price tag, sum, and so on.

The delivery date of the home is distinctive

Generally, in spot trading, the cryptocurrency is delivered to the purchaser promptly. For illustration, if a consumer intends to acquire or promote BTC, the consumer can instantly shut the transaction on a cryptocurrency exchange (spot trading by buy may well be somewhat slower).

However, futures trading can get up to a quarter to finish (for illustration, when the closing time is at the finish of the quarter) and some futures contracts may well be held indefinitely.

Flexible extended / brief trading

Spot trading is a single-way, which implies that soon after purchasing cryptocurrencies at the present price tag, traders can only revenue by promoting them soon after the price tag has risen. Futures trading, on the other hand, delivers two biases: the trader can use a Long or Short buy. If the consumer thinks that the price tag of an asset will enhance, the consumer chooses Long to acquire a futures contract and vice versa, Short to promote a futures contract. In other phrases, traders can revenue from purchasing or promoting futures contracts irrespective of no matter whether the price tag goes up or down.

Take benefit of the assistance

In spot trading, if a consumer owns $ five,000, the consumer can only acquire BTC or its equivalent for a different cryptocurrency. However, futures trading enables end users to trade with leverage which implies they can acquire cryptocurrencies well worth quite a few instances the sum of margin they offer you. The larger the leverage charge, the larger the leverage, the decrease the margin ratio.

How to pick out the proper futures exchange?

Security and stability

When selecting a futures trading platform, newbies need to very first think about the security and stability of the platform. A futures exchange, on the other hand, is ordinarily supported by a sturdy technologies group that can safeguard consumer assets from attacks.

Types of Futures Contracts Available

The varieties of futures contracts out there on just about every trading platform can fluctuate, as do the key varieties of futures trading. Some exchanges offer you perpetual futures contracts, though other individuals do not. Additionally, there are also exchanges that excel in a single variety of futures contract. Therefore, when selecting a stock exchange, newbies need to also spend interest to the varieties of futures contracts out there on the exchange.

User knowledge

Newbies need to also get into account the consumer knowledge of the exchange. For illustration, an overly difficult interface design and style helps make it tricky for end users to trade futures contracts. Consequently, a very simple and useful consumer interface is much more appropriate for novices.

Why pick out CoinEx Futures

In addition to the simple spot trading goods out there on most cryptocurrency exchanges, CoinEx has supplied a futures services to make it possible for end users to have much more investment solutions.

Easy to use

To increase the trading knowledge, CoinEx has developed a very simple and useful futures internet site that enables end users to begin trading instantly by following the directions.

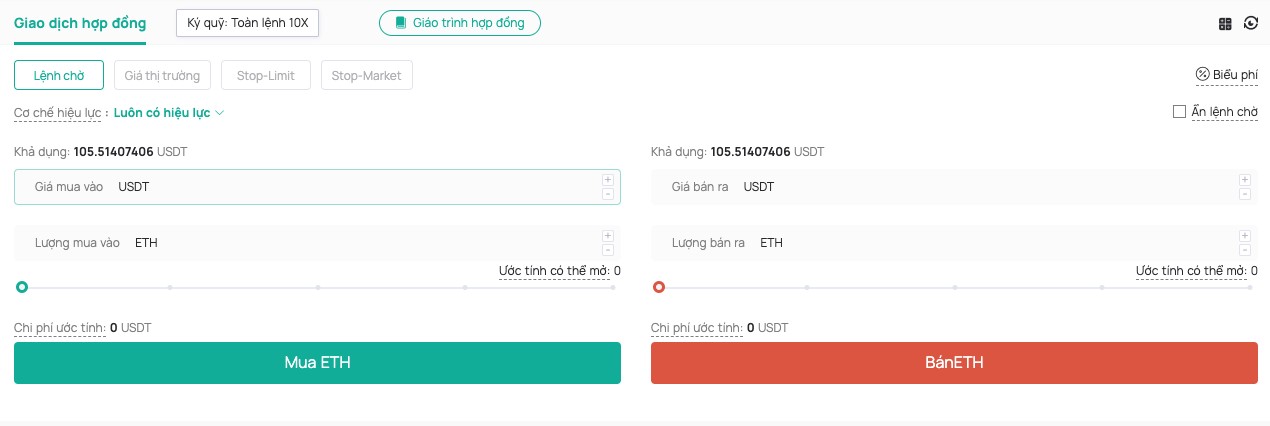

For illustration, in the interface over, end users can effortlessly acquire or promote brief. If Mr. A has a program to “long” the company, he can pick out leverage, enter the price tag and sum, then click acquire ETH to initiate a extended place. Selling is also incredibly very simple, end users just have to have to enter the price tag and sum on the proper side of the webpage, then click promote ETH.

Furthermore, soon after producing an buy, end users can also apply specified chance handle tactics, this kind of as setting TP / SL charges to get earnings very first or lessen losses in excess of time.

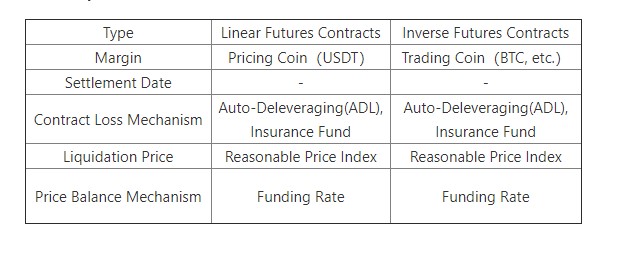

There are two solutions: linear contract and inverse contract

Depending on the cryptocurrency utilised for settlement, CoinEx delivers two varieties of futures contracts: linear contracts and reverse contracts.

A linear contract also regarded as a “USDT margin contract” is a futures contract settled in USDT A reverse contract, also regarded as a “coin margin contract”, is a futures contract that is settled in the respective cryptocurrency.

On CoinEx, each of these contracts have no expiration or settlement date, which can be held indefinitely.

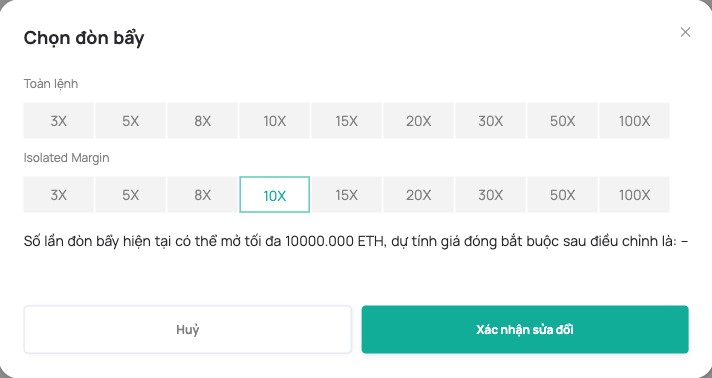

Offers up to 100x leverage

CoinEx Futures supports each cross margin and isolated margin. Both designs characteristic leverage ratios from 3X (minimal) to 100X (highest), meeting the demands of futures traders with various chance tolerance.

To reduce the chance, only BTC and ETH assistance 100X leverage, otherwise the highest leverage is 50X.

The leverage ratio supported by CoinEx Futures is divided into 9 ranges (eight ranges for non-BTC and ETH cryptocurrencies), ranging from 3X to 100X. These ranges have been predetermined by CoinEx.

Meanwhile, end users are unable to set any random leverage and can only pick out from 9 ratios, which also assists them keep away from problems when setting the leverage.

Enter TP / SL and shut all orders

As we all know, in contrast to the spot, whilst it delivers excellent and more rapidly returns, futures trading frequently will involve excellent dangers. Futures traders can be forced to liquidate orders when charges fluctuate wildly. Therefore, to enhance chance resistance, end users have to have to deal with their positions and setting the TP / SL price tag is an optimum approach.

As the title suggests, TP (Take Profit) is to get revenue very first. For illustration, if the price tag of BTC is increasing and Mr. A commences a extended place at $ 38,500, Mr. A can set TP to get earnings. If he expects that the price tag of BTC soon after reaching the $ forty,000 threshold will lower, Mr. A can set the price tag of TP at $ forty,000.

At the identical time, as the market place price tag continues to fall, we have to have to promptly cease our losses to keep away from harm to heavier assets. For illustration, Mr. B commences a place at $ forty,000, Mr. B can generate a $ 38,000 SL (Stop Loss) price tag if he believes the price tag will drop. As the price tag of BTC continues to fall, the SL price tag will be triggered when the price tag reaches $ 38,000. At this stage Mr. B will not endure more losses even if the BTC price tag falls under USDT 38,000 thanks to the SL mechanism.

Therefore, CoinEx advises end users to set the TP / SL price tag when putting orders in anticipation of acceptable losses and anticipated earnings.

The Close All button, on the other hand, bargains with quick transactions and is appropriate for people who want to shut the transaction as quickly as probable.

NLP examination of potential actions inside of 180 days

CoinEx presents a very simple NLP examination. When the “NLP Analysis” characteristic is enabled, end users can analyze everyday trading information and see the earnings and losses of their key and secondary accounts. The exchange has trading statistics and examination algorithms exceptional to NLP. In addition, this characteristic also involves statistics this kind of as weekly / month-to-month / quarterly asset trend, accumulated revenue, everyday return, ROI, and so on.

On CoinEx, end users can see a 180-day NLP examination of their company futures, permitting them to analyze the earnings and losses of their assets in excess of the previous 6 months.

Several futures mechanisms, which include Insurance Fund and Automatic Debt Clearance (ADL), assure no withdrawal for liquidation

CoinEx has launched an insurance coverage fund. This mechanism combines orders that will be forcibly liquidated with other orders on the market place at the bankruptcy price tag, and if the strike price tag exceeds the bankruptcy price tag, the surplus will be transferred to the Insurance Fund.

CoinEx employs the insurance coverage fund to bail out investor positions from regular automated liquidation (ADL). When the settlement price tag falls under (extended) or exceeds (brief) the bankruptcy price tag inside of a specified array, the extra will be paid by the Insurance Fund with out activating the ADL program.

When traders are forced to liquidate, their remaining positions will be taken in excess of by CoinEx’s ADL program. If you can not…