TRENDING

Bitcoin Dips Below $70,000 Amid Futures Liquidations

February 6, 2026

February 2026’s Best Crypto Presales: Bitcoin Hyper, NexChain & LiquidChain vs. ZKP Crypto’s 600x Potential!

February 4, 2026

Next

Prev

Market Analysis

Editor's Choice

Ethereum Eyes $9,600 Target Amid Institutional Interest

Ethereum's price may reach $9,600 following institutional investments and market trends.

Ethereum Foundation, Whales Drive $500M ETH Sell-Off

Ethereum's $500M ETH sell-off driven by Foundation's sales, whale activity, hacker liquidations.

BlockFi CEO receives $ten million from FTX bailout loan

BlockFi says CEO Zac Prince obtained practically $ten million from the platform thanks to a "bailout" loan from FTX for...

Coinbase Acquires Deribit, Expands Global Derivatives Reach

Coinbase's $2.9 billion acquisition of Deribit strengthens its derivatives platform and expands global market reach.

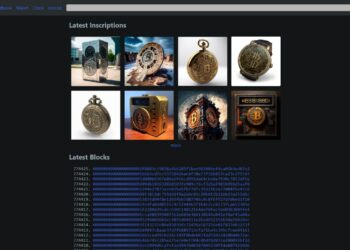

Bitcoin NFT and controversy in excess of the position of the Bitcoin network

Despite currently being the world's very first blockchain, bringing groundbreaking innovations, Bitcoin nowadays is "later" in DeFi and NFT than...