What is Vesta Finance (VSTA)?

Vesta Finance is a lending protocol that makes it possible for end users to block collateral to problem VST (Stablecoin of the Vesta task) produced on degree two.

The VST stablecoin will be pegged at a worth of one VST = one USD, due to the following traits:

- The procedure is intended to normally be above-collateralised: the worth of the collateral is normally greater than the stablecoin issued.

- Users can normally exchange VST for collateral straight with the procedure.

- The procedure algorithmically controls the generation of VSTs by means of a variable issuing commission.

How does Vesta Finance operate?

Loan

When end users lock collateral in the protocol to borrow VST, they open a debt place (debt place, also regarded as a vault).

After opening a deposit with selected collateral, end users can problem tokens (“borrow”) so that their deposit’s collateral charge stays over 110%.

Example: A consumer with $ one thousand underlying collateral in a deposit can problem up to 909.09 VST.

Borrowed stablecoins will be burned when the consumer pays off the vault debt.

Vesta’s procedure will frequently update the collateral cost towards the USD by means of a decentralized information feed. When a deposit falls under the minimal assure ratio (MCR) of 110%, it is regarded underneath assure and will be liquidated.

Liquidation

The protocol will liquidate the debt by means of the Stability Pool. Any consumer can deposit VSTs in the Stability Pool. This makes it possible for them to earn collateral from the liquidated vault. When the liquidation method takes place, the liquidated debt will be written off at the very same time an equivalent volume of VST will be burned in the Stability Pool and the liquidated assets will be distributed in a selected proportion to the depositors.

Stability Pool depositors can anticipate to earn a net revenue from liquidation, as in most situations the worth of the liquidated assets will be higher than the worth of the debt written off.

If the liquidated debt is well worth far more than the VST volume in the Stability Pool, the procedure will try to create off as substantially debt as probable with the VST in the Stability Pool, then redistribute the remaining collateral across all energetic deposits.

Vesta Finance governance model

The task is initiating a governance model with a Genesis DAO equivalent to the BarnBridge model to avoid malicious actors. DAOs exist only to make choices on governance proposals.

The task will perform the voting on Snapshot.org. A selected quantity of tokens will be demanded prior to voting starts, and a vote will only be accepted if sufficient delegates are reached. The unique quantity of votes demanded for these classes is however to be established but will be established shortly.

Basic data about the VSTA token

- Token title: Vesta Finance

- Ticker: VSTA

- Blockchain: Referee

- Token regular: ERC-twenty

- To contract: 0xa684cd057951541187f288294a1e1c2646aa2d24

- Token style: Government

- Total provide: a hundred,000,000 VSTA

- Circulating provide: five,000,000 VSTA

Token allocation

Token release system

Updating

What is the VSTA token made use of for?

- Vote for governance choices on the protocol.

- Rewards are distributed to end users who deposit VSTs in the Stability Pool to assistance the loan settlement protocol.

VSTA Token Storage Wallet

VSTA is an ERC20 token, so you will have numerous wallet alternatives to keep this token. You can pick from the following wallets:

- Floor wallet

- Popular ETH wallets: Metamask, Myetherwallet, Mycrypto, Coin98 Wallet

- Cool wallets: Ledger, Trezor

How to earn and personal VSTA tokens

Buy straight on the stock exchange.

Where to obtain and promote VSTA tokens?

Currently, VSTA is traded on two Uniswap, Balance exchanges with a complete day-to-day trading volume of all around USD ten,000.

Roadmap

In the close to long term, the task will produce far more options under, together with:

- Launch of on-chain governance

- More kinds of ensures

- Extends attain to other Layer two protocols

- Multi-chain assistance

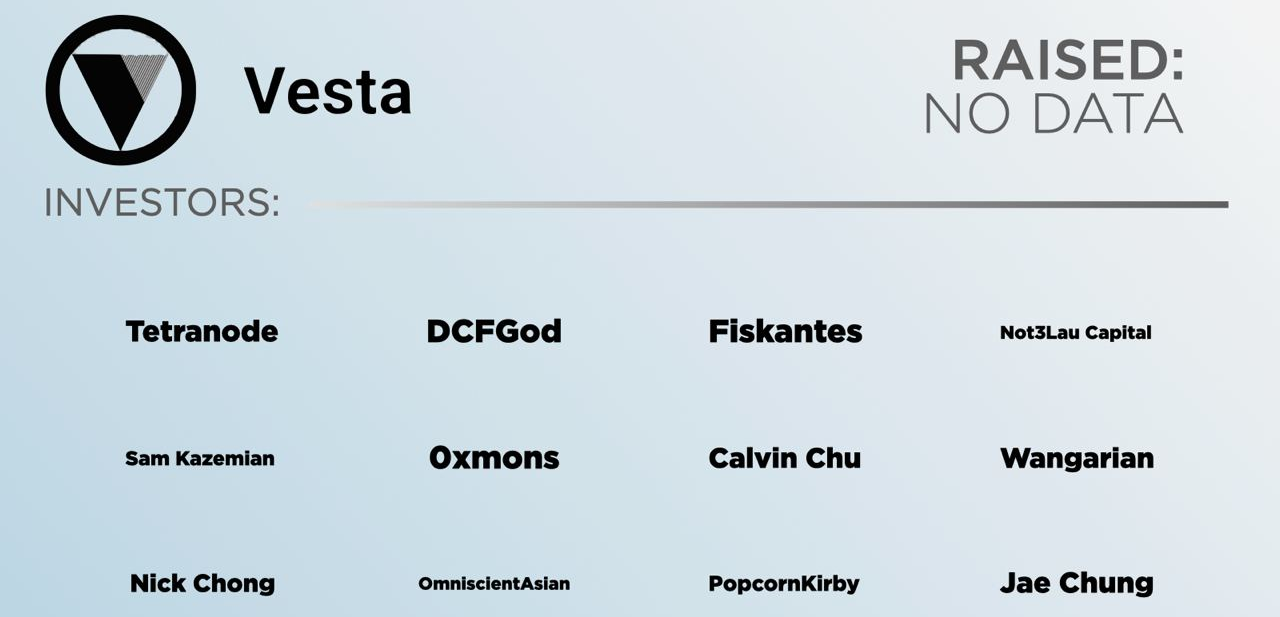

Investors

Vesta Finance has obtained Angel Round investments from different organizations and traders this kind of as: Tetranode, DCFGod, Fiskantes, Not3Lau Capital, Sam Kazemian, 0xmons, Wangarian, OmniscientAsian, PopcornKirby, …

Currently, Vesta Finance has not however announced the volume of cash the task calls by means of Angel Round.

Review of the Vesta Finance task

Vesta Finance is a lending protocol that makes it possible for end users to collateralise assets to problem stablecoins. Currently, the volume of TVL on the protocol is also only $ 13.four million, this indicator demonstrates that the task has not attracted numerous end users to use its solution.

Through this posting, you should have by some means grasped the primary data about the task to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you results and earn a good deal from this likely market place.