Pyth Network just up to date its whitepaper and here is what end users require to know about the venture.

DeFi’s speed of development constantly involves information to be substantial fidelity, up-to-date, and out there on any degree one blockchain. However, critical fiscal market place information is generally held by number of institutions and end users.

Pyth Network is a up coming-generation Oracle remedy that aims to carry fiscal market place information closer to end users. Pyth will incentivize market place participants – trading organizations, market place makers and exchanges – to share information immediately across the chain. Pyth will then act as an aggregator of this proprietary pricing information and return it for on-chain or off-chain applications.

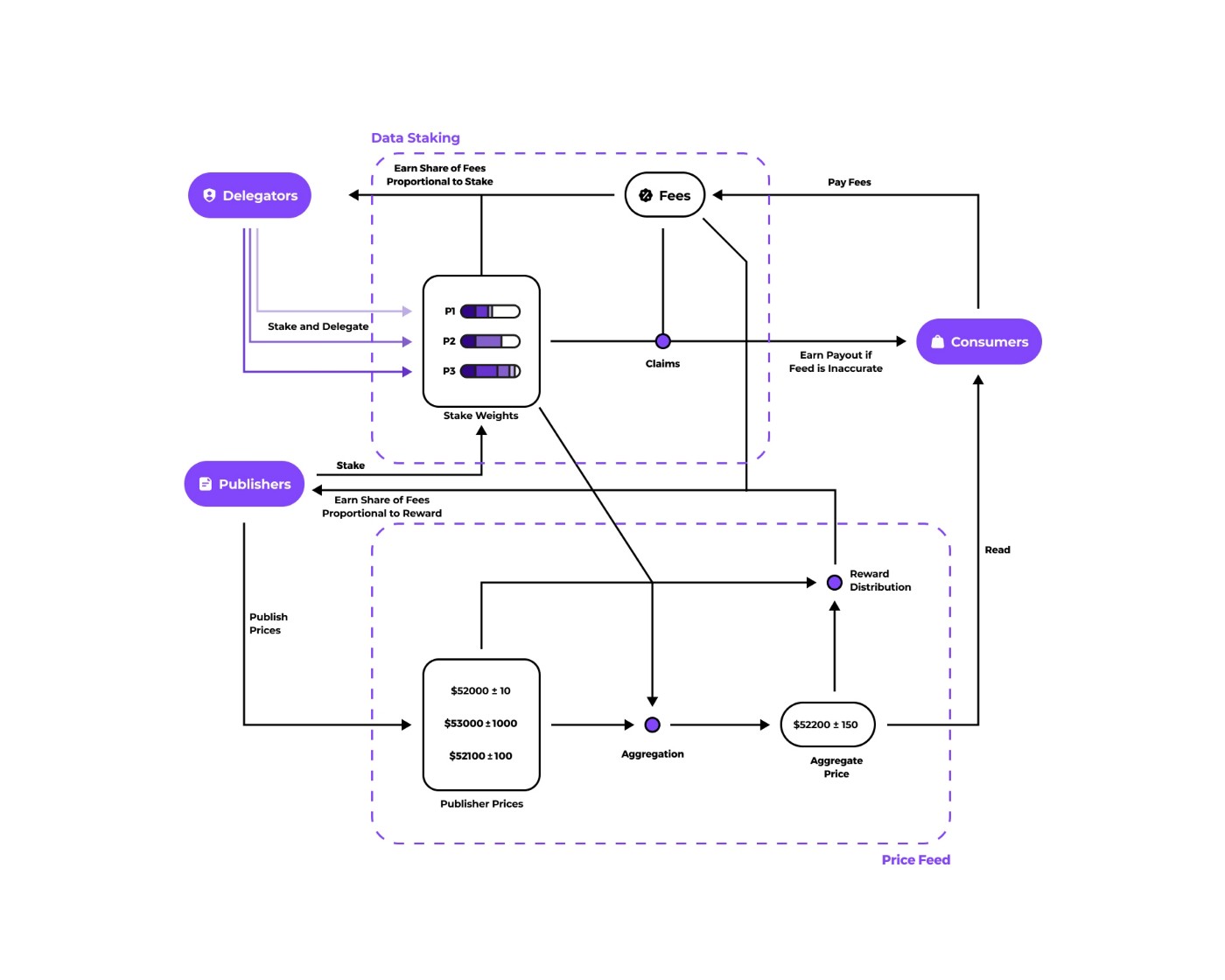

End end users can pick to pay out information fees for Oracle Crash Protection. Since information publishers have to stake tokens to energy a merchandise, these tokens will be utilized as payment for finish end users who voluntarily pay out the charge. Initially, 80% of the information charge will be passed on to the writer whilst the remaining twenty% will be shared involving publishers.

Stakeholders of the Pyth network

- Publishers Feed pricing and sharing a portion of information costs. These are generally the individuals who have entry to exact and timely pricing information and facts. The protocol rewards publishers for the volume of exact pricing information and facts they share.

- Consumers Read pricing feeds, embed information into sensible contracts or dApps, and optionally pay out information prices. Consumers can be on-chain protocols or off-chain applications.

- Authorized man or woman Staking tokens on a unique merchandise and publisher to take pleasure in a portion of the information charge, otherwise you will eliminate the staking tokens if Oracle’s effects are incorrect.

How do stakeholders interact with Pyth?

Pyth gives 4 principal mechanisms on the chain:

- Price aggregation: combines the reported rates and self confidence intervals of person publishers into a single selling price feed. This mechanism is created to develop a sound selling price feed and are not able to be dominated by little publishers.

- Data Staking: Allows delegators to stake tokens to share information prices. Authors also identify how a great deal influence (fat) every publisher has on aggregate rates. Finally, the protocol collects the tariffs provided by customers and distributes a share to the authorized individuals (at first at 80%). The rest (twenty%) will go to the prize pool for information editors.

- Reward distribution: identify the percentage of awards earned by every publisher. Each merchandise has a bonus pool that authorized end users can join. Preferred Reward Distribution Mechanism for High Quality Price Feed Publishers.

- Government: will use a coin-primarily based voting procedure that determines the substantial-degree parameters of the 3 mechanisms over, like tokens that can be utilized as information charges what goods are listed on Pyth percentage of information prices assigned to publishers, proxies and other utilizes the volume of PYTH a publisher have to stake or file a declare towards a merchandise …

The procedure of claiming ownership

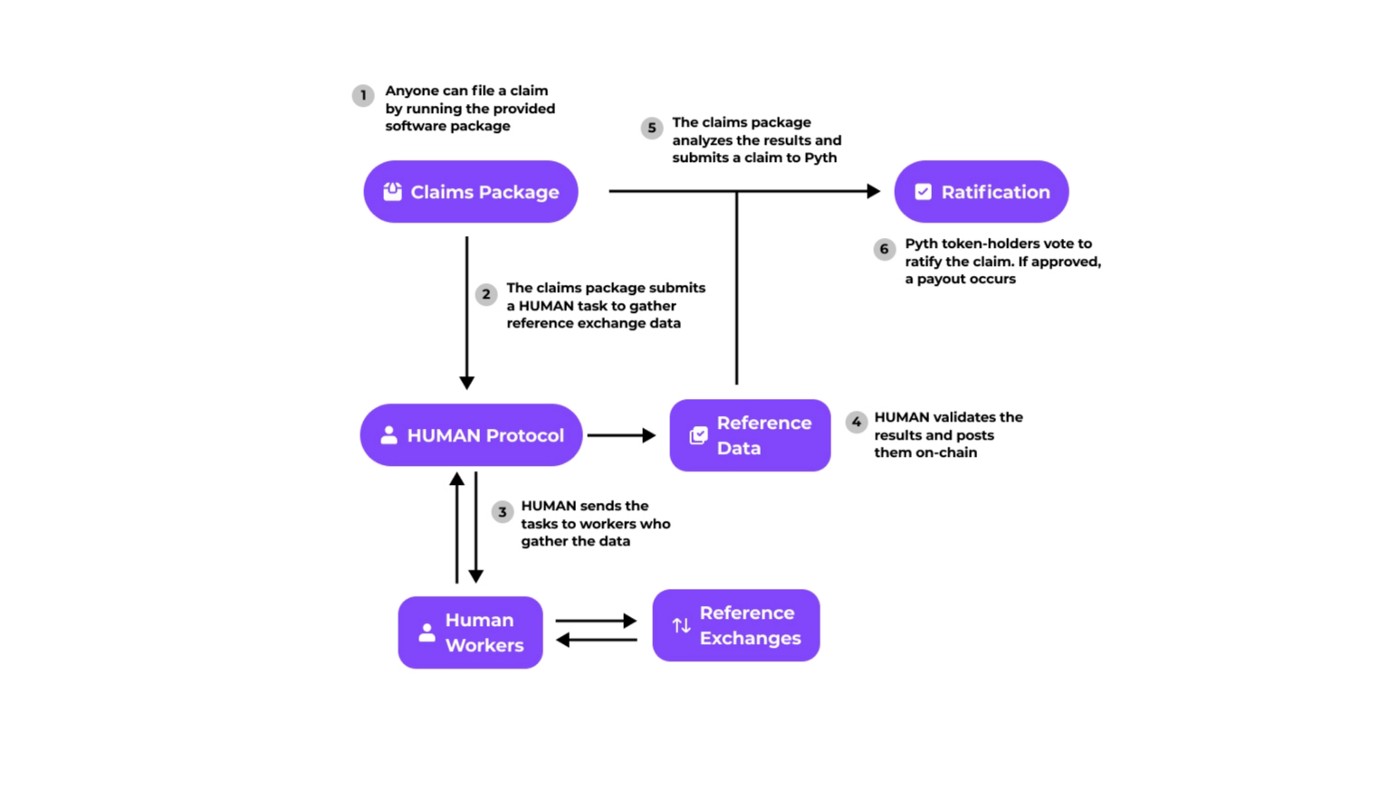

Pyth Network have to examine and resolve conflicts when the on-chain aggregate selling price is out of alignment with the authentic-planet reference selling price.

In common, the inquiry procedure determines regardless of whether the aggregate selling price and self confidence interval for a merchandise are comparable to off-chain information. This procedure will use the HUMAN protocol, an open supply software program package deal presented by Pyth, to collect the important off-chain information and facts and then feed the information and facts into an algorithm to identify the final result of the complaint. Finally, PYTH holders will vote to approve the algorithm’s output.

Anyone can make a complaint to the protocol to activate payments by linking PYTH.

Learn additional about the Pyth Network: Website | Twitter | Telegram | Discord

Maybe you are interested:

Note: This is sponsored material, Coinlive does not immediately endorse any information and facts from the over short article and does not assure the veracity of the short article. Readers should really perform their personal investigate prior to producing choices that have an effect on themselves or their firms and be ready to consider accountability for their personal alternatives. The over short article is not to be viewed as investment guidance.