Spin task overview

What is rotation?

Spin is a DeFi-derived infrastructure constructed on Close to Protocol, a trustworthy and scalable Tier one answer. Spin’s on-chain purchase guide answer will give DeFi customers the identical expertise as making use of CEX.

Spin’s infrastructure is based mostly on an purchase guide model that opens the door to a broad range of assets with various degrees of complexity in the DeFi room, such as limitless futures and valuable perpetuals, but also other styles of futures contracts.

Highlights of Spin

Spin is a instrument for each knowledgeable traders and newcomers to the markets. Spin is appreciated for its new consumer-pleasant UI / UX interface and is a platform that meets the wants of expert traders.

The task lets customers to trade derivatives this kind of as futures and alternatives on a decentralized stock exchange with an purchase guide outfitted with proprietary chance management equipment.

Users can effortlessly accessibility liquidity for trading. Furthermore, it is achievable to revenue from the marketplace-building mechanism formulated by the Spin crew.

Users have accessibility to a portfolio builder to task income and losses and even execute long term place simulations enabling for safer and less difficult trading.

Features of Project Spin

Central Limit Order Book template

Spin employs a personal pool of assets, liquidity will be transferred from the marketplace maker to the purchase guide. Therefore, traders often have adequate liquidity to trade effortlessly and make income based mostly on the marketplace formation mechanism formulated by Spin.

Spot trading – Spot trading

The present model of Spin Spot DEX on Close to is the initially purchase guide implementation that supports on-chain matching and Close to wallet connectivity.

Spin also gives customers the chance to make an quick token exchange at the marketplace cost with a single click. Spin boasts decrease charges than other AMMs.

Perpetual – Perpetual Contract

Spin gives a decentralized way to trade perpetual futures contracts, which implies that traders do not have to rely on centralized exchanges and entrust their currencies to a single entity. Instead, the money are stored in the user’s wallet, for illustration Close to Wallet. Perpetual Spin Contracts will help leveraged trading, income payments and multi-collateralized characteristics.

Option – Option

Spin’s objective in establishing alternatives trading is to offer a decentralized platform for trading operations and to make sure a easy and effortless-to-use block base for knowledgeable and knowledgeable traders as nicely as new traders. Spin will help partial reconciliation for alternatives trading.

Basic information and facts about the SPIN token

SPIN Token Specifications

- Ticker: ROTATION

- Blockchain: Close to the protocol

- Token regular: NEP-twenty

- To contract: Updating

- Token form: Utility, governance token

- Total provide: Updating

- Circulating provide: Updating

Distribution of SPIN tokens

Updating …

Uses of the SPIN token

Administration

SPIN token holders can participate and direct the improvement of the task by voting, as nicely as building proposals.

The governing aspects of the votable proposals are the following:

- The use of insurance coverage money,

- Distribution of trading charges

SPIN Token Functions

SPIN stakeholders will obtain:

- Reduce expenses when making use of the providers on the platform

- Increased the worth of leverage

- Participate in incentive packages.

- It will take customers 14 days to withdraw tokens from the staking platform.

Warranty

SPIN token holders can use their tokens as collateral for asset trading.

At the starting of this time period, only extreme collateral was permitted to make sure invulnerability to marketplace manipulation and safeguard consumer money.

Where to get, promote and very own SPIN tokens

Currently, the SPIN token is not for sale at any CEX or DEX, customers should really very carefully verify the information and facts prior to paying for the token to stay clear of getting scammed.

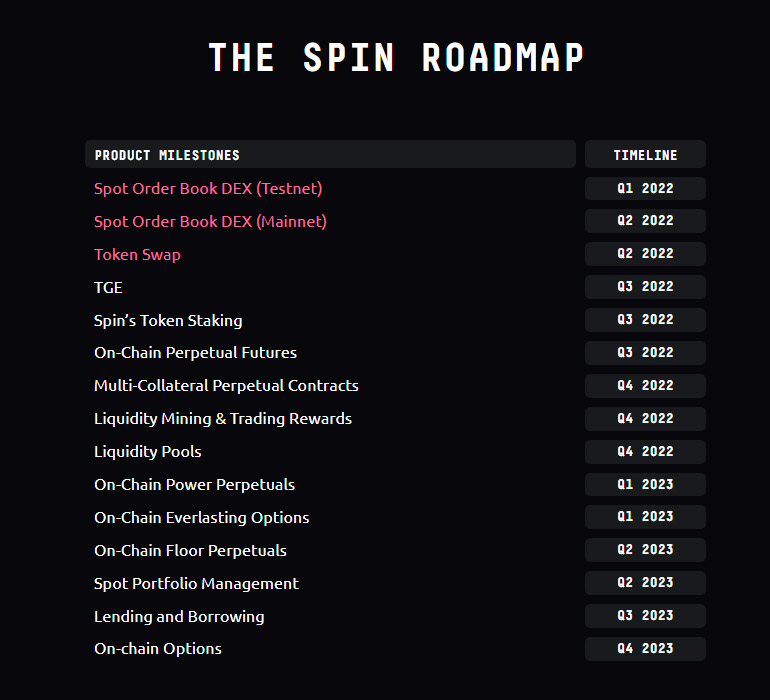

Spin task improvement roadmap

In 2022 the task consists of the following improvement ideas:

Q1 / 2022:

- DEX spot purchase guide (Testnet)

Q2 / 2022:

- DEX spot purchase guide (Mainnet)

- Token exchange

Q3 / 2022:

- TGE

- Stakeout

- On-chain perpetual futures: on-chain perpetual futures contract

Q4 / 2022:

- Multi-collateral perpetual contracts – Multi-collateral perpetual contracts

- Cash Draw and Trading Reward System – Cash Draw and Trading Reward System

- Liquidity pool

By 2023, the task has the following improvement strategy

The 1st quarter:

- Perpetual chain feeding

- Eternal chain alternatives

Q2:

- Floor perpetuals in chain

- Spot portfolio management

Q3:

- Loan and loan

fourth four:

Core improvement crew

Updating …

Investors and improvement partners

Projecting on the GMX task, should really I invest in GMX tokens?

Spin is the initially improvement task of the trading infrastructure with leverage and futures on the ecosystem of the Close to protocol. This has the likely to increase a niche in NEAR’s ecosystem, as nicely as the likely to invest in an ecosystem-driven platform. However, SPIN has not but finished the tokenless roadmap and the contract negotiation functions are nevertheless incomplete, so investing in the task is also risky, customers want to be mindful prior to submitting your investment selections.Through this short article, you have by some means grasped the primary information and facts about the task to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you achievement and earn a whole lot from this likely marketplace.