Babel Finance misplaced close to eight,000 BTC and 56,000 ETH, really worth $ 280 million, due to trade losses. In distinct, these are the user’s money deposited on the platform.

Loss of $ 280 million

To stick to The block, Babel Finance misplaced close to eight,000 BTC and 56,000 ETH, really worth $ 280 million, due to trade losses. On June 17, 2022, the platform announced it was blocking withdrawals and has not reopened given that then.

“During the tumultuous week of June, when the rate of BTC plummeted from $ thirty,000 to $ twenty,000, Babel’s unhedged positions suffered hefty losses. So Babel was liquidated and in the end resulted in a reduction of eight,000 BTC and 56,000 ETH. “

Due to these losses, Babel’s lending and trading division was unable to react to margin calls from counterparties.

“Conclusion: The reason for the failure is that Babel’s proprietary trading division, which was outside its core business, suffered heavy losses that affected the entire company.”

The proprietary trading division manages a quantity of trading accounts which are not covered, have no chance management mechanisms and do not report revenue / reduction to the Babel procedure. Or to place it just:

Babel Finance employed clients’ income to carry out very risky transactions, without having hedging assets.

This is not the 1st time that Babel has finished this. In October 2020, quite a few leaked sources claimed that the business was working with consumer money to trade BTC all through the very risky time period of Black Friday.

At the time, Tether was rumored to have “saved” Babel Finance by extending the Margin Call time to one month to give Babel a lot more time to gather collateral.

However, this time close to, no one particular was in a position to conserve Babel.

Restructuring program

A spokesperson for Babel Finance declined to comment on the reduction, but explained:

“The business is operating closely with customers, traders, stakeholders and external consultants at this quite hard time. Babel believes this is the only way to absolutely recover the business and maximize worth for all events. “

After reaching debt agreements with partners, Babel is now on the lookout to increase hundreds of hundreds of thousands of debt assets and equity. Specifically, Babel intends:

– Conversion of USD 150 million of the greatest creditor’s debt into convertible bonds

– Mobilize USD 250 million to USD 300 million in the type of convertible bonds

Secure a $ 200 million revolving credit score loan from creditors “for business recovery.”

If profitable, the program would flip Babel’s greatest creditors into shareholders of the business.

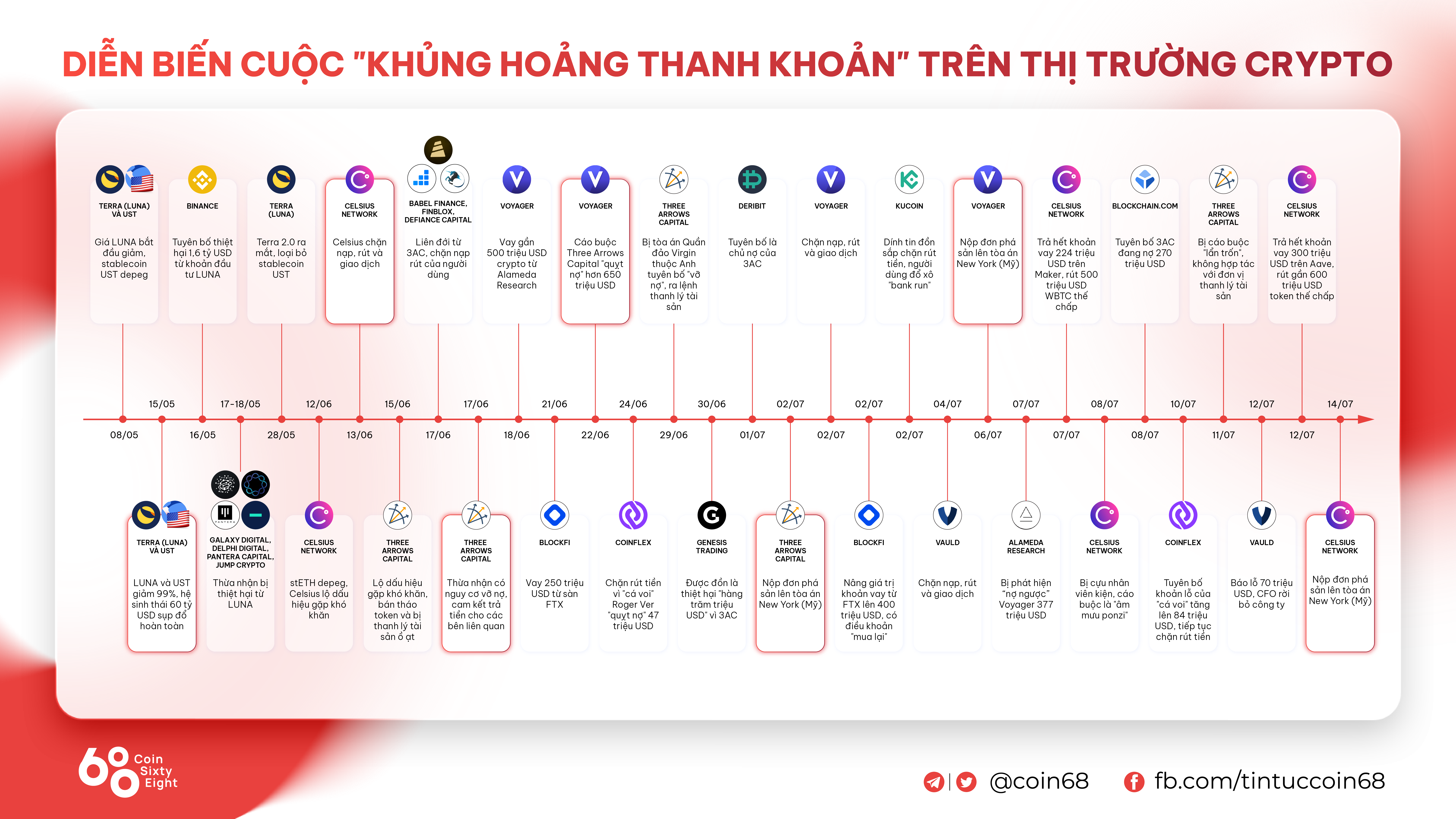

Babel Finance is not the only title impacted by the liquidity crisis that is spreading in the cryptocurrency industry. Three huge firms have filed for bankruptcy, such as Celsius, Three Arrows Capital (3AC) and Voyager Digital.

Synthetic currency 68

Maybe you are interested: