Michael Saylor is no longer CEO of MicroStrategy, following the enterprise reported a reduction of $ 918 million in the 2nd quarter of 2022.

At the identical time as the publication of the 2nd quarter fiscal report, billionaire Michael Saylor announced that he would be stepping down as CEO of MicroStrategy, the enterprise he founded in 1989 and is one particular of the holding providers with the biggest amount of Bitcoins in the globe.

Please join the @MicroStrategy management staff at five p.m. ET as we examine Q2 2022 fiscal final results, executive transition, and solution queries about our small business and outlook for #BusinessIntelligence And #Bitcoin. $ STRhttps://t.co/SxAjhbM9WD

– Michael Saylor⚡️ (@saylor) 2 August 2022

Michael Saylor has “left” the chair of the CEO

Consequently, Michael Saylor will proceed to serve the enterprise as Chairman of the Board of Directors. Phong Le – Chairman of the enterprise and former Chief Financial Officer – will rather presume the place of CEO. The over selection will get impact from 08.08.

In a statement, Saylor explained that:

“I believe separating the roles of President and CEO will allow us to better pursue the two corporate strategies of buying and holding Bitcoin and growing our software business. “

Phong Le held the place of CFO of MicroStrategy from August 2015 to July 2019 ahead of getting to be president of the enterprise in May of this yr. Phong will proceed in his functions as the two President and CEO. But he nevertheless holds the place of the former CEO “don’t sell Bitcoin”, including:

“I look forward to leading the organization in the long-term growth and health of the company’s business software and Bitcoin acquisition strategies.”

Beginning his tenure as CFO in July, Phong Le produced it clear that MicroStrategy remained committed to its Bitcoin HODL approach underneath its observe.

Results of the fiscal statements for the 2nd quarter of 2022

As of the finish of July 2022, MicroStrategy holds a complete of 129,699 Bitcoins, really worth around $ two billion with an regular price tag of $ thirty,664 / BTC. When the price tag of BTC peaked in early November 2021, all Bitcoins have been really worth up to $ eight billion, but as of this creating they have only disappeared at about $ two.96 billion. During the complete 2nd quarter, the enterprise also “bottomed out” only as soon as with a $ ten million obtain in BTC on June 29, a indicator that MicroStrategy could be “short of cash.”

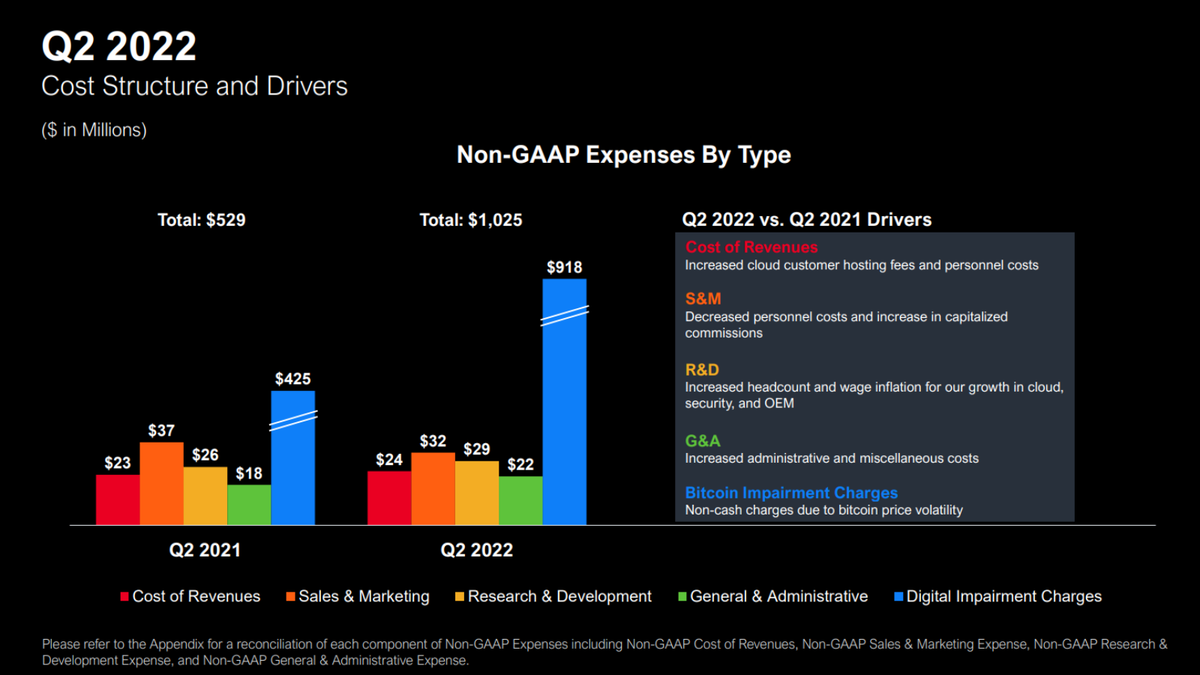

MicroStrategy is struggling a reduction of digital assets really worth $ 918 million due to the latest drastic drop in the price tag of Bitcoin. In the identical time period final yr, the enterprise also misplaced $ 417 million to Bitcoin.

In a industry downturn, Saylor informed MicroStrategy “Will continue to HODL through adversity,” the enterprise has anticipated and ready for volatility and is prepared to restructure its stability sheet accordingly. Returning to the most latest earnings report, on May three, the enterprise also unveiled that it will take a look at with better caution relating to potential return-making possibilities for Bitcoin.

As reported by Coinlive, MicroStrategy is “heavily losing” above $ one.three billion with its Bitcoin investment, since the BTC price tag is now under the DCA price tag, which is 25% of the value invested on the obtain. Despite this, CEO Michael Saylor has remained steadfast in his faith in the world’s biggest cryptocurrency, insisting that the loans his enterprise has produced to invest in Bitcoin amongst 2020 and 2021 will only be liquidated if the price tag of BTC drops. at $ three,600.

The move by CEO Michael Saylor could be a measure to appease the company’s shareholders following the injury induced by its “no Bitcoin” technique. It is really worth mentioning that Saylor has served as MicroStrategy’s CEO because the enterprise was founded.

Investment financial institution Jefferies downgraded MicroStrategy shares to underperform its holdings final month, setting a price tag target of $ 180. At press time, the MSTR stock is trading at $ 278.26, a reduction of two.86%. The MSTR peaked in February 2021 just as Tesla “collected” Bitcoin and rose once more in November of the identical yr, as Bitcoin hit the ATH mark, and then plummeted with the stock and crypto markets. .

Synthetic currency 68

Maybe you are interested: