Renowned house management company GoldenTree has all of a sudden announced its curiosity in creating an ecosystem for SushiSwap (SUSHI).

GoldenTree, which manages almost $ 50 billion in assets, on the morning of October six announced its curiosity in SushiSwap (SUSHI), a decentralized multi-blockchain (DEX) exchange platform.

Specifically, in a publish on the SushiSwap local community forum, a representative of GoldenTree stated that he has been following the undertaking for a lengthy time and expressed optimism about the prospective customers and possible of this DEX.

SushiSwap is a DEX that emerged from the “DeFi summer” in 2020, copying the working model of Uniswap but with a multichain course, multi-blockchain assistance alternatively of only becoming “loyal” to Ethereum like the rival Uniswap. I believed SushiSwap’s growth path would open with a talented growth crew, solid local community, and clear course, but the inner turmoil in the 2nd half of 2021 almost knocked out SushiSwap, leaving the undertaking with out a particular leader. . Then, the selection to companion with Frog Nation created SushiSwap even extra in crisis when that undertaking crew in early 2022 grew to become concerned in the drama 0xSifu – Solidly – Andre Cronje.

However, commencing in mid-2022, SushiSwap is back with a new growth path, known as Sushi 2.0. First, the DEX exchange made the decision to adjust the complete management crew by appointing a new “chef” Mr. Jared Gray, a developer with knowledge in the area of DeFi.

The initially local community-led / DAO election of a head chef was a big good results

We are pleased to introduce you to the head chef of Sushi @jaredgrey:https://t.co/2tRJOaEi4X

💬 Do you want to request issues in particular person? Join our Forum!

📩 RSVP: six October – 17:00 UTC: https://t.co/8F0Qrhf8Rv pic.twitter.com/jpzhPus7wx

– SushiSwap (@SushiSwap) October 4, 2022

Mr. Gray is anticipated to be the coordinator and organizer of the implementation of the objects incorporated in the Sushi two. roadmap, together with completion solutions this kind of as AMM Trident exchange, MISO v2 launchpad, NFT Shoyu exchange, Kashi lending platform and the mechanism. towards MEV Sushi Guard, and so on. Additionally, the Sushi local community will also unite to re-create Sushi DAO, a decentralized self-governing organization.

Before the constructive adjustments of SushiSwap, the wealth management organization GoldenTree made the decision to “bet” on this undertaking. GoldenTree uncovered that it has founded a cryptocurrency investment fund known as GoldenChain, led by former fund managers in the cryptocurrency market. The cause why SushiSwap was selected is due to the fact, regardless of obtaining gone via several issues and troubles in the previous, the undertaking and the local community have nonetheless conquer this time period collectively to give a new course. GoldenTree also prices SushiSwap as the title that embodies DeFi’s ideal functions – it can be about introducing the new and bettering from there.

one / You asked the institutions to purchase your suitcases, make the institutions purchase your suitcases. https://t.co/MjzoFYT4P6

– Avi (@AviFelman) October 5, 2022

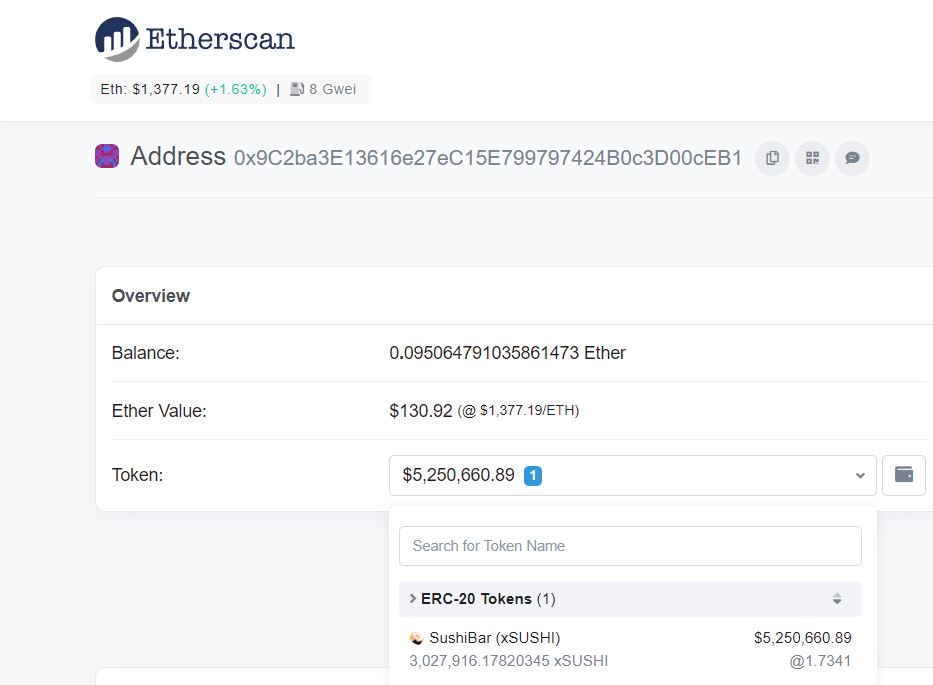

At the aforementioned occasion, GoldenTree announced an investment of more than three million SUSHI (well worth $ five.two million at the time of creating). The Foundation also presented to assistance and advise the Sushi crew in the restructuring of the project’s tokenomics, as properly as participating in the design and style of growth techniques and solution working designs.

The cost of SUSHI on the morning of October 6th rose substantially thanks to the over statement from GoldenTree.

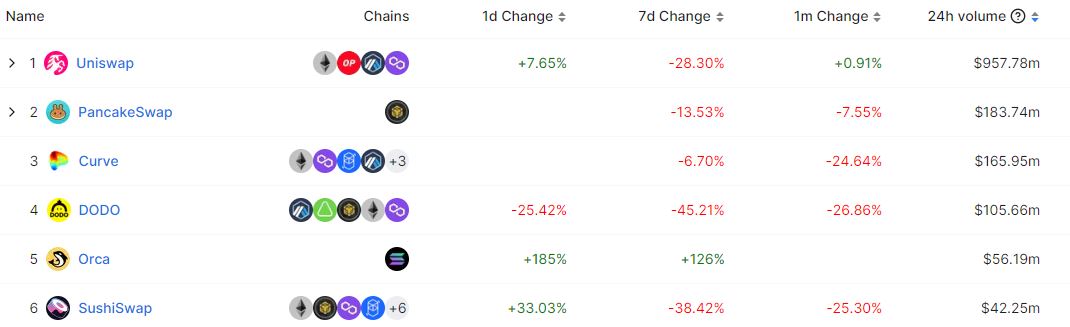

However, the way to go to restore SushiSwap’s place is incredibly complicated. According to DeFi Llama, regardless of becoming spread across ten blockchains, SushiSwap’s 24-hour trading volume is only $ 42.25 million, 23 instances reduce than Uniswap’s $ 957 million, even however this DEX is only obtainable on four blockchains / layer-two.

GoldenTree’s curiosity in SushiSwap is a continuation of the trend of returning to the cryptocurrency sector by the massive gamers in the conventional money sector, right after BlackRock, Fidelity, NASDAQ and, extra not too long ago, DBS.

Synthetic currency 68

Maybe you are interested: