Coinlive summarizes for readers the most up-to-date information on the condition of the FTX exchange, the Alameda Research fund and CEO Sam Bankman-Fried on the morning of eleven/eleven/2022.

Note: This write-up is for the sole function of supplying the comprehensive image. Coinlive are not able to promise a hundred% accuracy of the data in the “Voices” part.

Official information from FTX

FTX paves the way for Justin Sun coins

FTX has confirmed that it makes it possible for holders of “Justin Sun” coins (TRX, BTT, JST, SUN and HT) to trade one: one with their respective assets outdoors the exchange, beginning at 01:thirty on eleven/eleven (Vietnam time). Initially, the Tron workforce will inject $ 13 million into FTX to assistance the swaps, additional injections will be announced weekly.

FTX announcement relating to the Tron credit score framework:

We are pleased to announce that we have reached an agreement with Tron to set up a distinctive framework to enable holders of TRX, BTT, JST, SUN and HT to trade assets from FTX one: one to external wallets.

– FTX (@FTX_official) November 10, 2022

This is precisely what Justin Sun announced on November 10th.

FTX makes it possible for Bahamian consumers to withdraw money as necessary by law

Under strain from the Bahamian government, the FTX exchange has issued a discover making it possible for consumers residing in the island nation the place the exchange is situated to withdraw income.

FTX says these withdrawals are only a fraction of their present holdings and is on the lookout for other techniques to open withdrawals to worldwide consumers.

two) Withdrawal quantities consist of a tiny portion of the assets we at the moment have offered and we are actively functioning on more paths to enable withdrawals for the rest of our consumer base. We are also learning what we can and really should do all-around the planet.

– FTX (@FTX_official) November 10, 2022

The Japanese FTX exchange stops trading

At the request of the Japanese money authorities, the FTX JP platform will be positioned in “closed order only” mode. FTX claims that FTX JP is platform independent.

We are following the lead of the JFSA and will place https://t.co/XblZK9n7s1 in closing only mode @FTX_JP it is a separate entity that strictly follows Japanese segregation legislation https://t.co/q3bYGEuNIw

– FTX (@FTX_official) November 10, 2022

The Bahamas freeze FTX assets, on the lookout for liquidators

The Bahamas Securities Commission has announced the freezing of the assets of “FTX Digital Markets”, as effectively as filing a judicial movement to look for a liquidator on behalf of FTX.

Today, the Bahamas Securities Commission stepped in to freeze the assets of FTX Digital Markets. The Commission also asked the Court of Cassation to appoint a short-term liquidator of FTX. pic.twitter.com/1sy7yQWnAN

– Guardian of Nassau (@GuardianNassau) November 10, 2022

It all led to speculation that FTX really should have declare “bankruptcy” in the up coming days.

The White House talks about the FTX situation

A White House spokesperson commented that the FTX situation is why “the cryptocurrency industry needs to be regulated”. The White House and federal finance authorities proceed to keep track of the condition.

NOW – White House: “We need regulation of cryptocurrencies”. pic.twitter.com/01C9VYkff4

– Disclose.television (@disclosetv) November 10, 2022

Previously, the US Department of Justice and the Securities and Exchange Commission (SEC) had the two stated they would open an investigation into the collapse of the exchange.

Voices about FTX

FTX US is about to prevent trading in the up coming number of days, but withdrawals are nevertheless assured

The US exchange FTX out of the blue showed a warning urging consumers to near orders as they may well require to prevent trading but proceed to assistance withdrawals. FTX CEO Sam Bankman-Fried previously stated that FTX US is independent of FTX and nevertheless has sufficient income to operate.

Sigh. @SBF_FTXas a longtime buyer, I want it to perform. https://t.co/XYGTc0KMSu pic.twitter.com/8W9jT3457m

– markschwarz (@markschwarz) November 10, 2022

FTX needs to increase $ 9.four billion to “save the floor”

Source from Reuters confirmed that FTX is asking for $ 9.four billion to restore operations.

– db (@ tier10k) November 10, 2022

Earlier, rumors circulated that FTX took users’ income to lend Alameda, then invested it at a reduction when the cryptocurrency marketplace reversed in 2022 and ran into a deficit of up to $ ten billion.

In Internal messages sent to employeesCEO Sam Bankman-Fried stated up coming week’s aim is to increase capital.

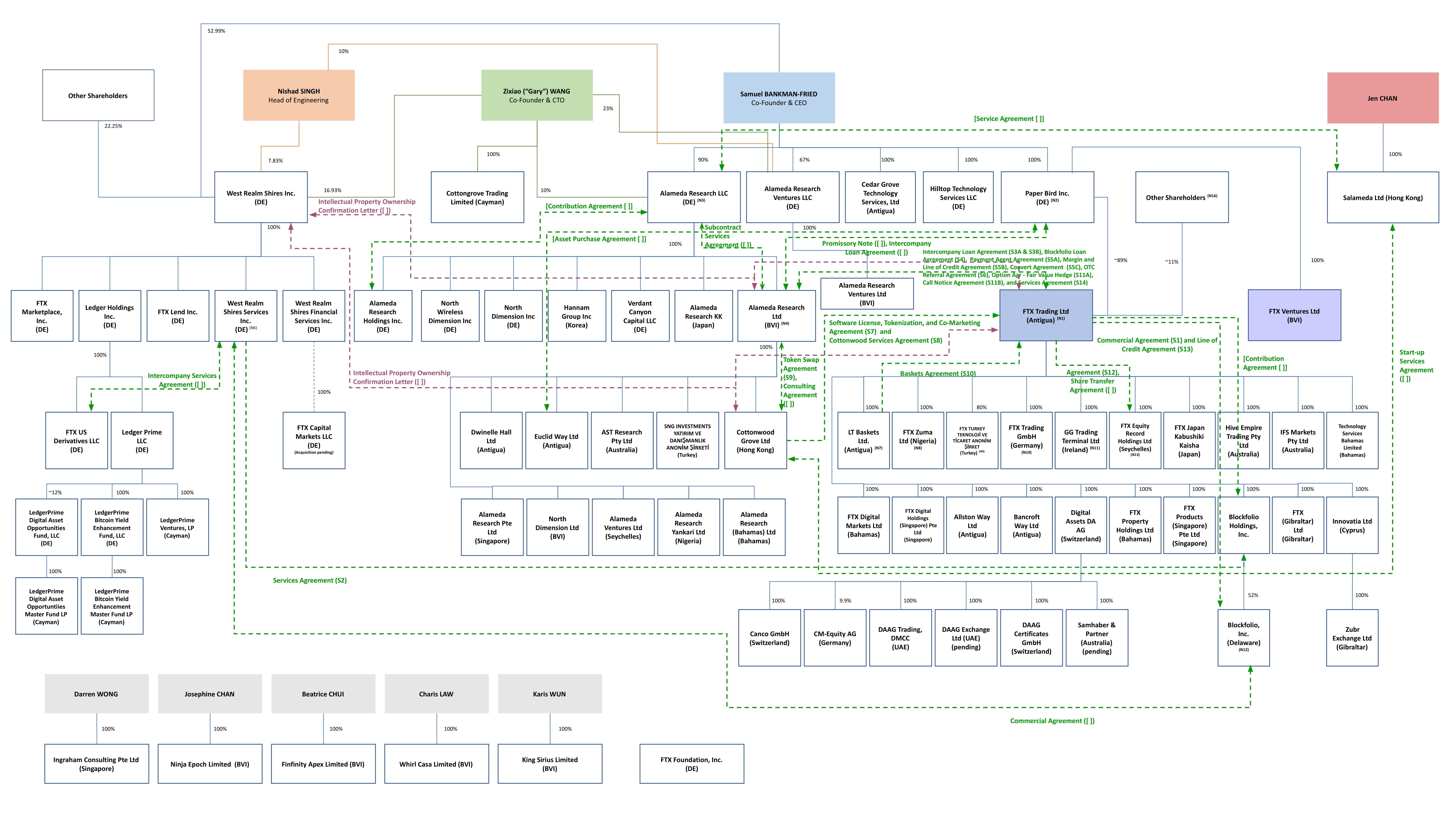

Map of the FTX empire – Alameda by Sam Bankman-Fried

Using a selection of information sources, newspaper Financial Times traced the branches established by Sam Bankman-Fried and his confidant on the FTX board of directors to serve firms with incredibly difficult “roots and bones”. (see complete dimension right here).

Inside discovery of the FTX tent

There are some rumors that only a tiny group of FTX senior executives know the true condition, when most staff members do not. This tiny group is created up of Sam Bankman-Fried’s workforce, who has worked with him because his early days and has a background of romantic relationships.

A separate former senior worker desired to proper the record on factors they felt essential clarification from the prior note. Please use your very own judgment and confirm the data in this letter. https://t.co/YfgqPtmOWG pic.twitter.com/dizIW3WdC0

– Capital of autism (@AutismCapital) November 10, 2022

Sam Bankman-Fried also urged staff members to invest in FTX shares at a price reduction of 50% beneath the marketplace value. Most staff members also retain their cost savings and bonuses immediately on FTX for the reason that they feel it is protected.

Organizations concerned

After the names claiming to be caught on FTX or agreeing to “lose everything” their investment in the stock marketplace, as effectively as the odds that stated “okay”, now it really is up to the marketplace maker Genesis Trading fund to admit that there are even additional. 175 million bucks assets held on FTX.

As component of our aim to supply transparency on this week’s marketplace occasions, the Genesis derivatives company at the moment has somewhere around $ 175 million of frozen money in our FTX trading account. This has no influence on our marketplace-building actions.

– Genesis (@GenesisTrading) November 10, 2022

Genesis claims it can nevertheless perform usually even if the reduction volume is up to 9 digits. However, in the announcement published on November ten, Genesis announced that it had only misplaced $ seven million, that it has no connection with FTX or Alameda, that it does not hold FTT.

We reiterate that Genesis has no materials publicity to FTT or other tokens issued by centralized exchanges. 95% of the collateral in our loan portfolio consists of USD / steady, BTC and ETH. Furthermore, Genesis has no lending connection with FTX.

– Genesis (@GenesisTrading) November 9, 2022

Synthetic currency 68

Coinlive has published a series of articles or blog posts summarizing the Binance – FTX – Alameda drama, readers can see additional right here:

– Binance liquidates its whole $ 580 million investment in FTX tokens

– Users massively withdraw from FTX

– The complete marketplace was heavily dumped, FTT misplaced 22 USD

– Binance has reached agreement to acquire back FTX – Clearance on the marketplace

– FTX CEO’s equity fell by $ 14.six billion, wrote a letter apologizing to traders

– CZ urges exchanges to supply evidence of buyer deposit

– The Solana process “bears the battle”

– Binance cancels FTX acquisition and most up-to-date updates

– Continuously several organizations declare “in solidarity” from FTX

– Sam Bankman-Fried writes a letter of apology and updates on the FTX – Alameda catastrophe