Transaction volume on Ethereum’s Layer two Arbitrum network hit an all-time large in the previous week, in accordance to on-chain information.

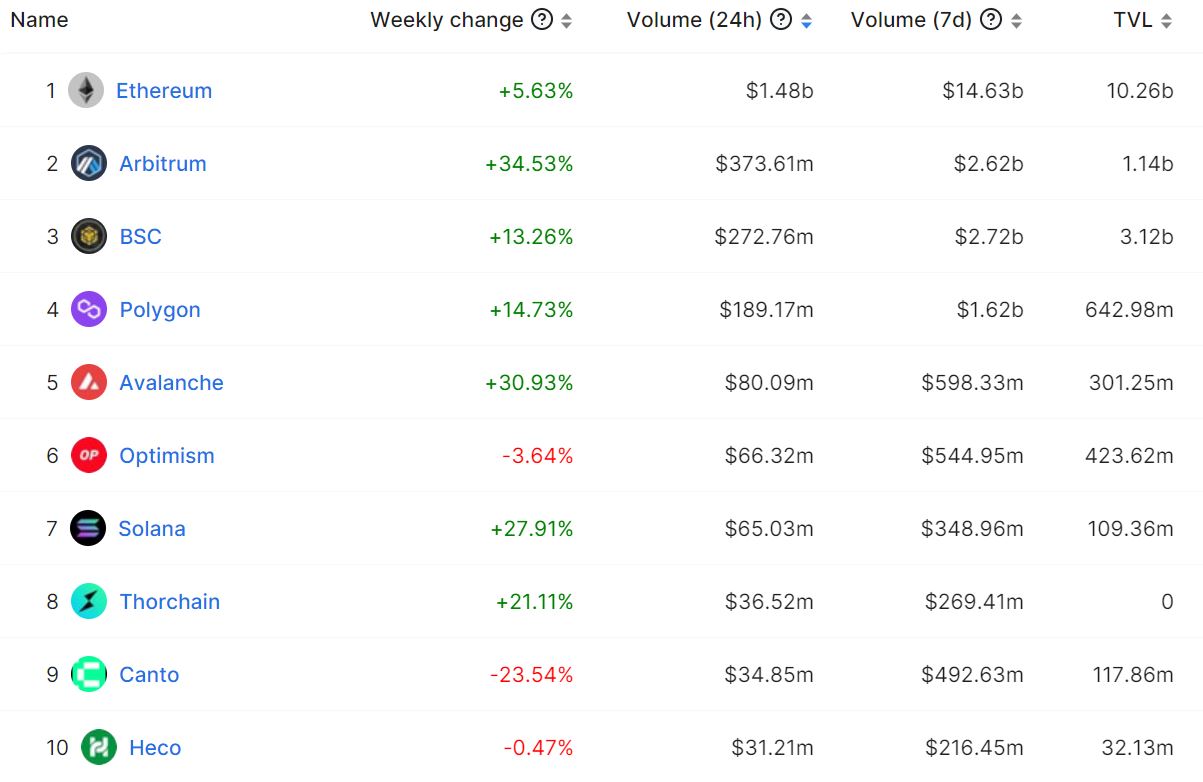

Data from DeFillama exhibits that trading volume from Arbitrum DEXs elevated to a record $two.62 billion in the previous week, up 34.53% from the prior week, and set a new weekly ATH. Arbitrum also set a record for the quantity of transactions logged in 24 hrs out of 690,000 transactions on Feb. 17, in accordance to Arbiscan.

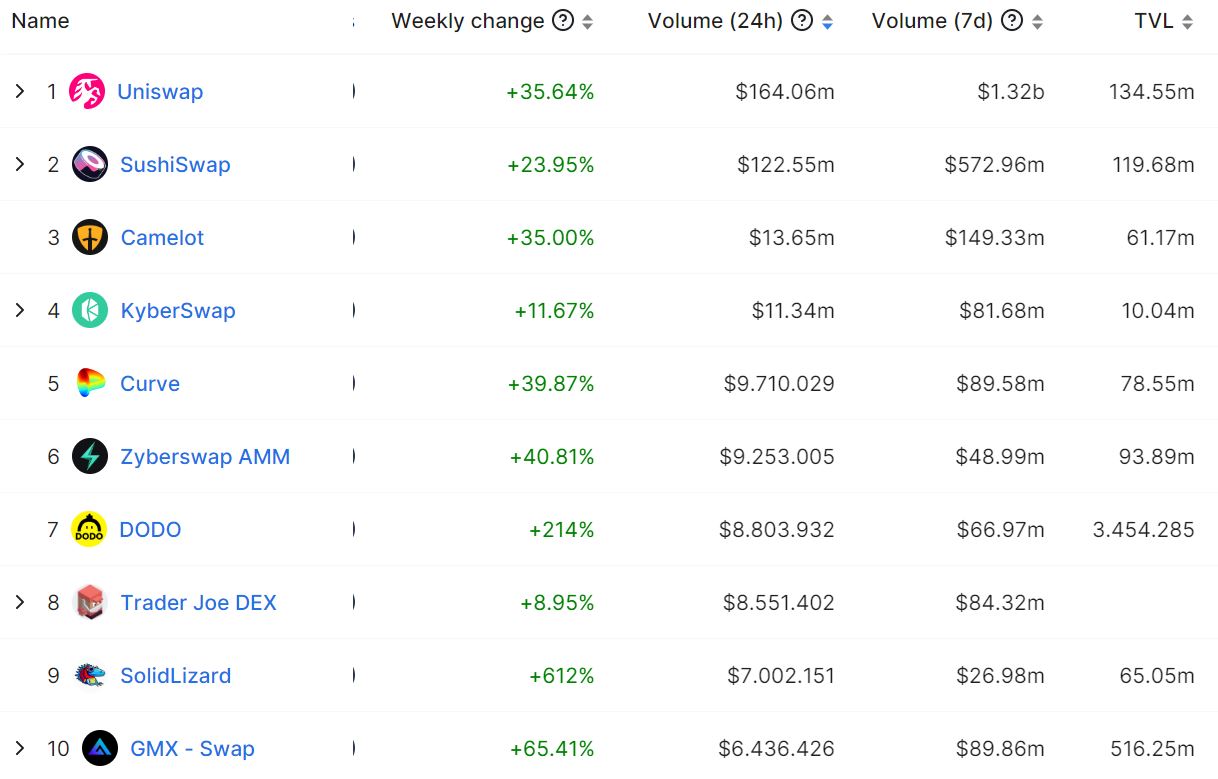

The two dominant DEXs on Arbitrum are Uniswap with $one.32 billion, followed by SushiSwap with $572 million.

Also adhere to DeFillamaTotal Assets Locked (TVL) on Arbitrum elevated to $one.eight billion at press time, of which derivatives platform GMX holds the biggest marketplace share at $522.76 million, followed by Zyberswap and Uniswap, with $134 million and $119 million, respectively.

Arbitrum’s DEX trading volume in excess of the previous 24 hrs also beats other sturdy rivals this kind of as Binance Smart Chain (BSC) and Polygon. According to the information, Arbitrum posted $374 million, increased than BSC’s $273 million and Polygon’s $189 million.

However, the volume of Arbitrum is even now far under the blockchain it is pegged on, Ethereum, at $one.48 billion in the 24-hour frame.

The cause for these amazing increases is that DeFi exercise on Arbitrum is getting to be additional energetic. Second Wu BlockchainArbitrum noticed a fairly regular influx of stablecoins in February, with USDC’s marketplace share expanding by 31%, though USDT and DAI elevated by 45% and 68%, respectively.

On Feb. 17, the quantity of transactions on the Ethereum L2 Arbitrum chain reached a record 690,000. Since February, the inflow of stablecoins to the Arbitrum has elevated considerably. Over the previous month, USDC is up 31%, USDT +45%, DAI +68%. pic.twitter.com/9rukXKkZ0e

— Wu Blockchain (@WuBlockchain) February 18, 2023

Arbitrum’s complete stablecoin marketplace cap is $one.26 billion, with USDC accounting for 66%.

On the other hand, the improve in on-chain exercise is in phase with the peak in gasoline consumption. Arbitrum at the moment has two.eight million addresses, up from two.two million addresses with “at least 1 transaction,” in accordance to Dune analysis.

Much of the exercise and pleasure for Arbitrum at the second is in aspect due to the truth that this tier two has but to broadcast tokens, regardless of quite a few prior rumours.

Synthetic currency68

Maybe you are interested: