[ad_1]

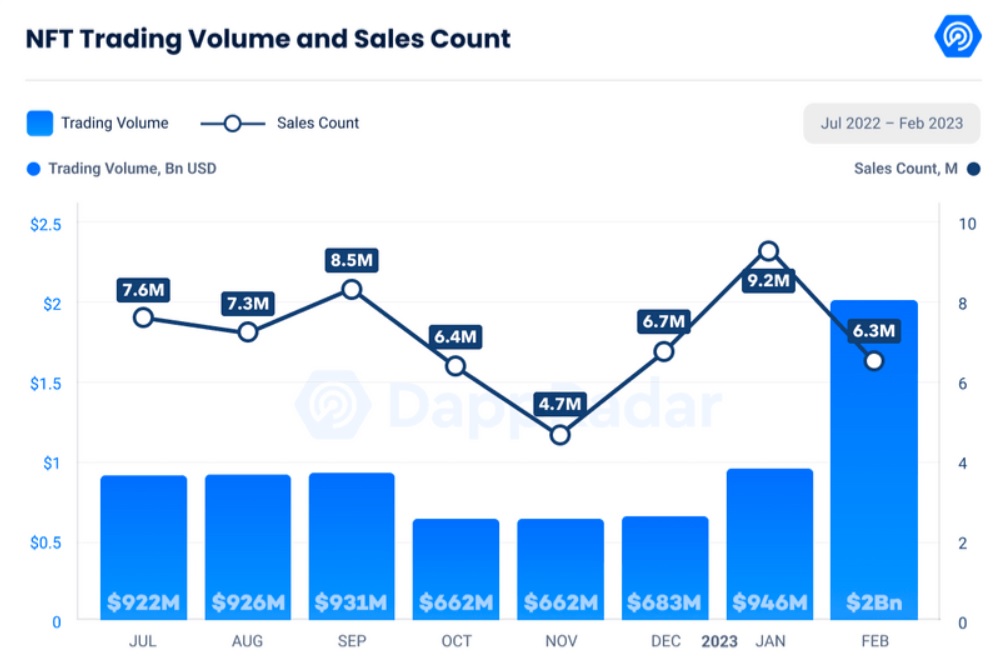

Non-fungible tokens According to DappRadar Industry Report, marketplace trading volume (NFT) improved to $two billion in February, reaching pre-LUNA crash amounts.

NFT trading volume recorded a 117% spike from January’s $956 million, when DappRadar data Shows.

Despite the substantial boost in NFT trading volume, income recorded a 31.46% decline, falling to six.three million from January’s 9.two million.

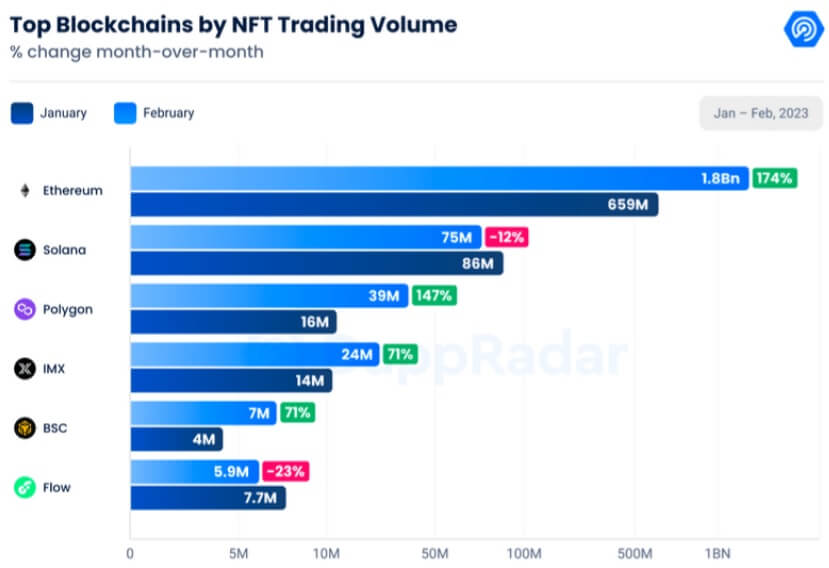

In February, Ethereum (ETH) remained at the top rated of the blockchain by NFT transaction volume. The chain recorded $one.eight billion in trading volume, marking a 174% boost from $659 million in January. Based on these numbers, ETH accounts for 83.36% of the total NFT marketplace.

Solana (SOL) and Polygon (MATIC) followed ETH as the 2nd and third chains, with the highest NFT trading volume in February. Although SOL ranked 2nd with $75 million in trading volume, it nonetheless recorded a twelve% drop from January’s $86 million. On the other hand, MATIC marked a 147% boost in February, reaching $39 million from $sixteen million the preceding month.

Blur vs. OpenSea

In February, Blur beat OpenSea in terms of trading volume. Blur produced extra than $one.three billion in trading volume in excess of the program of the month, when OpenSea came in 2nd with $587 million. These numbers indicate that Blur accounts for 64.eight% of the complete trading volume of the NFT marketplace, when OpenSea accounts for 28.seven%.

X2Y2 and LookRare followed OpenSea at third and fourth location in the rankings when recording transaction volumes of $39 million and $29 million respectively, representing one.9% and one.four% of the complete, respectively. marketplace.

Profit hunter vs artwork lover

Although the distinction in trading volume exhibits that Blur is the busiest NFT marketplace, OpenSea nonetheless holds the most substantial amount of customers. Currently, Blur has 96,856 customers in contrast to OpenSea’s 316,199. To catch up with OpenSea on that front, Blur has also experimented with to boost its consumer base by issuing airdrops to loyal customers.

Referring to this contrast in terms of consumer numbers and transaction volumes, DappRadar stated:

“This [the contrast in numbers] confirms that trading patterns on Blur are largely driven by NFT whale farming on the platform rather than conventional trading.”

To support this perception of Blur, one whale recently sold 139 NFTs and raised $9.6 million.

A particular section of the community also criticized Blur for removing art from the NFT and engaging people by promoting big profits. The representative of this crowd, Aaron Sage, recently wrote:

“I just wish the NFT space could shift its lens to the way we used to be – in terms of art and culture (i.e. clubhouse gibbons and even lazy lion twitter attacks) lazy), but not today with Blur.“

[ad_2]