Data displays that Bitcoin traders have turn into frightened once again as industry sentiment has now dropped to its lowest degree considering that early January.

Bitcoin Fear and Greed Index Now Indicates “Fear”

The “Fear and Greed Index” is an indicator that tells us about the total sentiment of traders in the Bitcoin (and broader cryptocurrency) industry. The figures use a numerical scale that runs from -a hundred to present this sentiment.

All index values above the 50 mark imply that traders are at present greedy, although values below this threshold indicate that the industry is at present fearful.

While the threshold could theoretically be apparent, in practice values close to 50 (involving 46 and 54) are deemed to signify a kind of “neutral” mentality.

There are also two other specific feelings, identified as severe dread and severe greed. The former takes place at values below 25, although the latter takes place at ranges better than 75.

The significance of the severe dread zone is that Bitcoin cost bottoms have formed historically as traders consider hold of this sentiment. Likewise, peaks have formed although severe greed has dominated the industry.

Now, here is a gauge of what sentiment in Bitcoin and the broader crypto sector seems to be like at the second:

The industry sentiment would seem to be that of dread correct now | Source: Alternative

As you can see over, Bitcoin’s dread and greed index is at present well worth 34, which indicates that traders share the dread sentiment correct now. However, this shift in sentiment is latest, as the cryptocurrency’s most up-to-date drop is what has spooked traders.

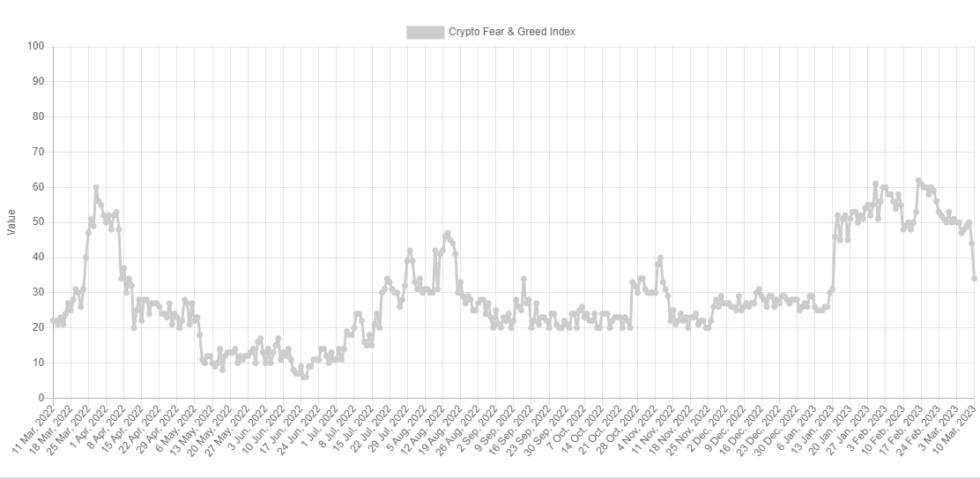

The chart under displays how the worth of the index has transformed above the previous 12 months:

Looks like the metric's worth has plunged in latest days | Source: Alternative

From the chart, it can be witnessed that this metric has a rather minimal worth throughout the Bitcoin bear industry, but at the start out of the bull run in January, sentiment has enhanced significantly and the worth is greedy.

Market sentiment has stored involving greedy and neutral for the previous number of months considering that, but above the previous two days, the indicator has fallen sharply. The index’s latest values are the lowest considering that early January when industry sentiment begun to make improvements to. This indicates that the pullback has proficiently re-established what ever motion traders have created psychologically throughout the most latest bull run.

However, a optimistic from the sentiment decline could be that Bitcoin could now be extra profitable to get as the odds of bottoming commonly turn into larger as the index moves reduce.

In reality, a trading philosophy acknowledged as contrarian investing is primarily based on this notion, in which traders choose to get when the industry is at its worst and promote when traders are greedy. Perhaps at instances like now, a contrarian investor will flip to get extra crypto.

BTC Price

At the time of creating, Bitcoin is trading about $19,700, down twelve% final week.

BTC has plunged throughout the previous day | Source: BTCUSD on TradingView

Featured photos from Thought Catalog on Unsplash.com, charts from TradingView.com, substitute.me