After the productive Shapella update of Ethereum, the trend most talked about by the cryptocurrency neighborhood is LSD, and new LSD-connected tasks are also appearing extra and extra. With the emergence of protocols produced to enhance the liquidity of LSD, a new phrase has emerged to substitute LSD, namely LSDfi. LSDfi is more and more getting a probable “scenario,” as Binance Research stated in an 18-web page investigation report on Industry Outlook. So what is LSDfi? Let’s uncover out with Coinlive in the posting beneath!

What is LSDfi? Is this a new industry trend in Q3 2023?

What is LSDfi?

LSDfi stands for Liquid Staking Derivatives Finance, which signifies DeFi protocols are developed and operated on prime Liquid staking. These protocols consist of standard pieces of the DeFi puzzle this kind of as DEX, Lending or extra complicated tasks that get benefit of the exceptional properties of LSD. LSDfi lets consumers to flexibly use their LSD assets for numerous unique functions, when assisting LSD tokens increase liquidity, enhance capital efficiency, and generate earnings in the method.I.

What is LSDfi?

What is LSDfi?

For validators on Ethereum, LSD is a quite significant issue. Before Shapella’s update, their ETH was locked and could not be withdrawn from the network. This issue was solved when LSD protocols this kind of as Lido Finance, RocketPool, Frax… had been born, making it possible for them to stake ETH via them and get LST (Liquid Staking Token). LSTs assistance ETH stakeholders enhance earnings and capital efficiency when making certain their function as validators.

After the productive Shapella update in April 2023, validators’ considerations about not currently being capable to withdraw their ETH from the network had been eradicated. At the very same time, consumers of LSD protocols can now very easily convert LST to ETH at a one:one ratio. This tends to make staking an appealing chance for ETH speculators.

This prospects to the emergence of extra and extra LSD protocols with appealing incentives to entice consumers to invest ETH in its platform. As LSD gets extra and extra preferred, a further sub-sector of DeFi has also emerged to get benefit of the LSD trend, enhance utility, and open up extra rewarding possibilities for LSD holders, namely LSDfi.

LSDfi ecosystem

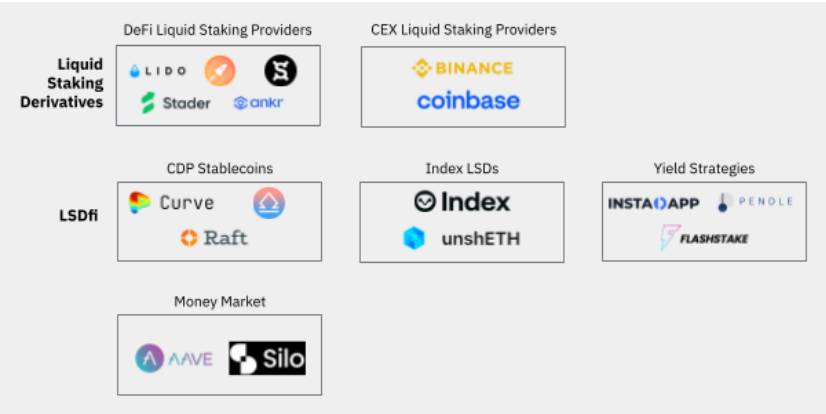

The LSDfi ecosystem incorporates DeFi protocols that have both established a foothold in the industry and both have LSD integrated as aspect of their product or service suite or are lately emerged tasks whose core product or service revolves all over LSD.

LSDfi ecosystem

LSDfi ecosystem

Pieces of the LSDfi ecosystem can be stated as:

- DeFi liquid staking companies: They are DeFi protocols that offer staking companies. Users who stake their very own tokens will retrieve the LSTs and use them for unique functions.

- CEX liquid staking companies: They are CEX exchanges that offer staking companies.

- CDP stablecoins: CDP stands for Collateral Debt Position. CDP protocols make it possible for consumers to use LSD tokens as collateral to mint stablecoins.

- LSD index: Users will lock their tokens in buy to get task LSD tokens. This way, they will be capable to hold many styles of LSD tokens to maximize the return on their assets.

- Performance Strategy: These are protocols that make it possible for consumers to create superior returns for the assets they very own via a wide range of methods.

- Money industry: They are lending protocols that make it possible for consumers to use LSD tokens as collateral to borrow other tokens.

Featured LSDfi tasks

Libra Finance (LBR)

Libra money task

Libra money task

Lybra Finance is a pioneering protocol in the LSDfi area, making it possible for stablecoin consumers with eUSD curiosity to mint to block ETH or stETH. Lybra Finance’s eUSD is the quickest rising stablecoin in the DeFi area.

Pendle Finance

Pendle Finance task

Pendle Finance task

Pendle Finance is a yield derivatives platform that lets consumers to use their potential earnings to mortgage loan, trade and invest. This task introduces an strategy termed “discounted goods”, which lets consumers to acquire items at a less expensive rate, but have to wait a selected volume of time to get the volume of that house. Additionally, Pendle has also developed an ecosystem all over the PENDLE token, which include two main tasks: Balance and Penpie.

Pendle Finance is 1 of the biggest LSDfi tasks at the second with a complete locked worth (TVL) of in excess of $140 million, which represents virtually 70% of the TVL of the whole LSDfi ecosystem. In addition, the complete trading volume on Pendle Finance also reached about $180 million and it is the LSDfi task with the 2nd capitalization in accordance to CoinGecko.

Agility (AGI)

Project agility

Project agility

Agility is an LSD task on Ethereum, centered on delivering liquidity to holders of LSD and other LSD protocols. Agility’s target is to turn out to be a platform that meets users’ yield requirements by improving true yield and unlocking LSD liquidity at virtually negligible price. At the very same time, Agility also aims to meet the liquidity requirements of other LSD protocols.

UNSHETH (USH)

unshETH task

unshETH task

DISCOVERY is a Liquid Staking Derivatives (LSD) task designed on Ethereum, which lets consumers to participate in staking ETH and LSD tokens to earn earnings. The target of the task is to make an aggregate platform, unshETH, that delivers consumers the skill to entry and optimize the returns of LSD tokens on Ethereum.

Maverick Protocol (MAV)

Maverick Protocol Project

Maverick Protocol Project

Non-conformist protocol is an AMM DEX platform that employs Directional LPing (precise Directional Liquidity Targeting) remedy to offer the ideal charges to liquidity companies. What is unique about Maverick AMM is that it supports native LSTs, which aids preserve liquidity inside the yield of individuals native LSTs.

summary

Above is all the facts about LSDfi, a new and probable piece of DeFi. Through this posting, you have most likely grasped some of the facts you will need about LSDfi to serve your investigation and investment method. Good luck!

Note: The facts contained in the posting is not deemed investment information, Coinlive is not accountable for any of your investment selections. I want you achievement and earn a whole lot from this probable industry.