Swell Network is an Ethereum-based mostly decentralized liquid staking protocol that makes it possible for end users to stake ETH and obtain a liquid staking token identified as swETH to optimize income. So, what is distinctive about this Swell Network venture? Let’s locate out with Coinlive by the write-up under!

What is the Swell Network (SWELL)? The Liquid Staking protocol optimizes income for end users on Ethereum

What is the Swell Network (SWELL)? The Liquid Staking protocol optimizes income for end users on Ethereum

What is the Swell Network?

Swell Network is the protocol Liquid staking Ethereum-based mostly decentralization makes it possible for end users to stake ETH and obtain liquid staking tokens identified as swETH to optimize income. The project’s mission is to simplify the use of DeFi for everybody and provide the finest Liquid Staking expertise.

What is the Swell Network?

When end users stake ETH on Swell Network, they will obtain swETH which can be applied for lots of functions, this kind of as offering liquidity to earn income, borrowing, or lending in other DeFi platforms. Additionally, end users can deposit their swETH into the Swell Network Vault to be launched in the long term to earn extra income.

The working mechanism of Swell Network

There will be two entities participating in the operational course of action in Swell Network: Staker (frequent staking consumer) and Node Operator (node operator).

Stakers

Stakers are end users who will stake ETH into the swETH contract and obtain swETH of an equivalent worth minted from that contract. From right here, end users can use swETH to offer liquidity on other DeFi platforms or deposit into the Swell Vault that will be launched in the long term to earn income.

Additionally, end users can obtain better income by holding swETH longer by the exchange charge on the swETH contract. This charge tracks the relative worth of the complete ETH staked on the Ethereum consensus tier, which include rewards, in contrast to the unique ETH staked.

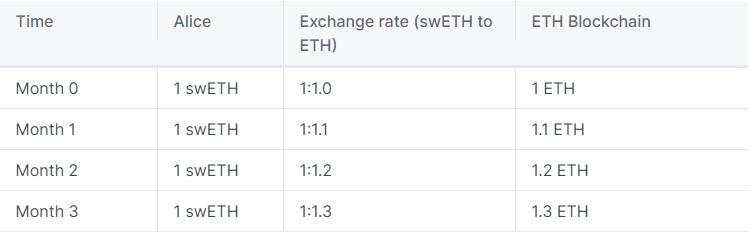

Table of reward exchange costs when end users hold swETH for a longer time period

The exchange charge is partly calculated by Oracle of Chainlink Proof of Reserve on ETH balances on the consensus degree paid every day. This metric is then applied to determine the volume of swETH to be minted when a consumer stakes and the volume of ETH to be returned to the consumer when they unstake.

Node operators

Node operators will be persons or organizations who will operate validators to maximize income for Staker. After the Staker receives swETH, the ETH will be sent from the swETH contract to the deposit manager contract and wait till it reaches 32 ETH. Next, the Node Operator will send a Validator important to the Node Operator’s ledger contract and carry on to send it to the Deposit manager contract to get 32 ETH to place into the Ethereum contract. The validator will have to wait in line to be activated so that the node operator can authenticate staking transactions on Ethereum’s consensus layer.

Currently, Swell Network supports two groups of node operators:

-

Independent node operators: These are person end users who want to turn into node operators on the Swell network to make income. However, they need to pledge sixteen ETH for every validator to act as the node operator.

-

Verified node operators: These are organizations and providers that have preceding expertise as node operators. These node operators only have to have to commit one ETH for every validator, but need to be verified and high-quality assured by Swell Network. Currently, there are eight verified node operators working on Swell Network, which include: Blockscape, DSRV, Hashquark, InfStones, Kiln, RockX, Stakely, and SNC.xyz.

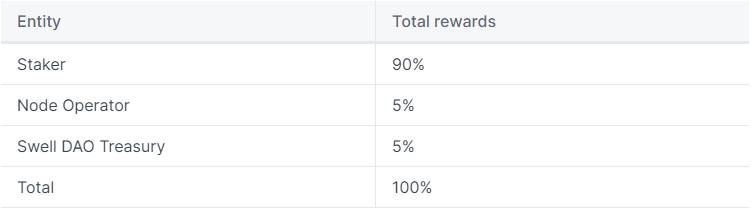

Currently, Swell Network is wanting to integrate SSV technologies, also acknowledged as DVT (Distributed Validator Technology) from ssv.network to minimize the volume of ETH demanded to turn into a node operator. Once the integration is effectively finished, the two the independent node operator and the verified node operator have to have to commit only one ETH to every validator. Additionally, Swell Network also costs a ten% commission on stakers’ staking rewards, of which five% goes to the node operators and the remaining five% goes to the DAO Treasury.

Rewards for stakers, node operators and DAO Treasury

Characteristics of the Swell network

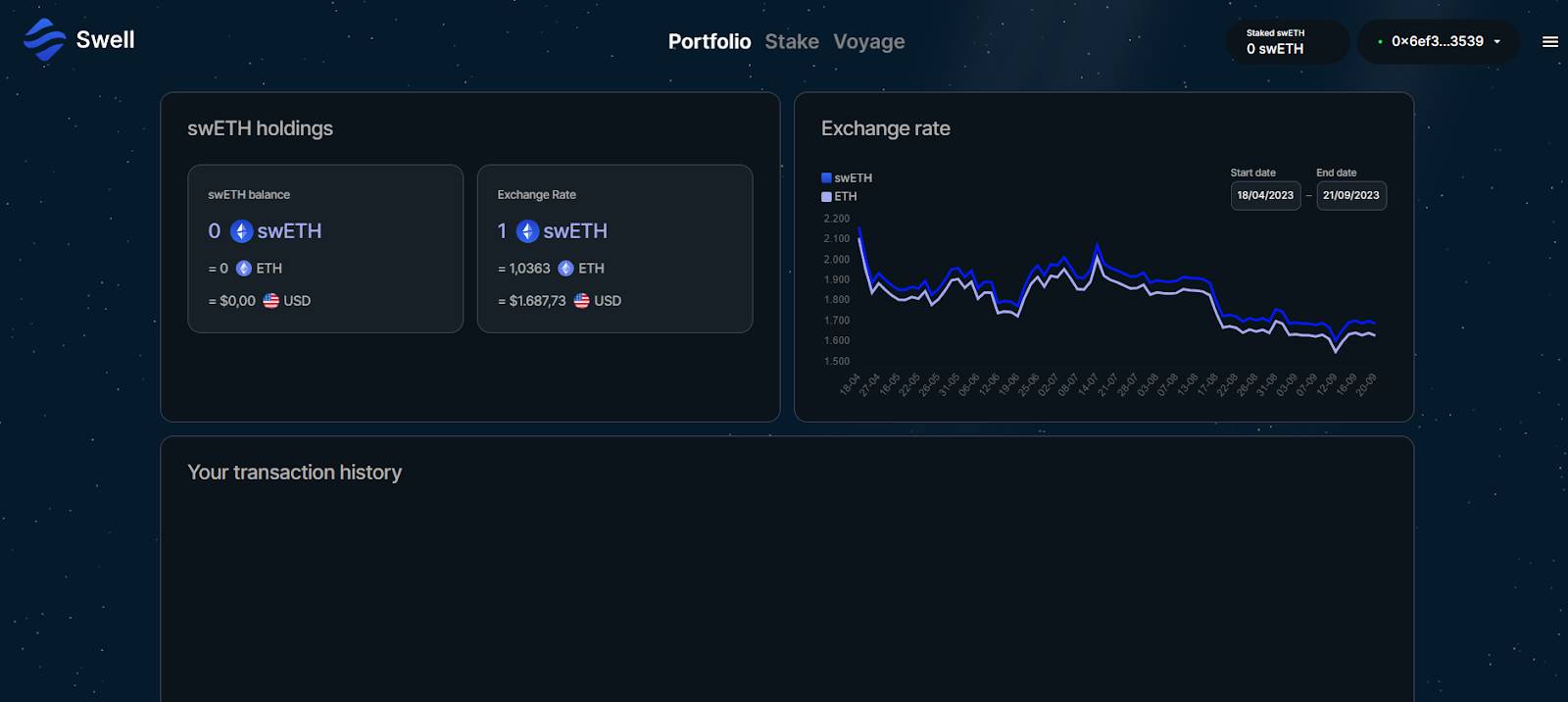

Wallet

This is a characteristic that makes it possible for end users to see their swETH stability on Swell Network. Furthermore, this characteristic also demonstrates the exchange charge in between ETH/swETH and the transaction historical past on the protocol.

Wallet options interface on Swell Network

Wallet options interface on Swell Network

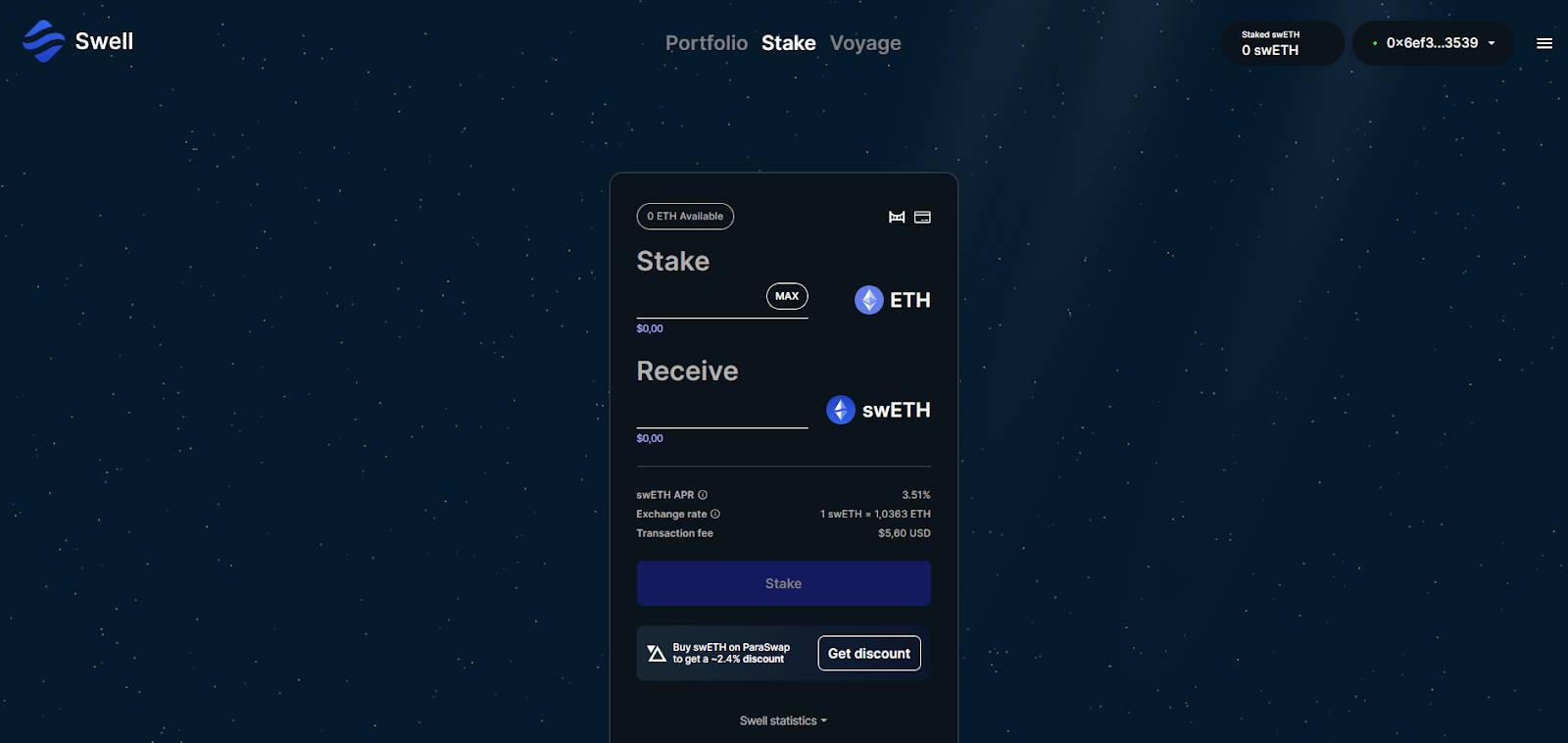

Pole

This is in which end users can stake ETH to get swETH based mostly on the exchange charge at that time. Furthermore, the interface also displays indicators this kind of as APR and swETH, transaction charges,…

Swell Network betting options interface

Voyage

This is an airdrop system organized by Swell Network to motivate end users to participate in staking and offer liquidity on other DeFi platforms. They will obtain gem rewards for holding or working with swETH to offer liquidity and will be ready to exchange it for SWELL, the protocol’s native token when it is launched.

Swell Network’s Voyage interface

Basic facts about tokens

Swell Network announced the launch of SWELL, the protocol’s native token applied in the following situations:

-

Users who hold SWELL have the suitable to vote to govern the protocol.

-

Used as an incentive for node operators offering liquidity to the swETH/ETH pool on DeFi protocols and airdrop rewards.

However, Swell Network has not announced a distinct release time for the SWELL token. Coinlive will update as quickly as there is the newest facts on the venture.

Roadmap for growth

Swell Network has long term growth strategies as follows:

-

Integration of SSV technologies, also acknowledged as DVT (Distributed Validator Technology). ssv.network minimize the minimal ETH necessity to turn into a node operator. At that stage, the independent node operator and the verified node operator will only have to have to pledge one ETH for every validator.

-

Launch of SWELL – native token of the protocol.

-

Vault launches for swETH on Swell and other DeFi protocols.

-

White label liquid staking launched.

Development staff

Swell Labs is the setting up and growth staff of Swell Network with the following excellent members:

-

Daniele Dizon: He is at this time the founder of Swell Labs and Swell Network.

-

Senya Webster: He is at this time the COO of Swell Labs and Swell Network.

-

Aaron Alderman: He is at this time the CTO of Swell Labs and Swell Network.

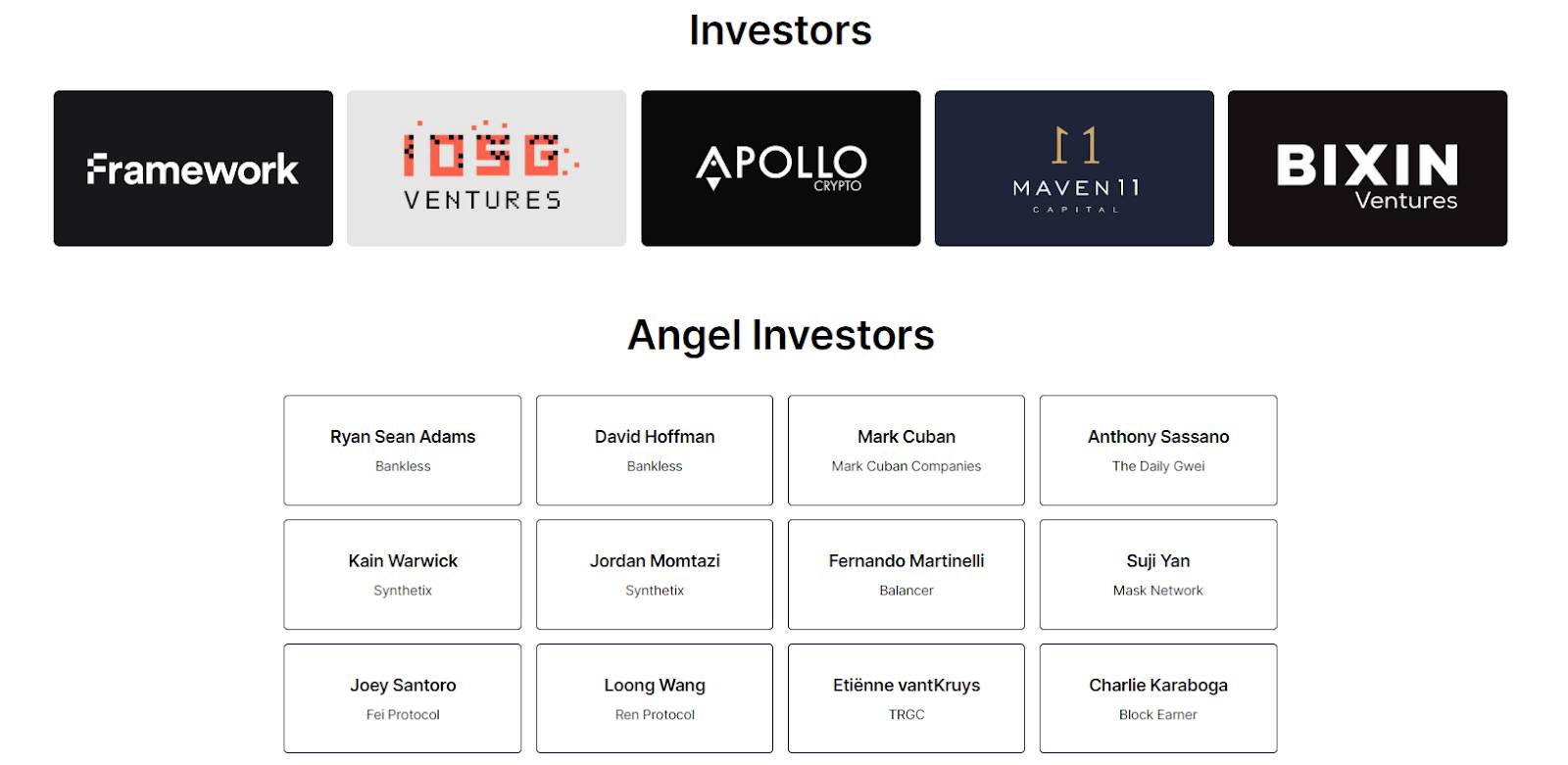

Investors

Currently, Swell Network is “backed” by investment money this kind of as Framework Ventures, IOSG Ventures, Apollo Capital, Maven eleven Capital and Bixin Ventures. Furthermore, person traders have also poured capital into standard tasks this kind of as Mark Cuban, David Hoffman, Loong Wang,…

Swell Network Investors. Source: swellnetwork.io

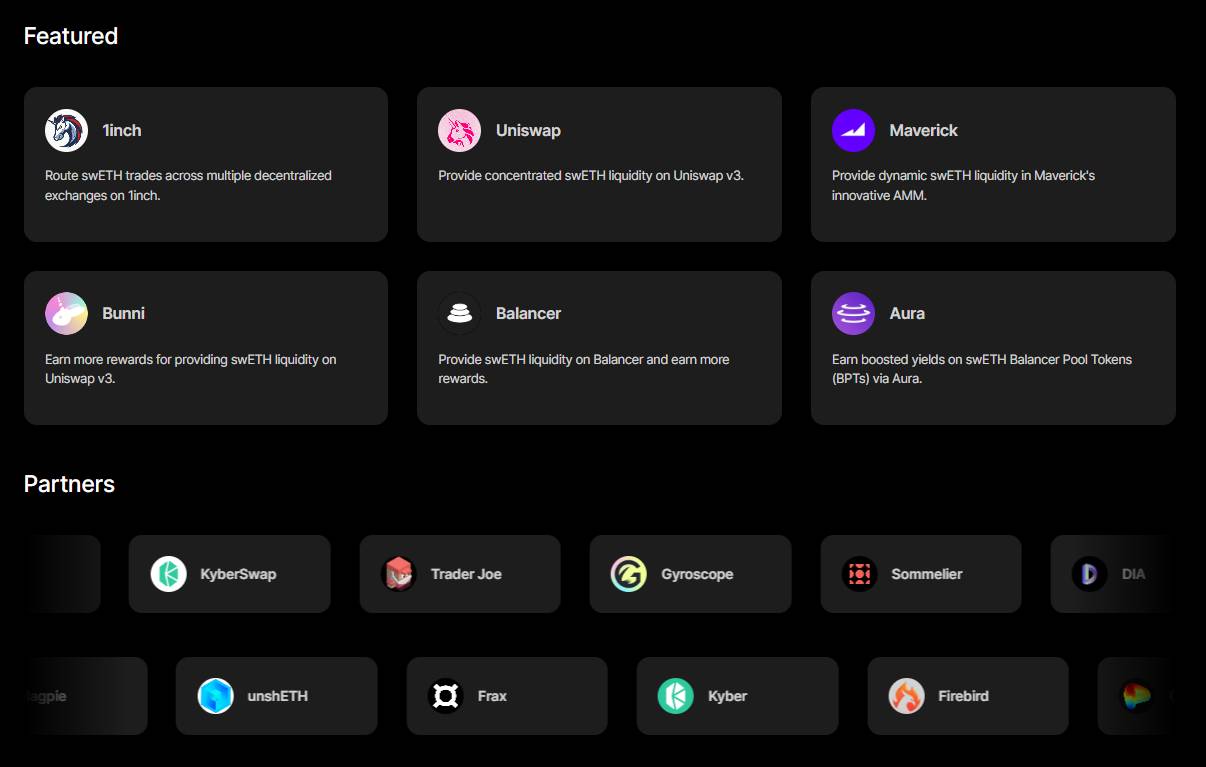

Company

Currently, Swell Network collaborates with a quantity of DeFi platforms and LSDfi protocols this kind of as Uniswap, Balancer, Maverick Protocol, Frax Finance, Pendle Finance,…

Partner of the Swell network. Source: swellnetwork.io

summary

Swell Network is an Ethereum-based mostly decentralized liquid staking protocol that makes it possible for end users to stake ETH and obtain liquid staking tokens – swETH to optimize income. The project’s mission is to simplify the use of DeFi for everybody and provide the finest liquid staking expertise.

Through this write-up, you will likely have some primary facts about the Swell Network venture to make your investment choice.

Note: Coinlive is not accountable for any of your investment choices. I want you accomplishment and earn a great deal from this prospective marketplace!