[ad_1]

Assets remaining in the Ethereum Foundation wallet immediately after the sale contain 240.67 ETH, 49,658 DAI, ten,125 ARB, and seven,096 USDC. Meanwhile, ETH dropped under $one,600.

The Ethereum Foundation efficiently offered one,700 ETH and exchanged them for two.seven USD Coin (USDC) on October 9, in accordance to information from Arkham Intelligence.

Information from wallet 0x9eE457023bB3De16D51A003a247BaEaD7fce313 of the Fund stated that the sale was carried out on the Uniswap exchange [UNI].

However, they did not promote all of a sudden but had a past program. According to Arkham, the nonprofit sent money from its Gnosis Safe Proxy wallet on the past 5th.

Very very little ETH left in the wallet

A intelligent multi-signature wallet on Ethereum, Gnosis Safe, is normally employed by decentralized automated organizations (DAOs). This wallet necessitates a minimal amount of people today to approve a transaction.

Following the sale, Ethereum returned 494,000 USDC to the institutional wallet just before sending it back to Gnosis Safe. The remaining money on the Ethereum Foundation wallet contain 240.67 ETH, 49,658 DAI, ten,125 ARB, and seven,096 USDC.

However, a seem at the organization’s X (formerly Twitter) web page displays it is unclear why the coins have been offered.

ETH was right away impacted by the marketing as the value dropped one.45% inside two hrs of it occurring. As a outcome, the coin’s value fell under the $one,600 threshold it had held for some time. But what about traders?

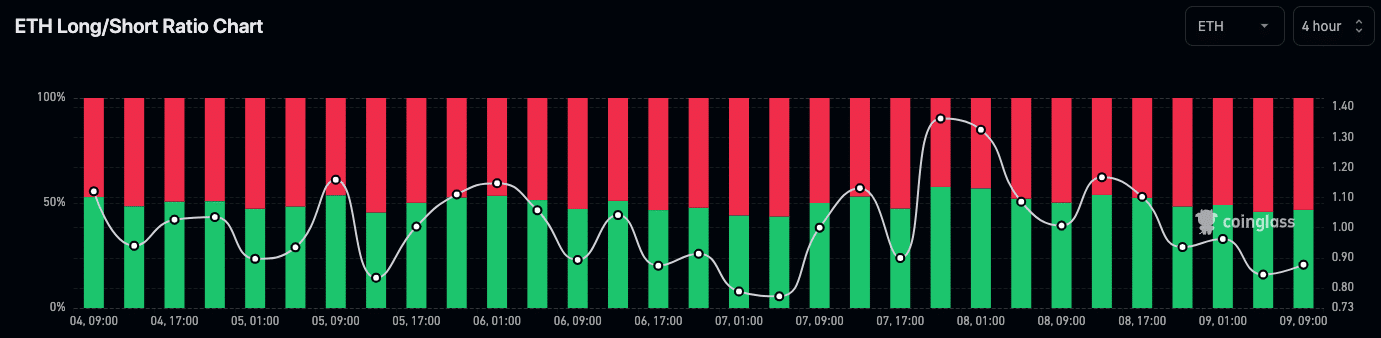

According to Coinglass, Long/Short ratio in four hrs of ETH is .87. Typically, a worth over one of this indicator signifies there are extra massive positions than brief positions. Conversely, a Long/Short ratio significantly less than one indicates there are extra brief positions than massive positions.

Be cautious with the subsequent hazards in the market place

So, ETH’s Long/Short ratio has proven that traders really feel the value could carry on to decline. However, the value of ETH could not go under $one,500 in the brief phrase. This is for the reason that Supply on the exchange has remained steady at the identical degree as given that final week.

Exchange provide is an indicator that measures the amount of coins that have been deposited into exchange wallets from external addresses. If the index rises sharply, it indicates there could be marketing stress approaching.

So, the lack of alter in this index indicates that ETH has adequate power to stand up to marketing from the fund’s exchange.

Meanwhile, traders who opt for to purchase Long want to pay out focus to Open Interest on exchanges. As an indicator of market place sentiment, Exchange Open Interest signifies when there is an maximize in action on the exchange.

However, an maximize in this index could be associated to closing or futures trading actions. While there is uncertainty about the actions taking area on these platforms, caution should really be exercised when opening lengthy positions.

General Bitcoin News

[ad_2]