After answering queries from his defense attorney, Sam Bankman-Fried now faces queries from US prosecutors, with previous statements to the media coming back to “damage” the former FTX CEO.

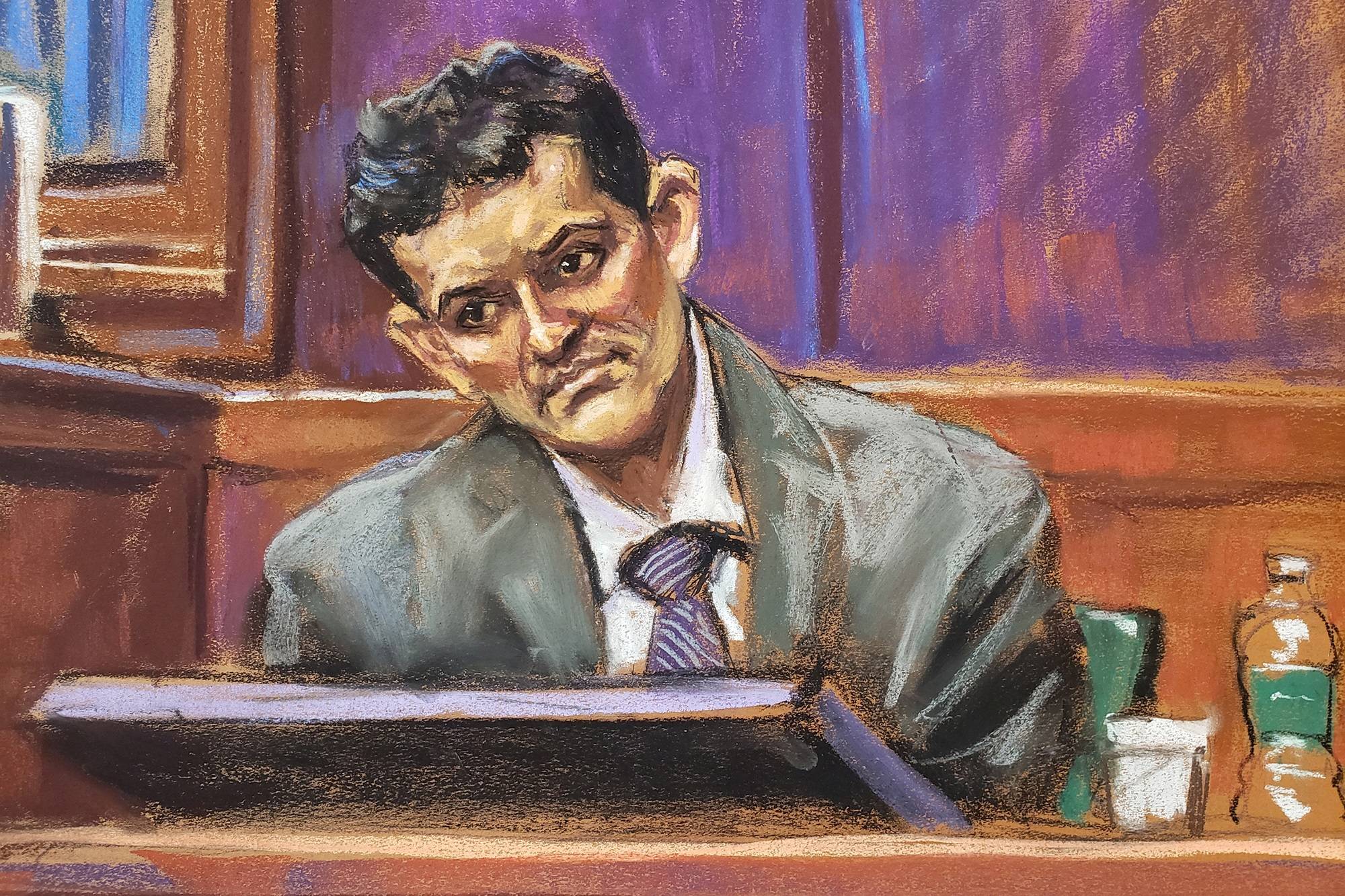

Painting of Sam Bankman-Fried on the witness stand through his trial. Photo: Jane Rosenberg/Reuters

The trial of Sam Bankman-Fried has entered its fifteenth day with the former CEO of FTX choosing to testify to defend himself and encounter the confrontation method with prosecutors from the US Department of Justice.

Defense attorney cross-examination session (continued)

During the 14th day of trial, the defense lawyer continued to request queries to support Sam Bankman-Fried defend himself.

Period June-September 2022

The former FTX CEO stated he maintains a record of priority duties to be achieved among September and October 2022. One of them is to make a function that makes it possible for non-programmers (together with Sam) to simply entry FTX’s database. The function of this is to enhance the pace of transactions on FTX.

Mr Bankman-Fried confirmed in court that the new modifications had been estimated to support FTX earn an added $one-two billion in yearly income. Additionally, FTX also has a danger management instrument to reduce users’ liquidation of their assets from impacting the exchange.

Going back to danger management, Sam Bankman-Fried stated he had a conversation with former Alameda Research CEO Caroline Ellison about producing hedging operations for the bottom. This move came just after the collapse of LUNA-UST, which sent Bitcoin tumbling into the $twenty,000 area and induced hefty losses in Alameda. Sam stated that Caroline needed to resign at that time, Sam left the determination up to her and only asked Alameda to get a hedging place to reduce dangers.

In September Caroline Ellison reported the hedging transactions to Sam Bankman-Fried, but Sam was dissatisfied due to the fact he believed the worth must be double the reported figure. Caroline agreed with Sam’s suggestion.

Also in September, Sam stated he had a organization journey to Dubai and the Middle East to attend a conference. When asked if he would meet the head of a Saudi state investment fund, Sam Bankman-Fried gave an unclear reply. However, Sam Bankman-Fried stated the journey was a results due to the fact he acquired market place share from Binance, the rival of FTX which has created Dubai its headquarters.

All past witnesses stated that Sam Bankman-Fried came to the Middle East to seem for traders to conserve FTX from its capital deficit. The former CEO is also stated to have met with Saudi Crown Prince Mohammed bin Salman to talk about investing in the exchange.

Sam Bankman-Fried says he normally spends up to a hundred days a 12 months traveling on organization, typically in the US capital Washington DC.

November 2022: The minute FTX failed

When the defense lawyer asked him about FTX’s string of failures, Sam Bankman-Fried stated it all came from his write-up. CoinDesk, Alameda Budget Disclosure. However, Sam claimed that the data in the write-up was outdated information on investment money.

Next, the CEO of Binance Changpeng Zhao threatened to promote the complete TTFleading to the cost of the FTX token to plummet on November 6th.

Sam Bankman-Fried contacted Caroline Ellison and the two agreed to speak to calm the problem. The former Alameda CEO’s Twitter publish claims the fund nonetheless has far more than $ten billion in assets not nonetheless reflected in CoinDesk’s leaked stability sheet.

– the stability sheet breaks down some of our biggest lengthy positions clearly we have hedges that are not listed

– provided the squeeze in the crypto credit score room this 12 months, we have now paid back the bulk of our loans—Caroline (@carolinecapital) November 6, 2022

However, the stress on FTX started to be felt when, just on November six, end users of the exchange withdrew far more than $one billion in assets from the platform.

In response, Caroline Ellison tweeted that she would Buy back all Binance FTT at the cost of 22 USD/token, but it did not make improvements to the problem. By November seven, end users had withdrawn $four billion from FTX.

@cz_binance If you are wanting to decrease the market’s affect on your FTT income, Alameda will be satisfied to invest in it all from you these days for $22!

—Caroline (@carolinecapital) November 6, 2022

FTX subsequently reported a delay in processing withdrawals. Sam Bankman-Fried stated former FTX CTO Gary Wang informed him the delay for Bitcoin withdrawals is up to an hour.

Sam Bankman-Fried continued to reassure the crypto local community on Twitter saying: “FTX is still good, assets are still safe”, and the rumors about the exchange are false (this Twitter publish has been deleted). The former FTX CEO stated that Binance might have “played a bad hand” due to the fact FTX constantly worked with officials. This statement by Mr. Bankman-Fried was promptly countered by the US Attorney and accepted by the judge.

When questioned once more by the attorney, Sam Bankman-Fried stated that at the time he nonetheless believed that FTX had no challenges, had no capital deficits and that FTX did not use consumer cash for other functions.

However, the problem is obtaining worse and worse. The cryptocurrency market place has collapsed, severely affecting the worth of Alameda coins utilized as collateral. The fund’s protective measures did not have the wanted result. Realizing the problem was out of manage, Sam Bankman-Fried deleted his Twitter publish saying “FTX is fine.”

So Sam Bankman-Fried provided to promote FTX to Binance. Binance at first agreed to the acquisition deal. But just after a day of evaluations, the exchange reversed its determination, leading to even far more panic in the cryptocurrency market place.

The former FTX CEO approached yet another investment fund, Apollo Management, to put together money reviews to send to this unit. This was also the time when FTX attorney Can Sun was invited to attend the meeting among the two sides to obtain good reasons to justify the deficit, precisely as this individual testified. Sam Bankman-Fried says he operates up to 22-23 hrs a day these days.

Sam Bankman-Fried announced on November eleven, 2022 FTX and Alameda Research went bankruptand he himself resigned as CEO.

Sam Bankman-Fried in the following days attempted to seem in the media to justify the collapse of FTX. The former CEO of FTX was also contacted by the authorities of the Bahamas (the place FTX is based mostly) to clarify the problem. Sam Bankman-Fried and Gary Wang then transferred the remaining assets on FTX to the Bahamian government.

Prosecutor’s discussion session

Sam Bankman-Fried nonetheless controls Alameda even even though he is no longer CEO

The prosecutor would like to verify that Sam Bankman-Fried owns 90% of Alameda’s shares and that the former CEO of FTX informed him the reality. In 2022, Sam, in spite of no longer remaining CEO of Alameda, will nonetheless be frequently up to date on the efficiency of the investment fund. As a outcome, Sam Bankman-Fried nonetheless communicates frequently with Alameda’s two co-CEOs, Caroline Ellison and Sam Trabucco, offering input into transaction selections..

This is demonstrated by the proof presented in court by the Prosecutor’s Office Sam Bankman-Fried orders Ellison and Trabucco to proceed with the transaction anywayexclusively hedging by investing in Japanese government bonds.

The prosecutor then asked Sam Bankman-Fried about his efforts to make clear himself to the media just after the FTX collapse. The Prosecutor presented proof that through these interrogations Sam Bankman-Fried insisted that he was no longer concerned in the affairs of Alameda Research, contrary to what was pointed out over.

Contrast in media statements and behind the scenes at FTX

US Department of Justice prosecutors carry on to push back towards Sam Bankman-Fried’s claims on social networks in October 2022, saying FTX is a safe and sound platform that end users can securely believe in to deposit cash and trade , that “the core of cryptocurrencies is mastering your assets”, and FTX will normally enable withdrawals at any time. However, at that extremely minute, FTX’s CEO knew that the exchange was dealing with a capital shortfall of up to $eight billion.

four) Thank you specifically to everybody who highlights the core of cryptocurrencies: financial freedom.

The freedom to very own one’s very own house

very own your information

to develop your plans— SBF (@SBF_FTX) October 23, 2022

To questioning passages the place the prosecutor presented distinct proof as over, Sam Bankman-Fried started responding with phrases like “I’m not sure”, “I do not remember”, “I think so”… During the rest of the trial, the former CEO of FTX grew to become closer 150 occasions saying phrases like that.

In cross-examination these days, on a lot of events, the SBF did not bear in mind, did not recall or was uncertain…

Please see some examples beneath:

Q. And is it not genuine, yes or no, that you stated in this podcast that you had been not concerned in Alameda trading at all and that you have not been concerned for… https://t.co/gbLSSzhCmV

— BitMEX Research (@BitMEXResearch) October 31, 2023

The prosecutor questioned the cryptocurrency management bill that Sam Bankman-Fried contributed to and presented to the US Congress in the fall of 2023. The former FTX CEO wrote on Twitter that “protecting consumers is vital.” he claimed it was genuine.

14) But my help for any bill, regulatory framework, and so forth. It unquestionably depends on these factors, as lengthy as they basically secure consumers and basically secure financial freedom.

Anyway, here is the website link to the web site publish after once more: https://t.co/O2nG1VrW1l.

— SBF (@SBF_FTX) October 19, 2022

However, through the exchange’s “true face reveal” following FTX’s bankruptcy, Sam Bankman-Fried admitted that the interaction with US officials was just a “screen” for the exchange to burnish its identify, not . In truth, the former CEO has no respect at all for American money management organizations.

When questioned by the prosecutor about the contradictions in the over statements, Sam Bankman-Fried only admitted that this occurred without having saying something else.

Additionally, the prosecutor also presented proof that Sam Bankman-Fried after referred to as his Twitter followers and the cryptocurrency local community “idiots.” The former CEO of FTX stated that this is only genuine to a compact extent.

Sam Bankman-Fried created a lot of political donations to American officials, in the hope that they would act…