The cryptocurrency market place, led by Bitcoin and Ethereum, has observed a robust rally in excess of the previous 24 hrs thanks to momentum from ETF prospective customers.

Volatility of the major cryptocurrencies on the market place as of 09:ten on November ten, 2023. Source: Coin360

Volatility of the major cryptocurrencies on the market place as of 09:ten on November ten, 2023. Source: Coin360

Complete one yr The day Binance announced the cancellation of the FTX acquisition following noting the exchange’s “irreversible” standing, top to FTX’s bankruptcy the upcoming day, the cryptocurrency market place showed a robust recovery, when each Bitcoin (BTC ) that Ethereum (ETH) recorded new highs in 2023.

November 10th is as well two entire many years Since Bitcoin reached its ATH peak at USD 69,000, at that time it was also thanks to ETF momentum and the inflation scenario in the US.

As reported by Coinlive, Bitcoin on November 9, it moved from USD 34,800 to USD 37,972 on Binance, when there have been a lot of new developments on the prospect of the US Securities Commission (SEC)-accredited Bitcoin spot ETF. This is the highest value given that the starting of May 2022, i.e. just before the collapse of the LUNA-UST group.

1h chart of the BTC/USDT pair on Binance at 09:15 on November ten, 2023

1h chart of the BTC/USDT pair on Binance at 09:15 on November ten, 2023

As a end result, Bloomberg specialists reported that the SEC is getting ready the essential procedures to approve ETFs, primarily following the latest legal defeat towards Grayscale. They additional stated that there is a time time period from November 9 to November 17 (US time) for the SEC to approve all twelve Bitcoin spot ETF proposals that have been submitted to the commission.

However, in the early morning hrs of November ten, BTC underwent a sizeable correction, dropping the value from $37,900 to $35,600, just before recovering to $36,600 as of this creating. Many other big altcoins have been also impacted by this correction.

Otherwise, Ethereum (ETH) nonetheless maintains its bullish momentum with no staying blown away by Bitcoin. The world’s 2nd-greatest cryptocurrency on the morning of November ten set a new substantial at USD two,132, the highest value given that April, when Shanghai upgraded to permit withdrawal of ETF staking.

1h chart of the ETH/USDT pair on Binance at 09:15 on November ten, 2023

1h chart of the ETH/USDT pair on Binance at 09:15 on November ten, 2023

As reported by Coinlive, this morning BlackRock submitted a request to the US Securities Commission to generate a spot ETF on Ethereum, confirming past rumors. Although the prospect of an approval in the close to potential is not substantial, this displays that ETH is accomplishing effectively The American money giant believes in none other than Bitcoin.

There is also a record of altcoins with notable development in latest instances TTF, the previous trading currency of FTX. Although declared “dead” by the unit that took in excess of FTX, FTT is nonetheless supported for trading on a lot of other exchanges.

On November 9, SEC Chairman Gary Gensler produced a comment leaving open the likelihood that FTX could be acquired by one more organization and restore operations, leading to FTT’s value to extra than double. The unit that will take in excess of FTX also admitted that it is taking into consideration repurchase provides for FTX from unnamed events.

1h chart of the FTT/USDT pair on Binance at 09:15 on November ten, 2023

1h chart of the FTT/USDT pair on Binance at 09:15 on November ten, 2023

Even extra spectacular is it Fuel, the premium token of the Neo (NEO) blockchain. From a value of USD five at the finish of October, NEO has now risen practically 5x to USD 24 as information broke that Neo was back and would be making an Ethereum-linked sidechain.

four-hour chart of Fuel/USDT pair on Binance as of 09:15 on November ten, 2023

four-hour chart of Fuel/USDT pair on Binance as of 09:15 on November ten, 2023

Additionally, liquid staking tokens Lido (LDO), RocketPool (RPL), and ssv.network (SSV) also noticed an maximize of extra than twenty% thanks to Ethereum.

1h chart of the LDO/USDT pair on Binance at 09:15 on November ten, 2023

1h chart of the LDO/USDT pair on Binance at 09:15 on November ten, 2023

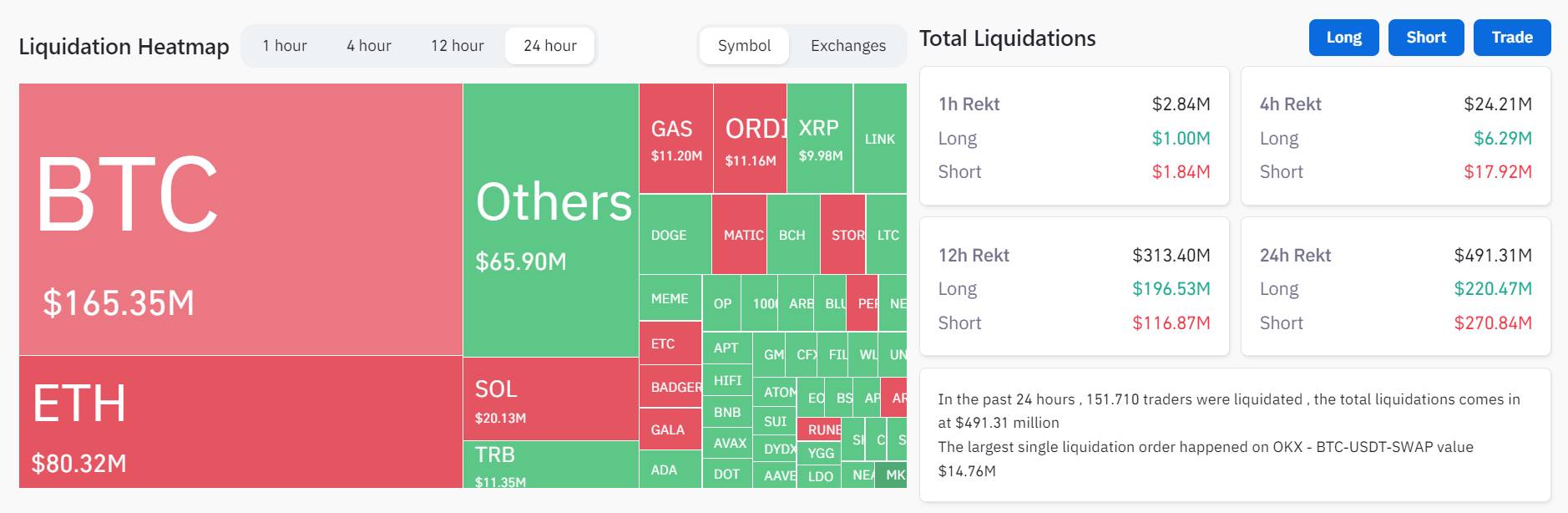

Nearly $500 million in derivative orders have been settled in the final 24 hrs, mostly in BTC and ETH, with a quick purchase fee of fifty five.18%. This is the greatest liquidation degree given that the August 18 dump that took Bitcoin to USD 25,a hundred, with a complete liquidation of practically USD one billion.

Long-quick purchase settlement information on the cryptocurrency market place as of 09:15 on November ten, 2023. Photo: Coinglass

Long-quick purchase settlement information on the cryptocurrency market place as of 09:15 on November ten, 2023. Photo: Coinglass

The complete cryptocurrency market place capitalization is now back at $one.45 trillion, the highest given that May 2022.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!