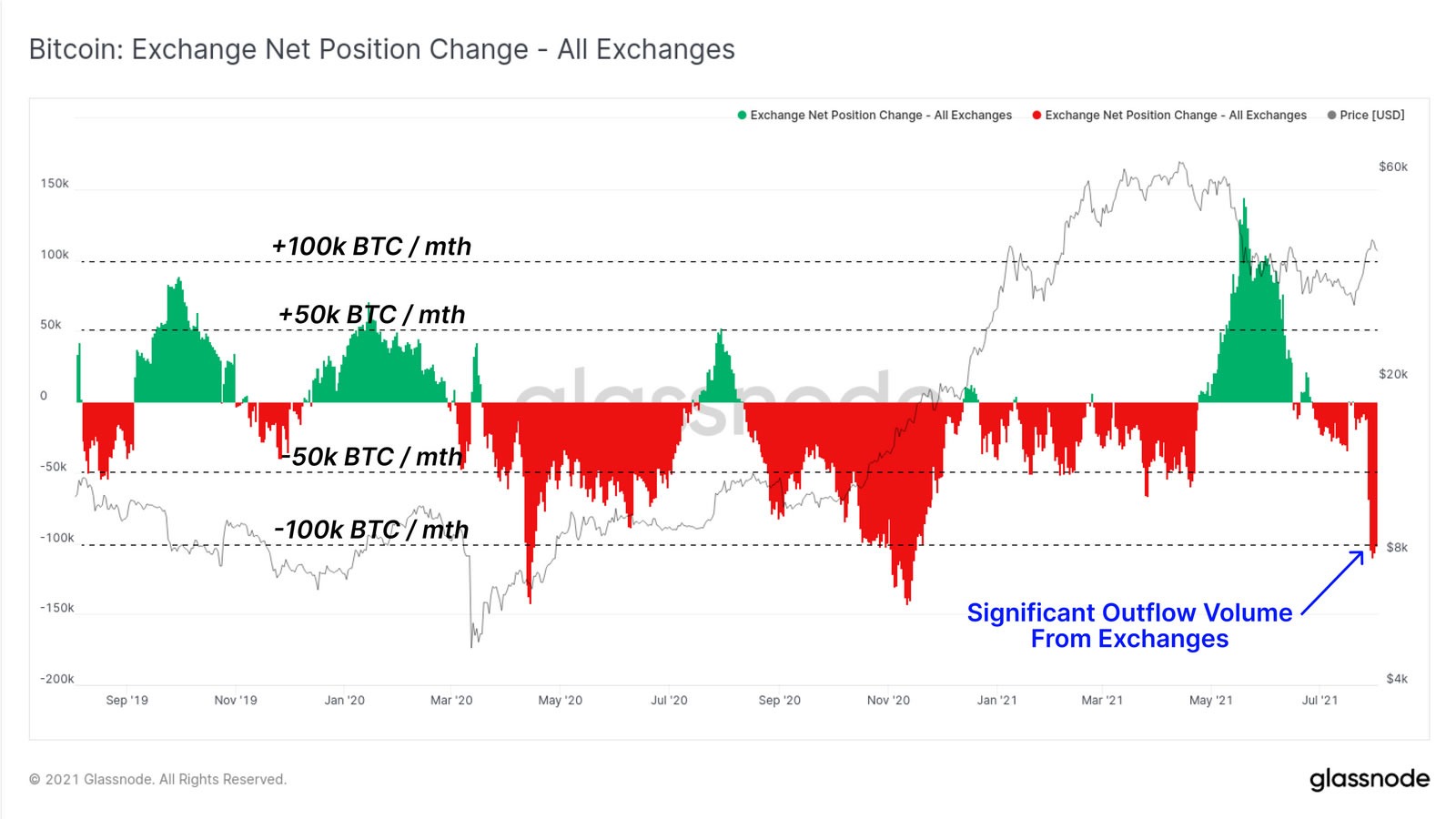

Centralized exchanges had their greatest Bitcoin withdrawal week due to the fact November 2020.

Bitcoin withdrawals from centralized exchanges have soared to an all-time large, with all over forty,000 BTC becoming withdrawn in the previous 7 days.

According to Glassnode’s On-Chain Week report of August two, Bitcoin outflows have accelerated to exceed a hundred,000 BTC per month for the third time due to the fact September 2019. The on-chain analytics supplier estimates that only the 13.two% of BTC. held on the stock exchange – new lower for 2021.

“This represents an almost complete retracement of the large inflow volumes observed during the May sell-off.”

Outflows surged to almost 150,000 BTC regular monthly at the finish of April 2020 following the violent “Black Thursday” incident that noticed cryptocurrency costs drop by additional than 50% much less than two days soon after the United States. President Trump announced a travel ban amongst Europe and the United States in March as the coronavirus pandemic escalates. Despite the dramatic drop, Bitcoin has rallied by 150% by the finish of May 2020, major to substantial construct-up.

Outflows once more reached almost 150,000 BTC per month in November 2020 as Bitcoin rose to check its record selling price of $ twenty,000, with BTC climbing to an all-time large the following month.

Glassnode has observed quite a few trends amongst Coinbase and Binance for significantly of 2021, with Coinbase encountering substantial outflows whilst Binance was the greatest recipient of BTC.

However, Binance’s reserves are beginning to dry up, with 37,500 BTC (well worth all over $ one.five billion) rolling out of the exchange final week.

The stability on Coinbase remained steady in June: whilst the exchange obtained thirty,000 BTC in mid-July, 31,000 BTC was withdrawn from the platform final week.

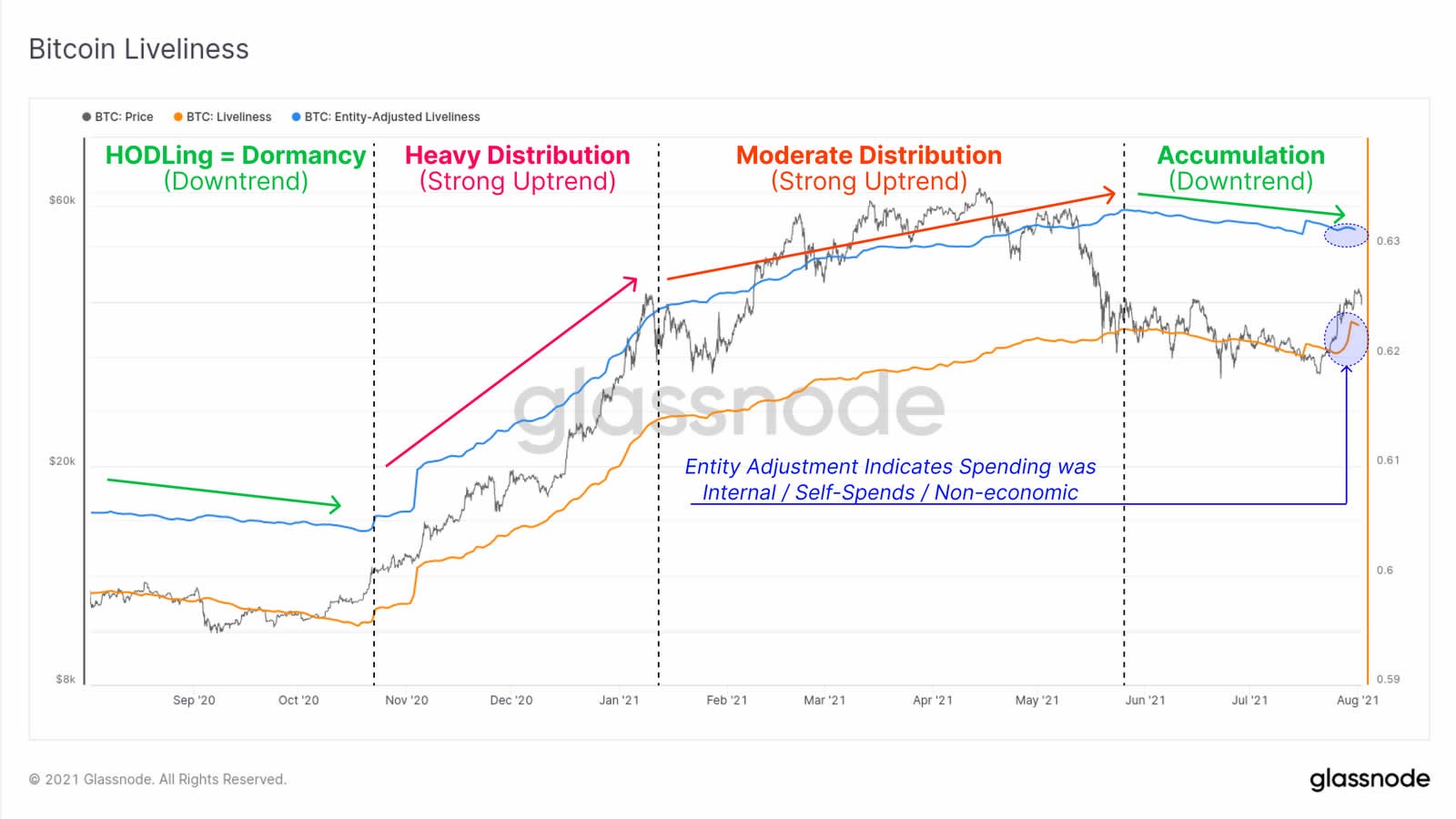

Looking at macro sentiment, the on the web analytics supplier referred to the “Business Strength index” to recognize consolidation trends.

The index measures the ratio of the complete variety of days the coins had been destroyed to the complete variety of days the coins had been produced, indicating a huge accumulation trend following the quick May promote-off.

“It seems that HODLing and accumulation are the trend that is most likely to dominate the online market.”

Synthetic currency 68

Maybe you are interested: