Toncoin (TON) has seen a surge in price recently, hitting a month high with a 20% increase this week. Although this growth has sparked hope, Toncoin is still facing pressure from holders who want to take profits.

Whether Toncoin can keep its momentum or not remains unclear as signs of a possible pullback emerge.

Toncoin Investors Are Profiting

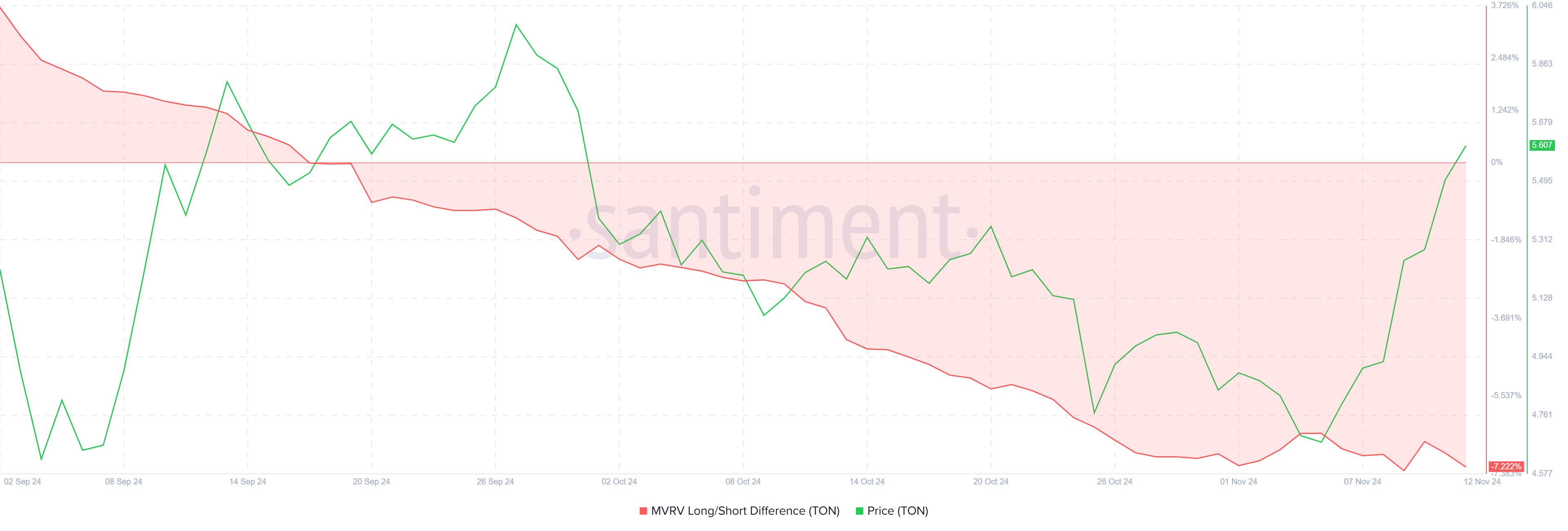

Currently, the MVRV Long/Short Difference index is warning of potential volatility for Toncoin. The index has fallen deeper into negative territory, showing that short-term investors are taking profits.

Since these investors usually only hold Toncoin for less than a month, they can easily sell it quickly, especially during high price spikes. This pattern is often bearish, as selling pressure from short-term investors can limit price growth and reverse the upward trend.

The negative MVRV Long/Short Difference index emphasizes the caution surrounding Toncoin. Although the price has recently increased significantly, the presence of short-term investors selling positions could hinder further upside momentum. This situation poses a challenge for Toncoin, as it may have difficulty maintaining an uptrend if short-term investors continue to sell in large volumes.

Toncoin’s macro dynamics are also showing signs of a possible reversal, reflected in the Relative Strength Index (RSI), which is approaching the overbought zone. History shows that when Toncoin’s RSI crosses this zone, the price often experiences a correction or reversal. If RSI crosses into overbought territory, Toncoin could face similar pressure, leading to a correction that could cool the recent rally.

The RSI near the overbought zone emphasizes a cautious view on TON’s price trajectory. The RSI correction pattern can affect investor sentiment, prompting traders to take profits before a potential price drop. These macro-level signals highlight that Toncoin may encounter resistance in its attempt to maintain its current bullish momentum.

TON Price Forecast: New Highs Are Far Away

Toncoin has increased nearly 20% in the past week, trading around $5.59. TON is currently targeting the key resistance level at $5.96 as it attempts to break through and reach the $6.00 mark, a key milestone for the asset.

However, with the mentioned negative indicators, it seems unlikely that Toncoin will easily overcome this resistance level. If selling increases, TON could fall below the $5.37 support level, hinting at continued price declines as profit-taking becomes more prominent.

If Toncoin can stabilize and hold $5.37 as strong support, it could attempt to rebound towards $5.96. Surpassing this level would challenge the current negative outlook, providing the necessary foundation for TON to aim for new highs.