The cryptocurrency market will see $3.98 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today. This huge expiry could impact short-term price action, especially as both assets have recently dropped in price.

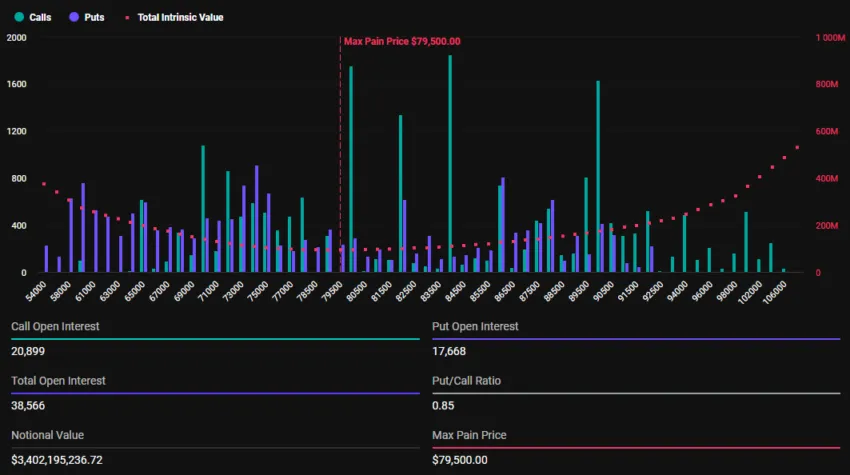

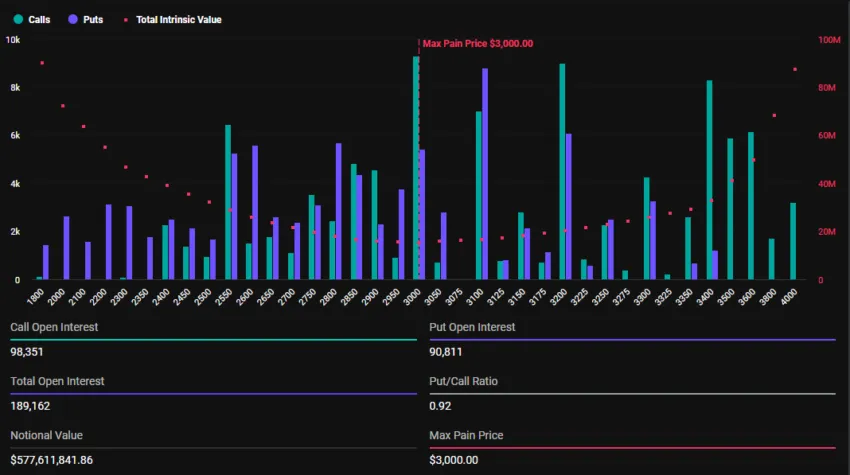

With Bitcoin options valued at $3.4 billion and Ethereum at $581.57 million, traders are bracing for volatility.

High-Stakes Crypto Options Expiry: What Traders Should Watch Today

According to data from Deribit, Bitcoin options expirations cover 38,566 contracts, compared to 48,794 contracts last week. Similarly, Ethereum options expiry totaled 189,018 contracts, down from 294,380 contracts the week before.

With Bitcoin, expiring options have a maximum pain price of $79,500 and a put-to-call ratio of 0.85. This reflects optimistic sentiment, despite the recent correction in asset prices. In comparison, Ethereum options have a maximum pain price of $3,000 and a put-to-call ratio of 0.92, reflecting a similar consideration of the market.

Maximum Pain Price is an important indicator that often guides market behavior. It represents the price at which most options expire worthless, causing maximum financial pain for traders.

Meanwhile, put-to-call ratios below 1 for both Bitcoin and Ethereum suggest optimism in the market, with many traders betting on rising prices. While put options represent bets on a price decrease, call options indicate bets on an increase in price. Taken together, this index (put-to-call ratio) evaluates market sentiment.

Traders and investors should prepare for volatility, as expiring options often cause short-term price fluctuations, creating uncertainty in the market.

“The market can be very volatile, so trade carefully,” a leading Asian crypto influencer Wise Advice warning.

However, the market usually stabilizes quickly afterward as traders adapt to the new price environment. With today’s high volume expiry, traders and investors can expect a similar outcome, potentially influencing future crypto market trends. As Bitcoin and Ethereum options near expiration, both assets could approach their respective strike values.

This is a result of the Maximum Pain Price theory, which predicts that option prices will converge around strike values where the largest number of contracts—both call and put options—expire worthless .

Many Barriers to Year-End Expiry of Cryptocurrency Options

With the market remaining optimistic, the general sentiment is that Bitcoin’s upside potential can still be realized, potentially reaching $100,000 before the end of the year. However, bigger challenges lie ahead, with more crypto options expiring at the end of the month and, possibly, more (about $11.8 billion for BTC) on December 27.

These dates have special significance as Bitcoin price rallies usually end right at the end of the year, between November and December. However, since they usually start between October and November, these rallies usually lasts into the beginning of the new year.

The expiration of Bitcoin options at the end of the year could be an important catalyst. It can influence the immediate price action as well as the trend through the new year, 2025. With optimists looking at the year-end expiration as a unique opportunity to venture into uncharted territory beyond $100,000, pessimists pledged to limit price discovery to protect their positions.

“Looking at the options market, the market is clearly polarized and trading is very fragmented, with some large traders looking to the sky to go long, while many traders are now on the short side of the market,” Greeks.live share.

If the battle for positions becomes more intense later in the year, the effects of this options expiration could spread beyond December, setting new standards for Bitcoin and Ethereum.

The latest data shows that the trading value of Bitcoin has decreased by 2.46% to $87,813. Similarly, Ethereum has dropped 5.43%, currently trading at $3,053.