Stellar (XLM) has seen a significant increase in trading volume, hitting its highest level since May 2021. This surge coincided with Ripple’s (XRP) surprise surge to $1 in Saturday, November 16.

XLM price also increased by 30% over the past 24 hours, replicating XRP’s impressive performance. But why does this happen? This analysis reveals every aspect involved in this closely linked migration.

Stellar’s History with Ripple Remains Valid

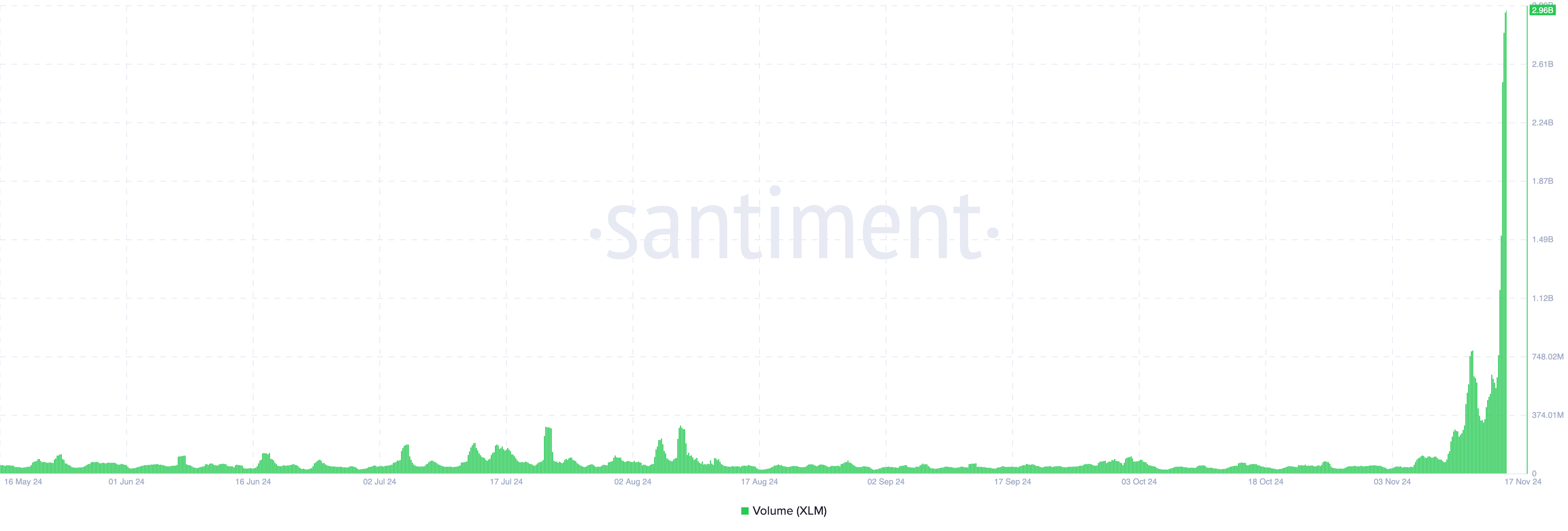

According to data from Santiment, XLM’s trading volume has skyrocketed to $2.96 billion at this time. This increase in volume clearly points to increased buying pressure on altcoins and growing market interest.

The last time XLM experienced such high volumes was during the 2021 bull market, when the crypto asset saw widespread price rallies.

This surge shows that investors are increasingly confident in XLM’s potential, especially after XRP’s recent price surge. Historically, both altcoins share a strong correlation, mainly for two reasons.

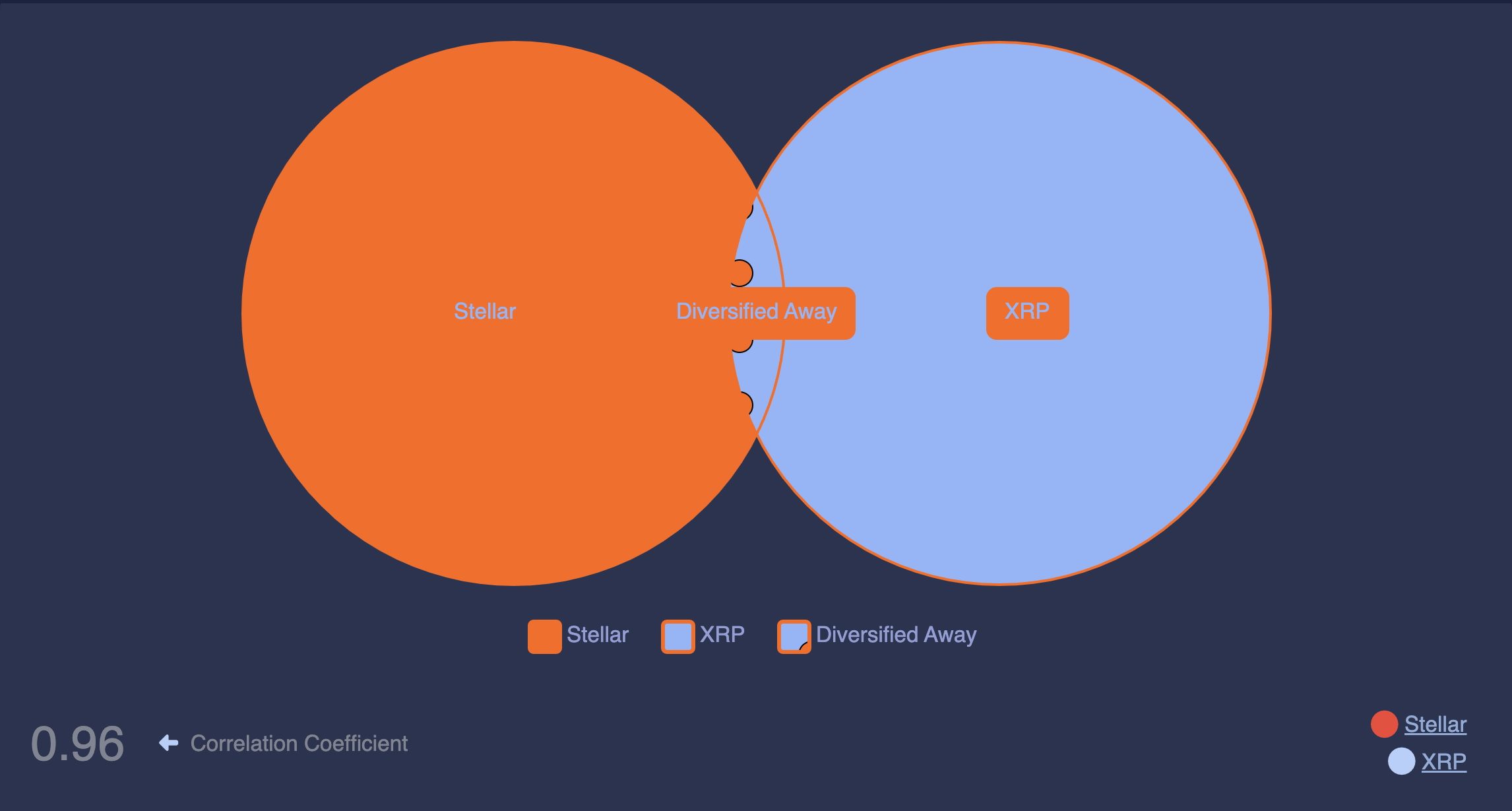

First of all, Jed McCaleb, the former co-founder of Ripple, went on to co-found Stellar. These two projects are closely related, especially in their focus on blockchain-based international payments, making Stellar’s fundamentals inextricably linked to Ripple’s.

As a result, XRP and XLM prices often move together. Data from Macroaxis supports this, with the 90-day correlation index reaching 0.96. For ease of understanding, this coefficient ranges from -1 to +1. Values near -1 indicate weak correlation, while values near +1 indicate a strong cohesion between assets.

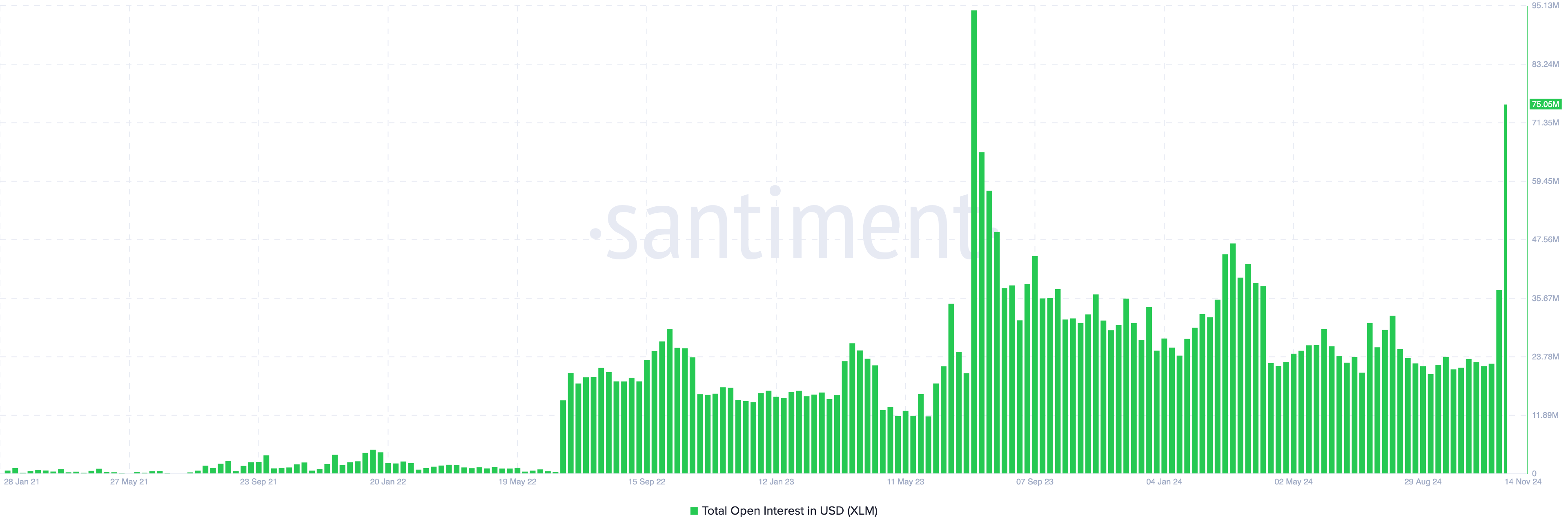

Besides XLM volume, altcoin Open Interest (OI) is also another indicator that is experiencing a significant increase. High OI levels indicate that capital is flowing into the market, with new positions being established, reflecting strong bullish sentiment.

On the contrary, low OI suggests the opposite. According to Santiment, XLM open interest has increased to 75.05 million USD — the highest level since Ripple’s partial victory in the US in July 2023. If this value continues to increase, then the XLM price could surpass the zero level .20 USD.

XLM Price Forecast: Likely Rise to $0.24

On the daily chart, XLM price initially rose to $0.22, but was rejected at that point. Despite the slight correction, the altcoin’s value remains above the Ichimoku Cloud. The Ichimoku Cloud is a technical indicator that measures support and resistance and determines the direction of trends.

When the cloud is above the price, the trend is down, indicating high resistance. But in the case of XLM, the cloud is below value, hinting at strong support that could push the price higher.

If this persists and XLM volume continues to increase, the altcoin could reach $0.24. However, if investors decide to take profits, this may not happen. Instead, the XLM price could drop to $0.16.