OM, the native coin of the real asset (RWA) Layer-1 Mantra blockchain, has seen strong growth, reaching over 30% in the past 24 hours. It hit a new record high of $4.52 on Monday before falling to $4.20, which is its current trading price.

Despite the impressive rise, on-chain indicators indicate that OM’s upward momentum may be slowing. Here’s why.

Mantra Trader’s Profits

The net flows of large OM holders have decreased over the past few days. According to IntoTheBlock data, it dropped 54% from November 14 to 17. This indicates a cumulative decline from whales, which could put downward pressure on the altcoin’s price.

Large Holders are addresses that control more than 0.1% of an asset’s circulating supply. The net flow index measures the difference between the purchases and sales of these investors over a specific period of time.

A decline in net flows suggests that whale addresses are reducing their positions, which is a bearish indicator that could signal increased selling pressure and higher downside risk.

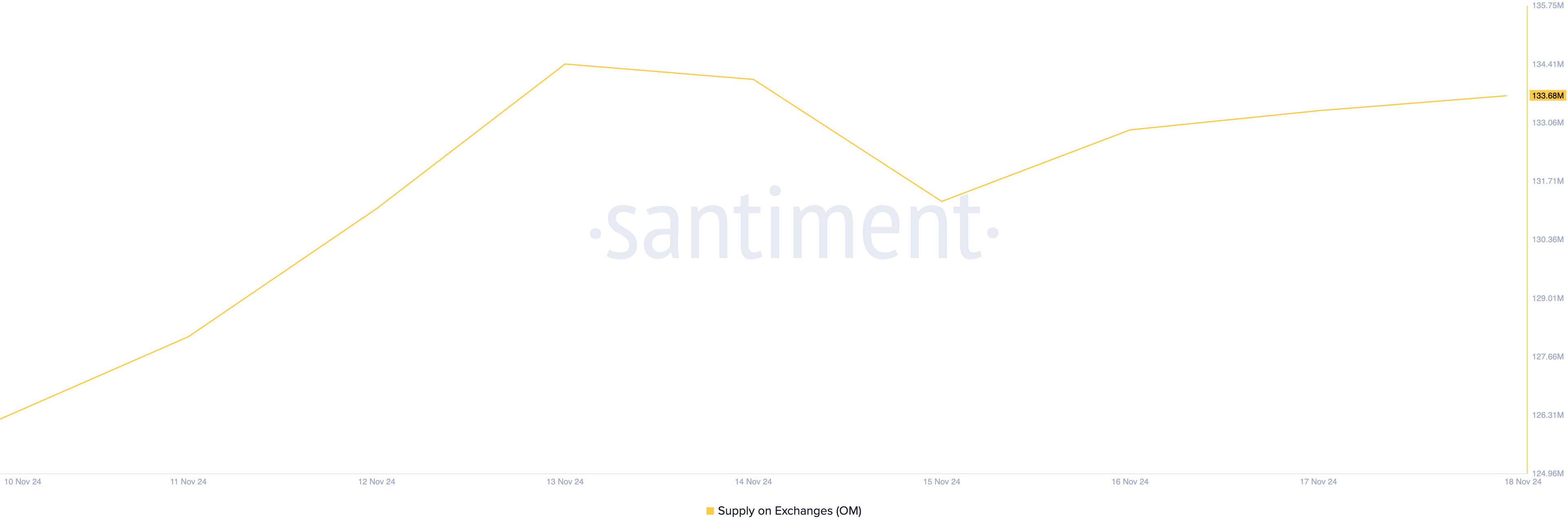

Notably, the decline in net flows of these large holders has been accompanied by an increase in supply on the exchange, confirming selling activity. According to Santiment data, the supply of OM on cryptocurrency exchanges has increased by 2% in the past three days. Up to now, 134 million OM Tokens worth over 553 million USD are being held in wallets on the exchange.

When an asset has an increase in supply on an exchange, it indicates that more Tokens are being transferred from individual wallets to exchange wallets. This shows that investors may be preparing to sell, leading to increased selling pressure. Such a trend is usually bearish, as it can lead to a potential price decline due to increased supply in the market.

OM Price Forecast: Tokens Have Two Options

Currently, the RWA asset trades at $4.20. If financial profiteering continues, Mantra Token could lose recent gains, potentially falling 15% to $3.56. If the bullish momentum weakens further at that level, it is unlikely to hold as strong support, leading to a deeper decline towards $2.80.

Conversely, a recovery in buying pressure could bring the Token back to its record high of $4.52 and potentially even higher.