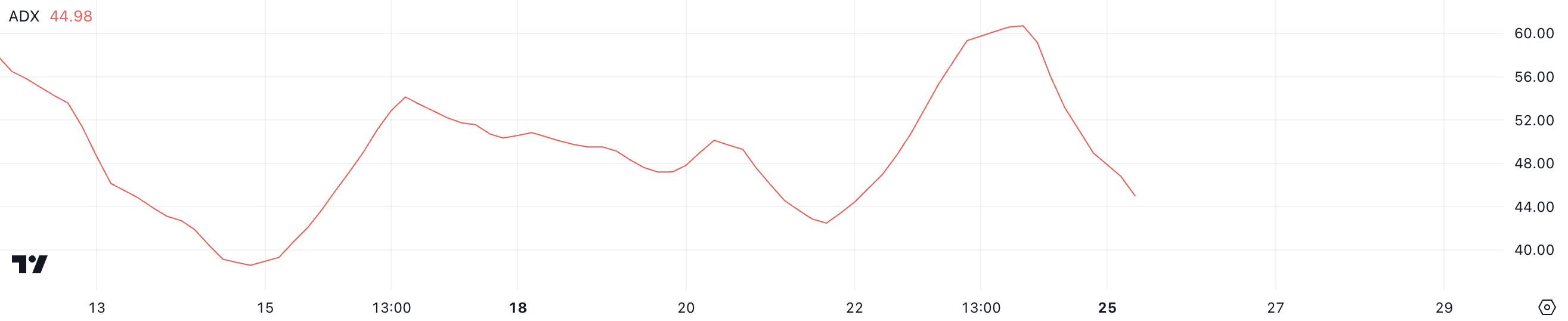

The price of Cardano (ADA) has increased 193.65% in the past 30 days and 37.82% in the latest week. Despite an impressive run, indicators suggest that ADA’s rally may be losing momentum. ADX, an indicator that measures trend strength, has dropped from above 60 to near 45, signaling bearish momentum even though the uptrend is still maintained.

With accumulation from whales stabilizing and price approaching key EMA levels, ADA faces a pivotal moment that could lead to a test of its highest price since 2021 or another Strong correction of 48% if downward pressure increases.

ADA’s Uptrend Looks Like It’s Decreasing

Currently, Cardano’s ADX index is almost at 45, down from above 60 just a few days ago. ADX, also known as the Average Directional Index, measures the strength of a trend, with values above 25 indicating a significant trend and values above 40 indicating a very strong trend.

While ADX at 45 still reflects strong momentum, a decline from 60 is a sign of weakness in trend strength, even if direction remains unchanged.

Currently, ADA is in an uptrend, supported by directional indicators. The decline in ADX shows that although the uptrend still holds, the explosive momentum has started to lose some of its strength. If ADX continues to decline, this could indicate that the current trend could flatten or reverse if selling pressure increases.

However, with ADX still above 25, the trend remains meaningful, and Cardano’s price is likely to maintain a bullish bias in the short term unless further weakness occurs.

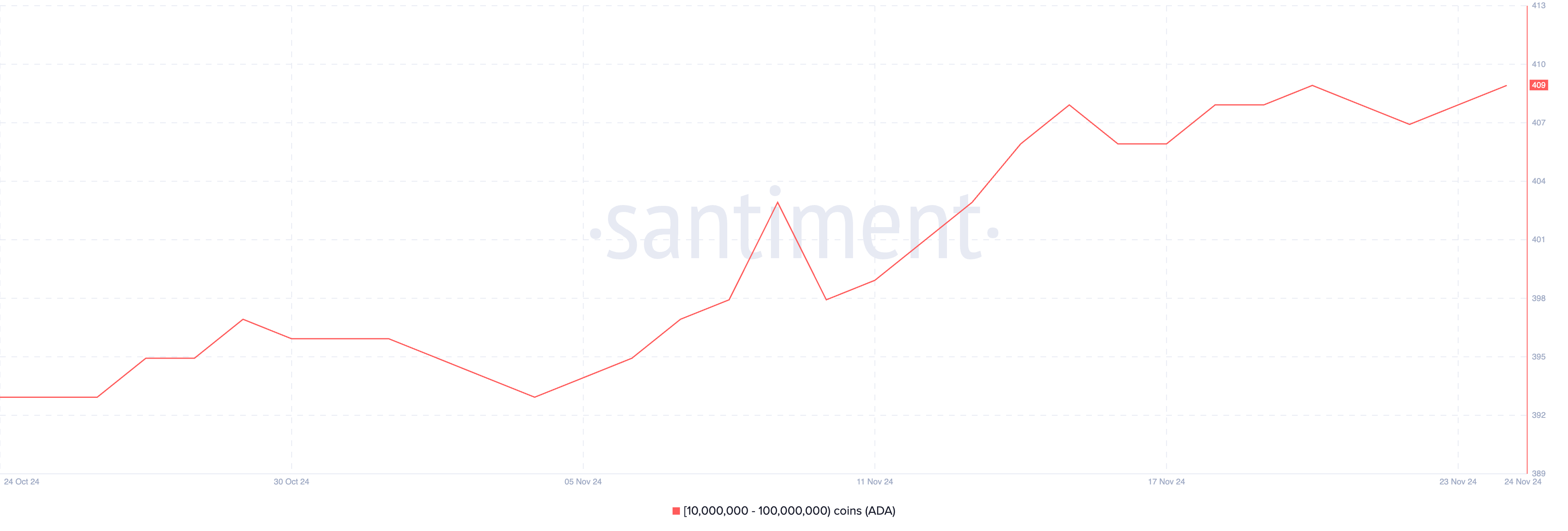

Cardano Whales Have Stopped Accumulating

Whales began aggressively accumulating Cardano from November 10, with the number of wallets holding between 10 million and 100 million ADA increasing from 398 to 408 on November 15. Monitoring whale activity is important because These large holders often have the ability to significantly impact market trends.

Their buying behavior could indicate growing confidence in the asset and could fuel a price rally, while their selling behavior could put downward pressure on prices.

Since November 15, the number of whale wallets has stabilized, ranging from 407 to 409. This continued accumulation shows that whales are holding their positions, reflecting a neutral to neutral sentiment. increasing tendency.

If the whales continue to hold neither increasing nor decreasing, the price of ADA may become less volatile, the market is waiting for new impetus to move in a specific direction.

ADA Price Prediction: Highest Price Since 2021 or a Sharp Correction?

Cardano’s EMAs continue to reflect a driving uptrend, with the short-term EMAs above the long-term ones. However, the price is currently not far above the short-term EMAs, suggesting that the bullish momentum has eased.

This suggests that the uptrend is losing momentum and ADA price is approaching a key point where it could rebound or fall below these lines, signaling a potential trend shift.

If the uptrend regains strength, ADA price could test levels above $1.155, potentially reaching $1.16, the highest price since March 2021. However, as indicated by the bearish ADX , the current uptrend is losing intensity, increasing the possibility of a reversal.

If the trend turns bearish, ADA’s nearest support is at $0.519, which would mark a sharp 48% correction from current levels.