Hedera (HBAR) price has skyrocketed 182.56% in the past 30 days, but recent indicators suggest this uptrend is losing momentum. ADX has dropped sharply, signaling a significant weakening in trend strength although the uptrend remains intact.

The Ichimoku clouds and EMAs also point to potential risks, with HBAR approaching key support levels and possibly forming a death cross.

HBAR’s Uptrend Is Rapidly Losing Momentum

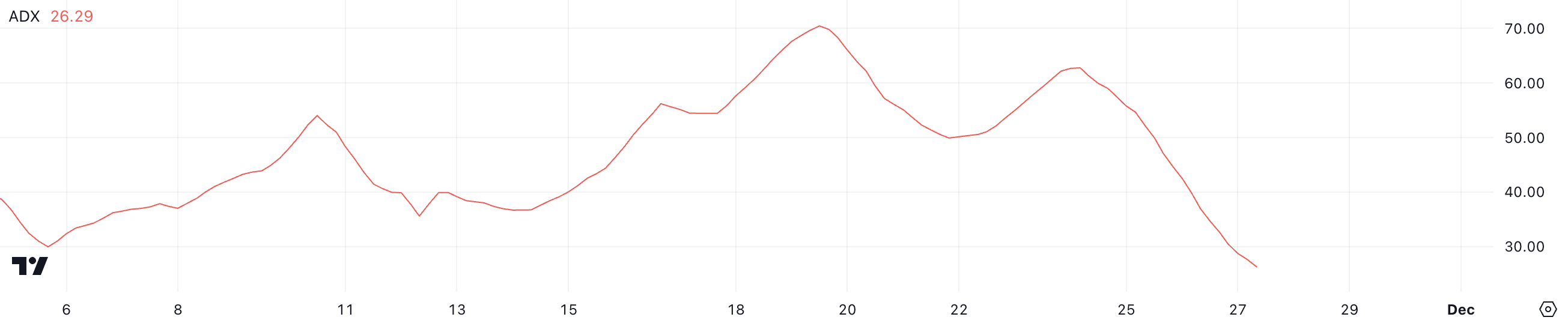

Hedera’s ADX has dropped to 26.2 from levels above 60 just three days ago, signaling a significant decline in trend strength. ADX, or Average Directional Index, measures the strength of a trend, regardless of direction, on a scale of 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggests a weak trend or no trend.

This sharp decline shows that while HBAR is still in an uptrend, its momentum has weakened significantly.

With ADX just above 25, HBAR’s current uptrend remains, but is less strong than at higher ADX levels. This suggests a consolidation period is coming as momentum slows. For the uptrend to regain strength, ADX needs to rise again, supported by increased buying pressure.

However, if ADX continues to decline, it could signal further weakening of the trend, increasing the risk of a reversal.

Ichimoku Clouds Show a Changing Trend

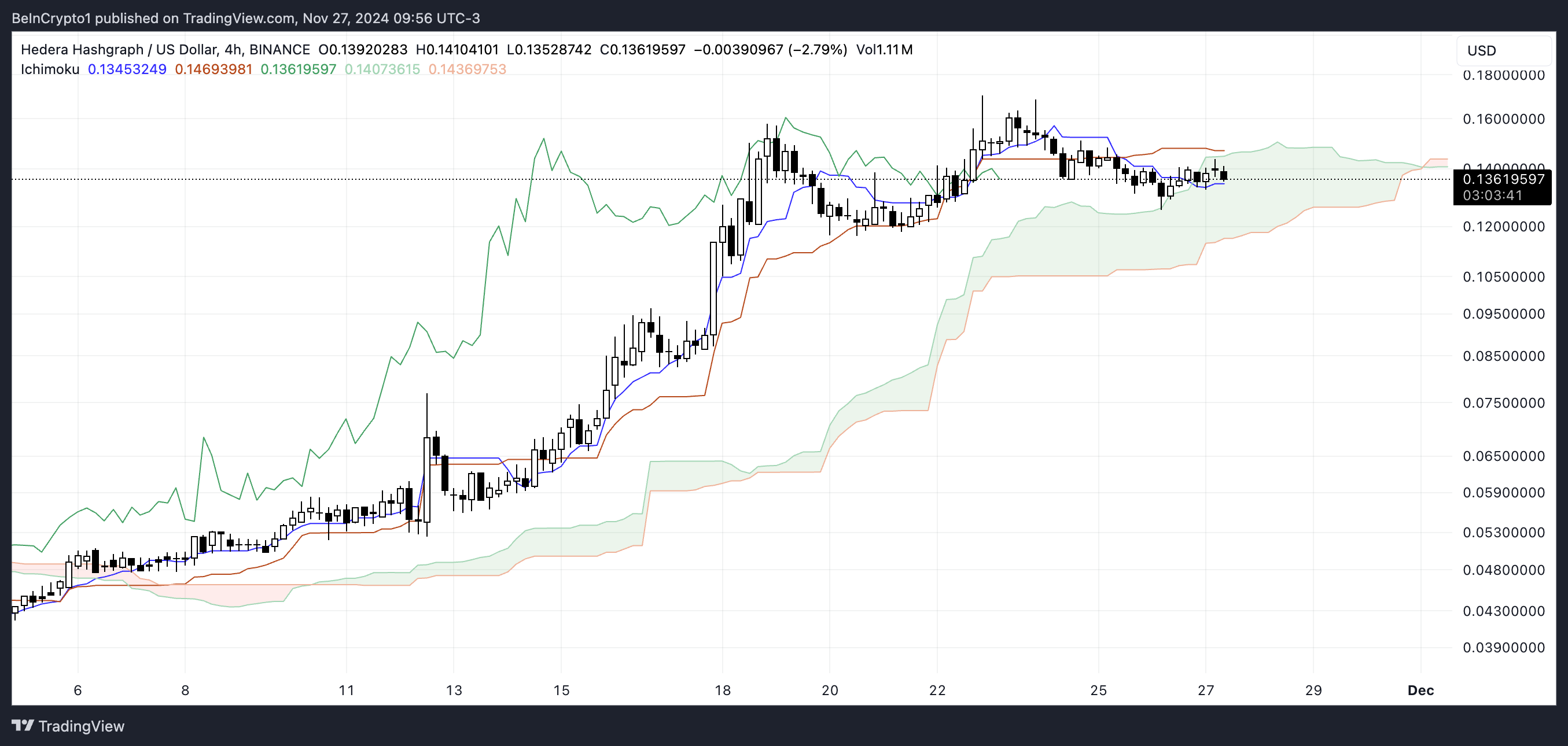

Hedera’s Ichimoku Cloud chart shows that the price is currently near the Kijun-Sen (orange line) and Tenkan-Sen (blue line) levels, indicating a period of consolidation following the recent rally.

The price is no longer above the clouds, suggesting the possibility of an upcoming trend reversal.

If HBAR sustains above the Kijun-Sen level and bounces back, a continuation of the uptrend is possible, confirming the bullish sentiment.

Conversely, if prices continue to fall below the clouds, it could signal a trend reversal, with increased selling pressure potentially pulling prices down further.

HBAR Price Prediction: Downtrend Could Lead to a Sharp Correction

Hedera’s EMAs suggest that the current uptrend could soon reverse, as the shortest EMA is approaching a cross below the longer-term one.

This formation, known as a death cross, is a strong bearish signal and can trigger increased selling pressure. If the death cross materializes, Hedera price is likely to test the support at $0.117, and if this fails, the price could fall further to $0.052.

On the other hand, if HBAR price regains bullish momentum and avoids the death cross, it could test key resistance levels at $0.158 and $0.17. A break through these levels could potentially push the price towards $0.20, representing a potential 48% upside.