Token unlocks are more than just scheduled events; they are important factors driving the market. Whether it is price pressure, volatility or ecosystem development, their impact is undeniable. Keyrock, a cryptocurrency market maker, has published a report on token unlocks and how these events affect the market.

Research indicates that token unlocking, although predictable, has a significant impact. Leveraging insights from research helps crypto market participants be more effective in handling these events, turning potential disruptions into opportunities.

Research from Keyrock Reveals Information About Token Unlocking

Study looked at over 16,000 token unlocks, shedding light on the major impacts these events have on market behavior. The results of the study provide valuable insights for traders and investors. Every week, more than 600 million USD worth of Tokens are circulated thanks to unlocking. Despite their regularity, the market’s reaction to these events is almost uniform.

“Understanding the unlock schedule is no longer optional for traders. It is essential to time market entry and exit effectively,” the study emphasizes.

According to Keyrock, 90% of unlocks create negative price pressure. This is true regardless of the size, type or recipient of the Tokens. What’s interesting is that the price impact often starts well before the unlock date, likely due to community members running ahead of the event. Larger unlocks amplify this effect, causing sharper price declines (up to 2.4 times larger) and increased volatility.

It should be noted that Token unlocking events typically follow a structured schedule in the allocation tables. These schedules can range from single major releases (cliff unlocks) to continuous monthly distributions (linear unlocks). Keyrock’s research classifies these events by size, determining that smaller unlocks, while sporadically less impactful, can create cumulative price pressure.

- Nano (

- Unlocks Small (0.5%-1%) and Medium (1%-5%): Likely to affect market sentiment.

- Large (5%-10%) and Epic (>10%) Unlocks: Large events with high market impact.

For traders, the size of an unlock determines its importance. Great token unlocks, while initially disruptive, often spread their impact over time, leading to a more gradual price recovery.

Besides size, the type of recipient of the unlocked Token also greatly affects the price dynamics. Evaluating the profile of the unlock recipient is necessary to determine the potential market impact. Keyrock has identified five main categories in this context.

Unlock Team

These are the most harmful, leading to average price reductions of up to 25%. Uncoordinated selling by team members, coupled with a lack of strategic measures to mitigate market impact, exacerbated the situation. Often considered compensation, these tokens are sold quickly to meet financial needs, causing sharp price declines.

“Unlocking the typical team shows how a lack of planning can increase market disruption,” the report said.

Therefore, traders should avoid entering orders during these unlocking periods or even during the linear distribution period that follows.

Unlock Investor

Strategically managed and with controlled impacts thanks to advanced prevention and liquidation strategies. Interestingly, investor unlocking exhibits more controlled price behavior than team unlocking.

Early investors, often from venture capital (VC) backgrounds, use advanced strategies such as OTC trading, derivatives, and options to reduce the impact of token sales. These methods reduce immediate selling pressure and ensure orderly market conditions.

Keyrock’s research shows that applying similar strategies by team projects can significantly reduce the negative effects of token unlocking.

“Sophistication in planning and execution can turn unlocks into opportunities rather than debt,” Keyrock said.

Unlock Ecosystem Development

Particularly positive, these unlocks often lead to price increases (+1.18% on average) because they inject liquidity or encourage ecosystem development. Tokens often serve infrastructure development, contributing to the long-term development of the ecosystem.

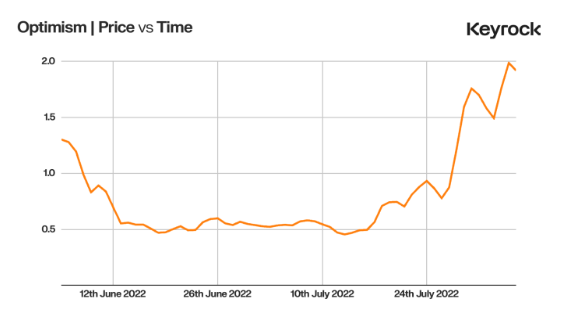

Keyrock cites the example of Optimism (OP), which strategically allocated 36 million USD Tokens to 24 projects following a major unlock in June 2022. This approach not only stabilizes the market but also promotes network expansion.

“Unlocking combined with an ecosystem development strategy can act as a catalyst instead of a disruptor,” Keyrock said.

Community or public unlocks typically have a mixed impact, with many tokens held or sold by recipients, reflecting moderate price pressure. Meanwhile, burn unlocks are rare and are therefore excluded from the analysis.

Important Highlights: Patterns and Strategies Around Unlocking

Meanwhile, two phenomena frequently lead to price pressure before token unlocking. First, there is retailer anticipation, where traders sell early to avoid dilution, which pushes prices down further. The second, is the institutional underwriting strategy, where sophisticated holders lock in prices ahead of time, minimizing their impact on unlock day.

Post-unlock, prices typically stabilize within two weeks as market moves adjust. For ecosystem development unlocks, stability comes with concrete growth benefits, as seen in projects like Optimism, which has effectively used Token unlocks to fund ecosystem expansion.

“Optimism’s strategy following the big unlock in June 2022 provides a classic example of how ecosystem unlocking, when designed well, can drive immediate utility and long-term growth . Despite the initial sell-off, Optimism has demonstrated how combining unlocking with targeted incentives can turn a supply shock into a launching pad for expansion,” a research piece states.

Keyrock’s research highlights the importance of tracking unlock schedules and understanding recipient behavior. For traders, timing is important. Exiting positions 30 days before major unlocks and re-entering 14 days later can minimize risk and maximize profits. For projects, carefully planned unlock schedules and strategies such as phased releases and liquidity support can minimize market disruption and align with long-term growth goals .