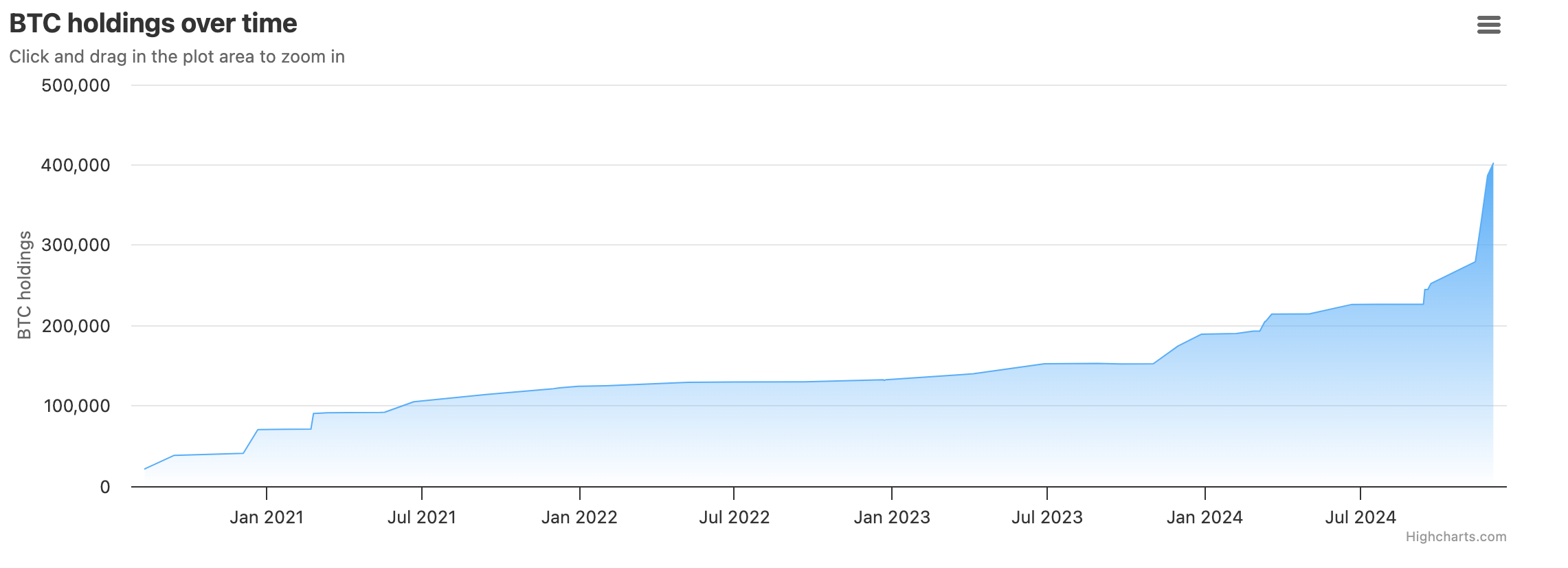

Today, MicroStrategy purchased an additional 21,550 Bitcoin, spending $2.1 billion. This is the company’s second purchase in October, at a price of $98,783 per BTC.

From October until now, Michael Saylor’s company has purchased more than $15 billion worth of Bitcoin.

MicroStrategy Buy More Bitcoin

This morning, MicroStrategy broadcast one announcement announced confirmation of the Bitcoin purchase. Saylor’s steadfast strategy no longer comes as a surprise, as two days ago he advocated a “Bitcoin accumulation plan,” championing the asset as a long-term investment.

“Satoshi came up with a game that we can all win. Bitcoin is that game,” Saylor stated in an interview today.

Previously in December, the company spent $1.5 billion to buy an equivalent amount of Bitcoin. Saylor has been a staunch supporter of Bitcoin for many years, but his recent purchases have increased significantly.

Due to this rapid consumption, MicroStrategy is now one of the largest Bitcoin shareholders in the world. This large amount of Bitcoin has had a dramatic impact on the company’s stock price this year. Bitcoin’s bullish cycle since the ETF was approved in January is also reflected in MSTR’s stock price, up nearly 450% from the beginning of the year until now.

Overall, 2024 was Bitcoin’s most successful year, with the price finally hitting the $100k mark. This strong market increase has stimulated large institutional investors to rush to buy BTC.

For example, BlackRock, a leading ETF issuer, increased its Bitcoin purchases after surpassing the $100k mark. This group of issuers now own more Bitcoin than Satoshi Nakamoto, which is truly astonishing. MicroStrategy has a long history of buying and backing Bitcoin, but BlackRock’s total assets under management are 100 times larger thanks to net inflows in IBIT.

Although Michael Saylor considers his Bitcoin-first approach infallible, report believes that the company’s underlying capital flow is still small compared to spot ETF issuers. However, these oversights have not deterred other public companies from pursuing MicroStrategy’s path.

As TinTucBitcoin previously reported, smaller public companies such as MARA and Metaplanet have also increased their Bitcoin holdings throughout this bull market. These accumulations suggest that public companies consider Bitcoin’s price target even higher, as they view these price peaks as buying opportunities.