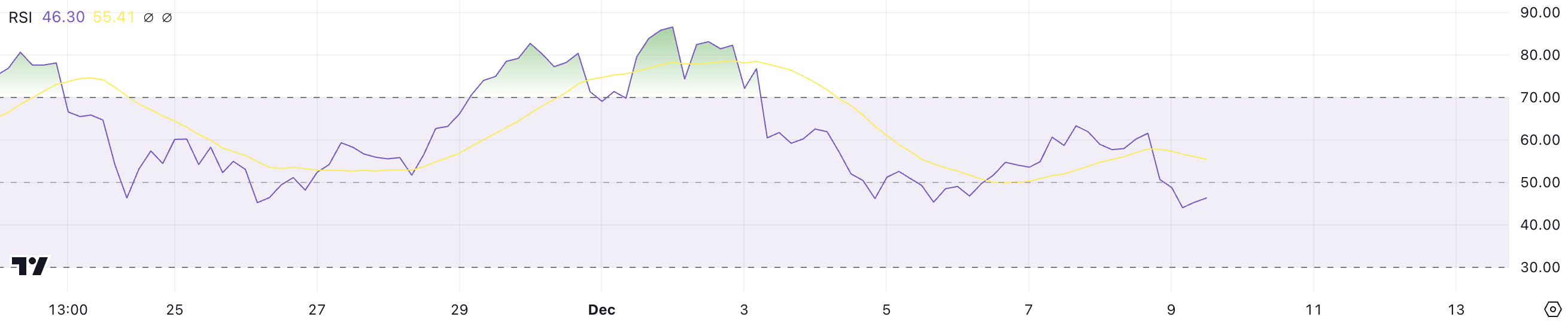

Ripple (XRP) price has increased more than 330% in just the past 30 days, surpassing Solana’s market capitalization and reaching a 6-year high. However, XRP’s RSI is now 46, down significantly from the overbought level above 70 that the coin reached from November 29 to December 3, when XRP price peaked around $2.90, highest level since 2018.

This decline shows that the bullish momentum has cooled, and current market sentiment is neutral or somewhat bearish. Therefore, XRP may face a period of accumulation or mild downward pressure before a possible recovery.

XRP RSI Turns Neutral After Consecutive Days Above 70

Currently, XRP’s RSI is 46, a significant drop from overbought levels above 70 between November 29 and December 3, when its price peaked around $2.90, a highest since 2018.

This decline in the RSI suggests that the recent bullish momentum has weakened, and the market may be in a neutral or somewhat pessimistic phase.

RSI, or relative strength index, is a momentum index that measures the speed and variability of price movements. It ranges from 0 to 100, with values above 70 typically indicating overbought conditions, while values below 30 indicate oversold conditions.

With XRP’s RSI currently at 46, it shows that the asset is neither overbought nor oversold, suggesting a neutral market sentiment. If this trend continues, Ripple price could experience a period of accumulation or mild downward pressure before potentially recovering.

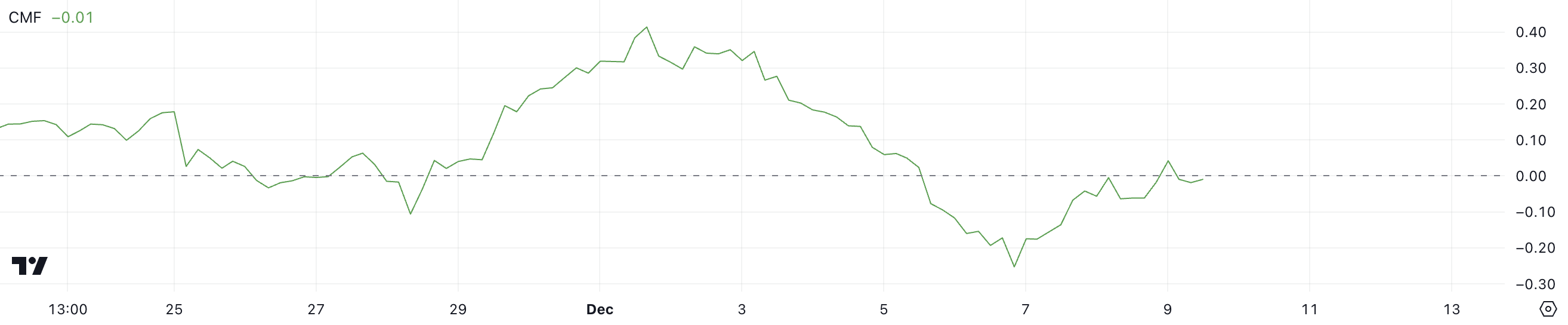

Ripple’s CMF Index Shows Around 0

XRP’s CMF is currently -0.01, after having had a short-term positive reading of 0.04 just a few hours earlier. The index reached a negative peak of -0.25 on December 6, after remaining positive from November 29 to December 5.

This CMF index conversion shows that XRP’s next moves remain uncertain, and that the asset is struggling to maintain bullish momentum.

CMF, or Chaikin Money Flow, measures the accumulation and distribution of assets over a specific period, taking into account both price and volume. It ranges from -1 to +1, with values above 0 indicating accumulation (buying pressure) and values below 0 indicating distribution (selling pressure).

The current CMF index of -0.01 points to weak selling pressure, suggesting that although there has been an attempt to reverse the downtrend, it is not strong enough to maintain positive upward momentum. If this trend continues, XRP price could face further downward pressure in the short term.

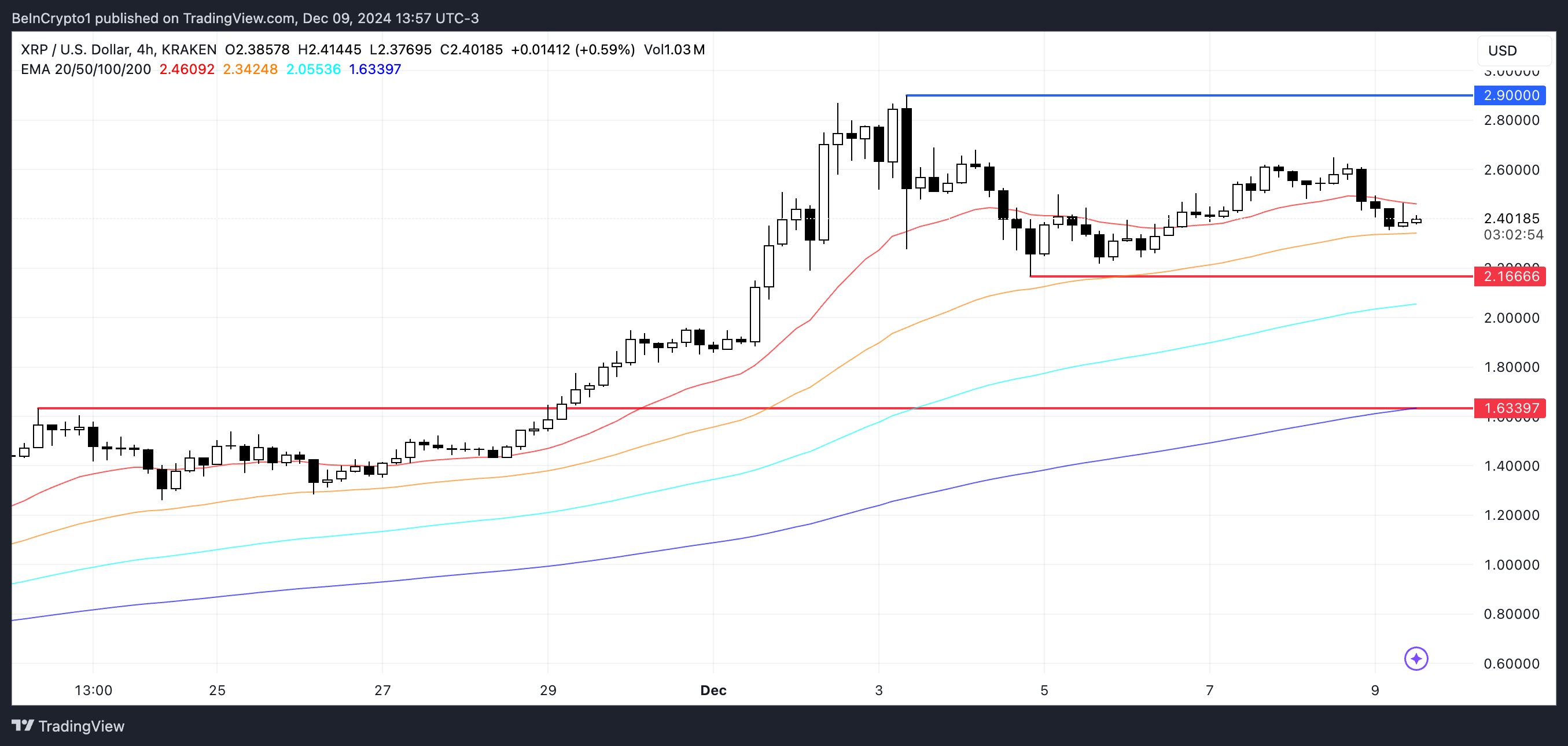

XRP Price Prediction: Can Ripple Fall Below 2 USD?

Ripple’s EMAs remain bullish, with the short-term lines above the long-term ones, suggesting an overall upward trend.

However, the price is currently below the shortest line, indicating that the trend may be changing and the bullish momentum may be waning.

If a strong downtrend develops, XRP price could test the support at $2.16, and if this level fails to hold, it could fall to $1.63, marking a 32% correction.

On the other hand, if Ripple price regains upward momentum, after having increased more than 330% in the past 30 days, it could rebound to $2.90 and potentially push to $3, an unprecedented level. seen as of January 7, 2018.