Cardano (ADA) has been facing a bearish trend in recent days, with its price down 7%. While this decline reflects pressure from the general market, it also opens up opportunities for holders. ADA.

The cryptocurrency’s current position creates the potential for a bullish reversal, fueling investors’ hopes.

Cardano has a chance

Cardano’s 30-day Market Value to Real Value Ratio (MVRV) shows that investors who bought ADA in the past month are experiencing an average loss of 15%. However, this decline has pushed the MVRV ratio into the opportunity zone, ranging from -13% to -26%. As history shows, this range has been the hallmark of spectacular rallies.

This is the first time in four months that ADA’s MVRV ratio has fallen into this key zone, indicating a possible bottoming. Previous times when this indicator fell into this area were accompanied by significant price recoveries. As ADA enters this phase, investors are closely following the altcoin for signs of momentum.

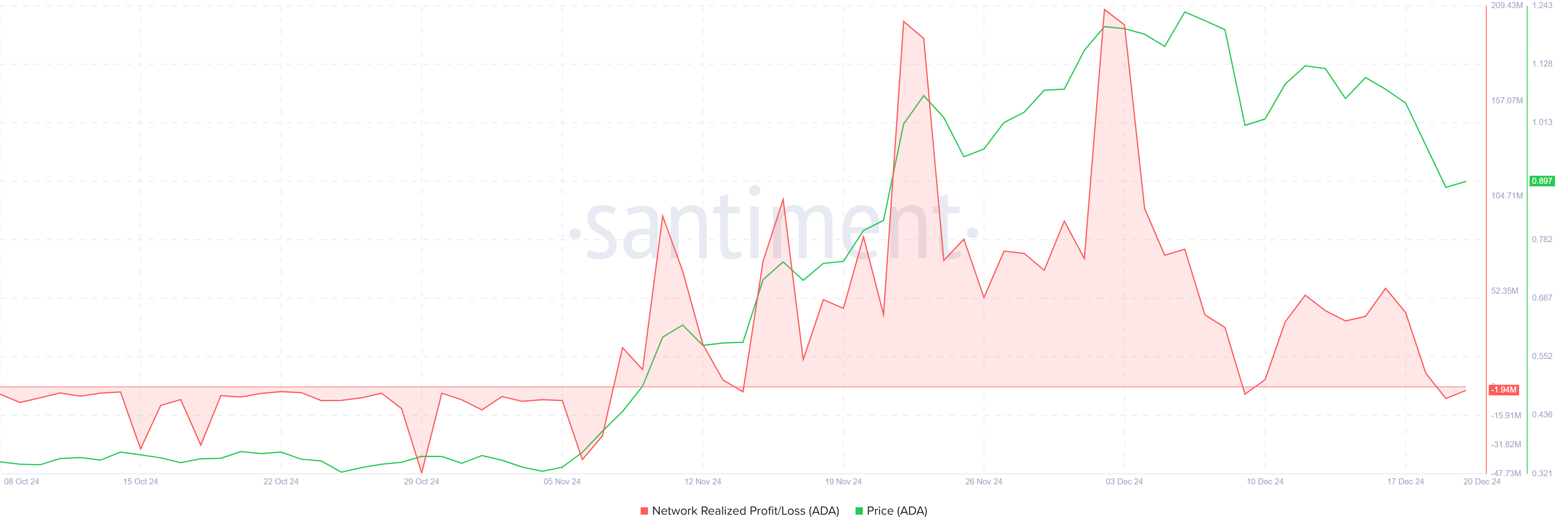

The actual profit indicator for Cardano is currently not showing significant spikes, suggesting that investors are refraining from selling to capture profits. This attitude is important because it helps minimize market volatility and eliminates the immediate threat of sharp corrections due to excessive selling.

With selling minimized for profit, the market has a chance to stabilize, allowing investors more space to accumulate ADA. This period of reduced volatility strengthens the foundation for a potential rally. The continued lack of profit spikes could pave the way for sustained growth in the near future.

ADA Price Forecast: Looking for a Recovery

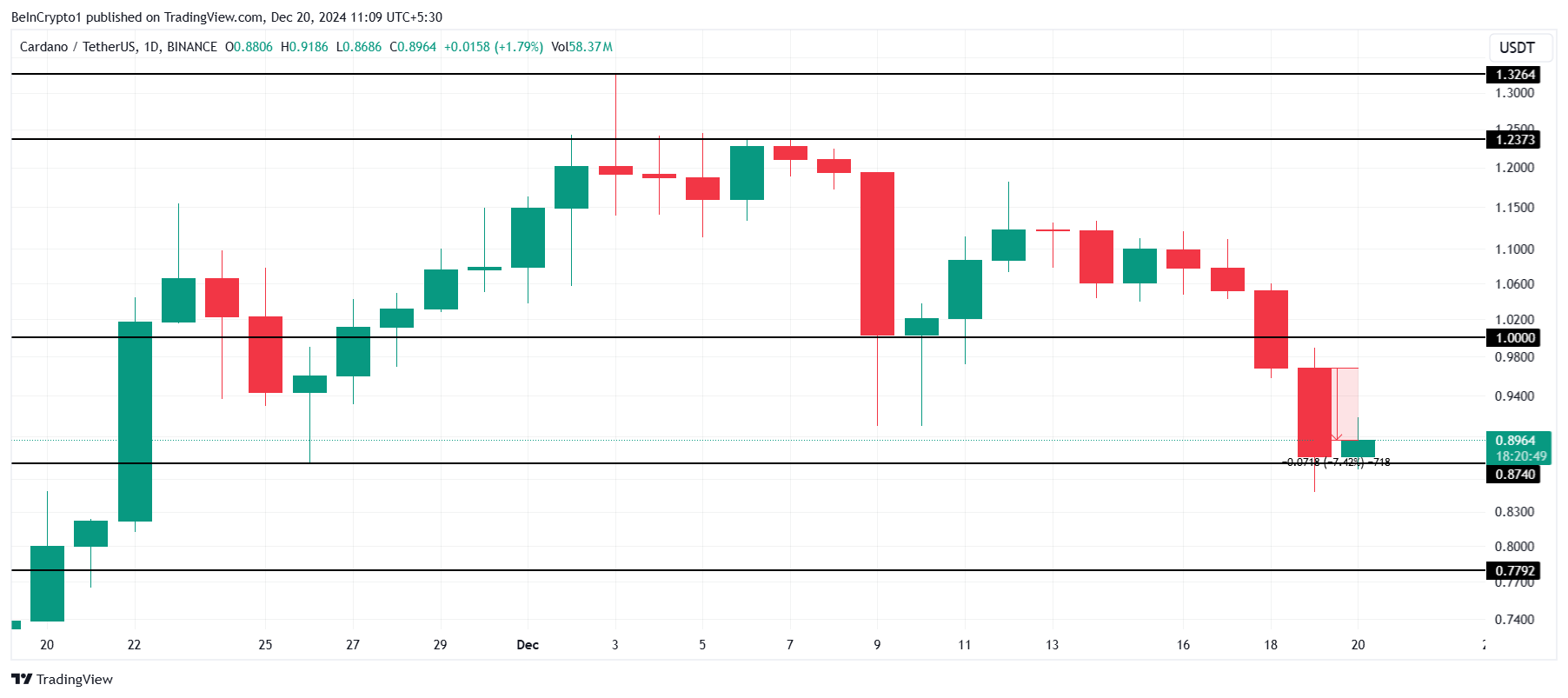

At $0.89, Cardano’s price is holding above the key support level at $0.87 after experiencing a sharp 7% slide in the past 24 hours. The ability to hold above this level is important to maintain bullish sentiment in the short term.

If the positive indicators turn into a rally, ADA could regain the $1.00 mark it lost. Turning resistance into support would mark new strength for Cardano, facilitating a price recovery to $1.23 and attracting further investor interest.

However, if it fails to hold above $0.87, the price could fall further. If this level is broken, ADA is likely to drop to $0.77, invalidating the bullish thesis and possibly initiating a bearish period.