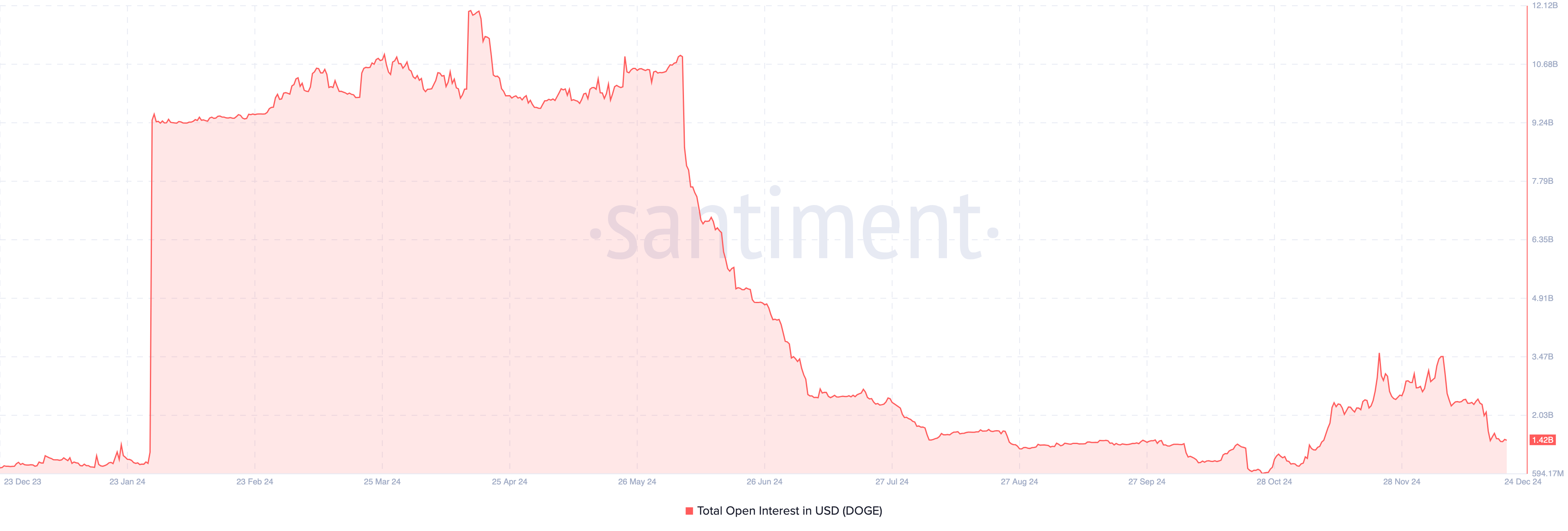

In April, Dogecoin (DOGE) Open Interest reached a yearly high of $12 billion, but has dropped sharply from this peak to October. It rebounded earlier this month but is now at risk. dropped to lowest since November 10.

The decline in Open Interest, commonly known as OI, corresponds to the price action of DOGE, which has dropped 20% over the past seven days. So, what awaits this cryptocurrency?

Dogecoin Traders Reduce Exposure, Investors Be Cautious

Currently, Dogecoin Open Interest is down to $1.42 billion. Open interest represents the total number of open contracts—long or short—in the futures or options market at any given time. The increase in OI indicates that new positions are being added, reflecting greater attachment and trust in the cryptocurrency’s price movements. Conversely, a decrease in this indicator represents the closing of positions, indicating a decline in trader confidence or a neutral view on the asset. Therefore, the notable decline in DOGE OI suggests that traders are not expecting a short-term price move that could result in good profits.

If this trend continues, with Dogecoin price falling towards $0.32, the value of the cryptocurrency could witness a prolonged correction.

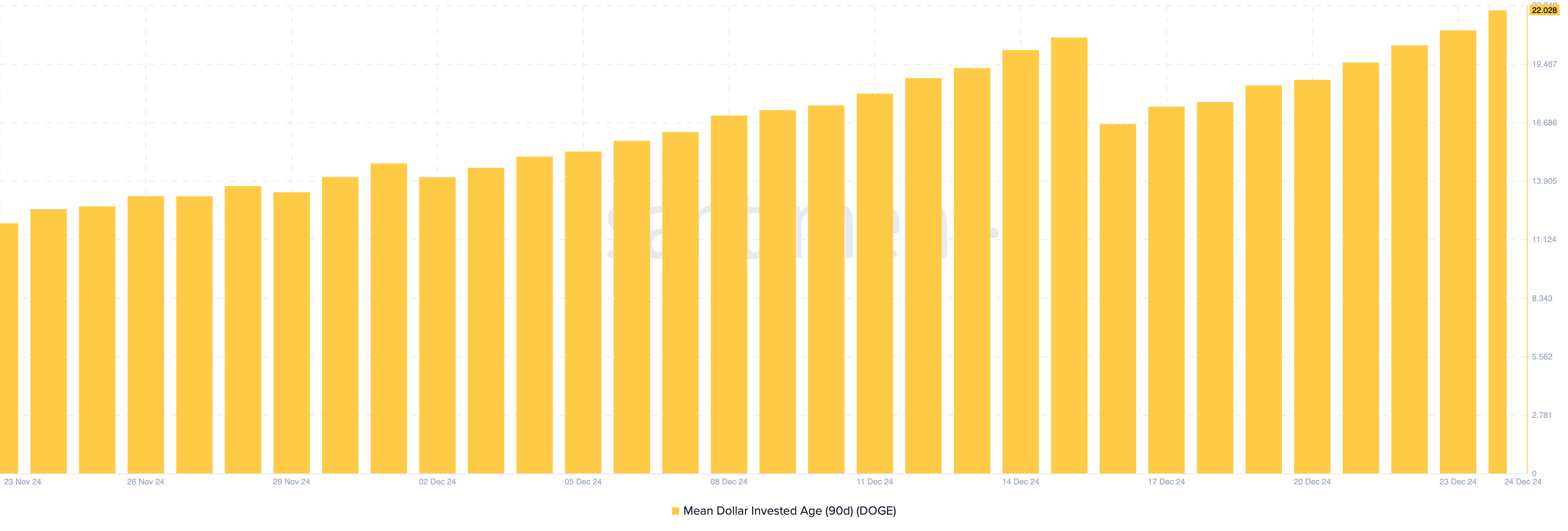

Median Investor Age (MDIA) is another indicator that suggests further decline in Dogecoin’s price. As its name suggests, MDIA is the average age of all coins on the blockchain adjusted for purchase price.

When MDIA increases, this suggests that investors are holding coins in their wallets without actively trading them. This indicates stagnation and is often considered a bearish sign. Conversely, a decline in MDIA indicates that previously inactive coins are being moved, implying increased activity or trading. This is generally considered beneficial, as it can signal renewed interest and liquidity.

According to Santiment, Dogecoin’s 90-day MDIA has increased, suggesting that owners are largely keeping the coin stationary. If this situation persists, it supports the cryptocurrency’s bearish outlook.

DOGE Price Forecast: The Correction Is Not Over Yet

On the daily chart, DOGE continues to lose ground above key support levels. Notably, the coin fell below the $0.35 support zone as investors failed to defend this area. The Moving Average Convergence-Divergence Index (MACD) also supports this decline.

MACD measures momentum. When this index is positive, momentum is bullish. But if it is negative, then the index is decreasing. As observed below, the MACD is in the negative zone. If this remains the same, Dogecoin price could drop to $0.27.

Conversely, if investors reclaim the $0.35 support zone and defend it successfully, this trend could change. In that case, DOGE could recover to $0.48.