AAVE, the native token that runs the DeFi (DeFi) lending protocol Aave, has skyrocketed 12% in value in the past 24 hours. This wave follows a recent proposal to integrate Chainlink’s new oracle.

As of now, AAVE is trading at $369.10 and is trending back towards a three-year high of $399.85.

Aave Plans to Integrate Chainlink’s Smart Value Recapture (SVR).

On December 23, Chainlink was introduce Smart Value Recapture (SVR) service. This is an oracle service designed to capture profits generated from Maximum Extractable Value (MEV) and redistribute it to DeFi protocols.

After launch, a community member submitted one propose Temporary check in to Aave’s admin forum to discuss integrating SVR into the lending protocol.

According to the proposal, liquidators and foragers typically profit more during Aave’s liquidation process, leaving less value for the protocol’s users. By integrating Chainlink’s SVR system, MEV generated from Aave’s liquidations will be reclaimed and distributed fairly to all participants, including finders, builders, and the protocol itself .

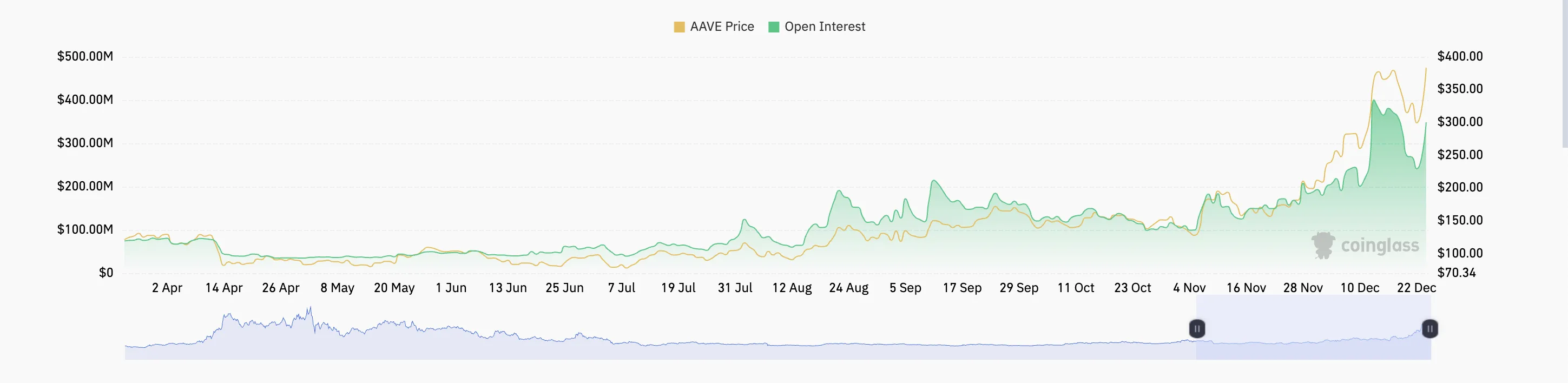

This proposal stimulated strong trading activity in AAVE. In the past 24 hours, its value has increased significantly. The increase in open interest has confirmed the increase in demand for this altcoin.

Up to this point, open interest reached 376 million USD, an increase of 32%.

Open interest is the total number of outstanding contracts in the derivatives market, such as futures or options, that have not been settled. As with AAVE, when an asset’s open interest increases during a bull run, traders are opening new positions in the bullish direction, indicating strong market confidence and the potential for continued upward momentum.

Additionally, on the daily chart, AAVE’s RSI is in an uptrend, reflecting buying and selling activity. According to data at this time, it is at 62.88.

This indicator measures the oversold and overbought market conditions of an asset. At 62.88 and in an uptrend at this point, market participants are buying more AAVE than they are selling.

AAVE Price Prediction: Likely Rise Above $400

AAVE is currently trading below resistance at a three-year high of $399.85. If buyers continue to accumulate, AAVE could break through this resistance and establish it as a support floor. This breakout could push its price above $400 for the first time since 2021.

However, if a sell-off begins, they will invalidate this bullish outlook, and AAVE’s price could drop to $323.46.