Ethereum (ETH) price has increased 48.19% in 2024, but still lags behind Bitcoin’s 123% increase this year. Although ETH has achieved impressive results, its recent uptrend appears to be losing momentum, with ADX showing that the trend’s strength is weakening.

Large institutional investors are accumulating more ETH, reaching the highest number of large holders since September. Key resistance at $3,523 will be important in determining whether ETH can extend its upward momentum to $4,100 or will face a correction to test lower support levels.

ETH Uptrend Still Strong, But May Be Losing Momentum

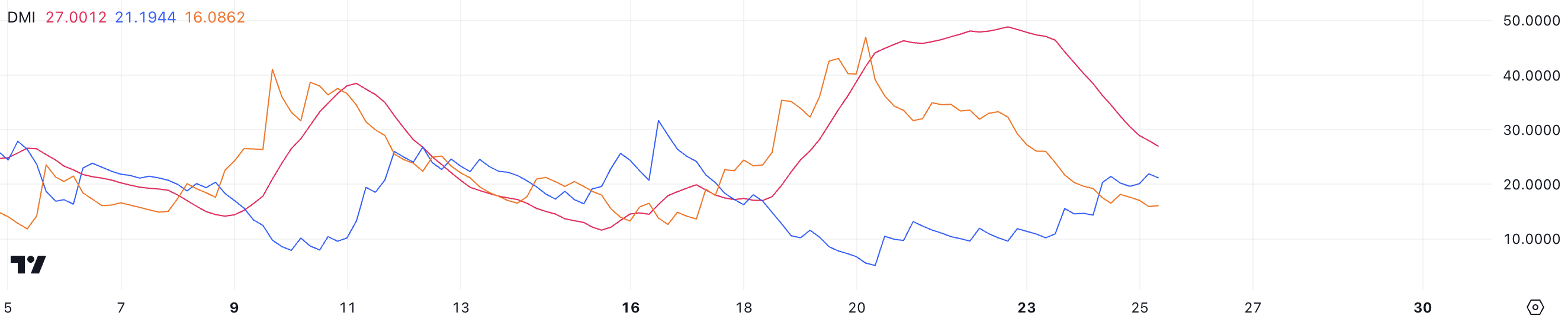

Ethereum’s Directional Movement Index (DMI) chart shows that the Average Directional Index (ADX) is currently at 27, down sharply from 46 just two days ago. This decline indicates that the strength of ETH’s recent uptrend is fading, although the price has consolidated after gaining 9% over the past three days.

Despite the ADX hinting at bearish momentum, the D+ index (positive direction indicator) at 21.1 was still higher than the D- index (negative direction indicator) at 16, confirming that buying pressure remains strong. selling activities, although less intense than before.

ADX is a popular indicator that measures the strength of a trend on a scale of 0 to 100 without specifying direction. Values above 25 indicate a strong trend, while values below 20 signal a weak or non-existent trend.

With Ethereum’s ADX currently at 27, the uptrend remains moderately strong, but the decline in value highlights a slowdown in momentum as the market consolidates. This suggests that the price of ETH is stabilizing, potentially setting the stage for both a continuation of the uptrend or a change in sentiment if sellers prevail.

Ethereum’s Major Institutional Investors Just Hit Highest Level Since September

The number of whales holding at least 1,000 ETH has reached its highest level since September, now reaching 5,631. This marks a recovery from 5,565 recorded on October 26, indicating increased interest and accumulation by large investors.

The increase in whale activity indicates growing confidence from large investors, which is often considered a good signal for Ethereum’s price trend.

Monitoring the activities of whales is important because these large investors can significantly influence market trends due to their large positions. An increase in the number of whale addresses often indicates accumulation, which can support price stabilization or growth momentum.

With the highest number of Ethereum whales since September now recorded, this accumulation may indicate that major investors are preparing for a possible price increase, hinting at near-term optimism . Increased interest from whales could lay the groundwork for Ethereum’s price to maintain strength or even increase further if this trend continues.

ETH Price Prediction: Nearest Resistance Is Important

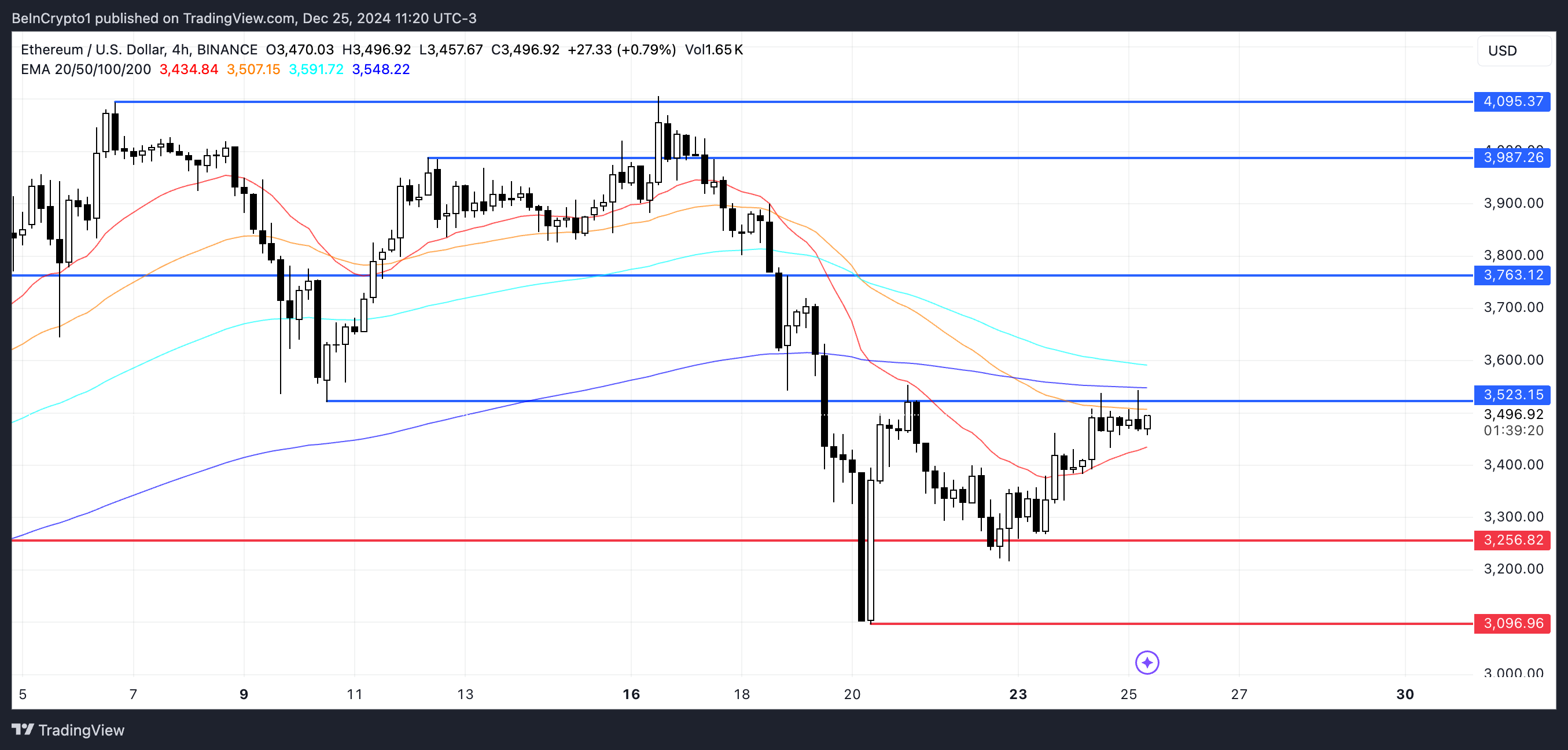

Ethereum’s resistance at $3,523 is an important factor for short-term price developments. If this resistance is surpassed, ETH could test $3,763 next.

If the uptrend continues, Ethereum price could continue to climb towards $3,987 and potentially test levels around $4,100 once again, signaling a strong continuation of the bullish momentum.

On the other hand, if ETH fails to surpass $3,523, the price could face a correction, testing support at $3,256.

If this support fails to hold, ETH price could fall to $3,096, indicating increased selling pressure.