Solana (SOL) price continues to attract significant user activity and trading volume on applications such as Raydium, Pumpfun, and Jito. However, SOL has dropped 17% in the past 30 days, lost a market capitalization of $100 billion and is currently at $90.6 billion.

Indicators such as BBTrend and ADX hint at a weakening of the downtrend, with signs of a potential recovery in momentum. Key levels at $183 support and $194.99 resistance will determine whether SOL can stabilize and climb back towards $200 or face further decline.

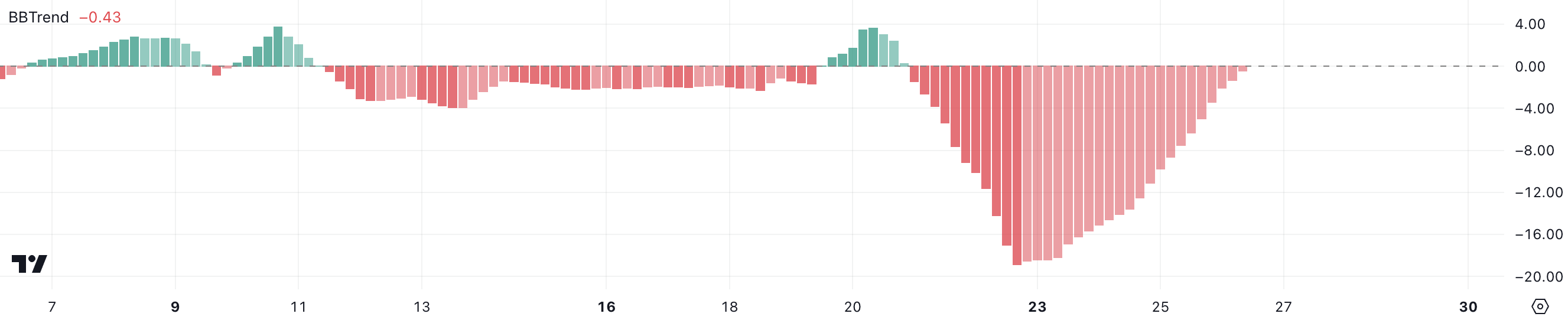

BBTrend Solana Almost Positive After 5 Days

Solana’s BBTrend is currently at -0.43, its highest level since December 21. This is a significant recovery after bottoming at -18.89 on December 22. This steady upward movement shows that the bearish momentum is weakening, and buying pressure has gradually increased over the past few days.

Although SOL’s BBTrend remains negative, the move closer to the neutral zone and positive potential suggests a change in market sentiment that could pave the way for price stabilization or an uptrend in the short term.

BBTrend, or Bollinger Band Trend, is a momentum indicator derived from Bollinger Bands that measures the price relationship to the midpoint of the band. Positive BBTrend values reflect bullish momentum, while negative values signal bearish conditions.

If SOL’s BBTrend turns positive again, as last seen on December 20, this confirms a complete reversal of bearish sentiment and could support a new bullish price trend. In the short term, BBTrend’s continued recovery is a good sign, suggesting that SOL’s price could record further growth if buying momentum continues to strengthen.

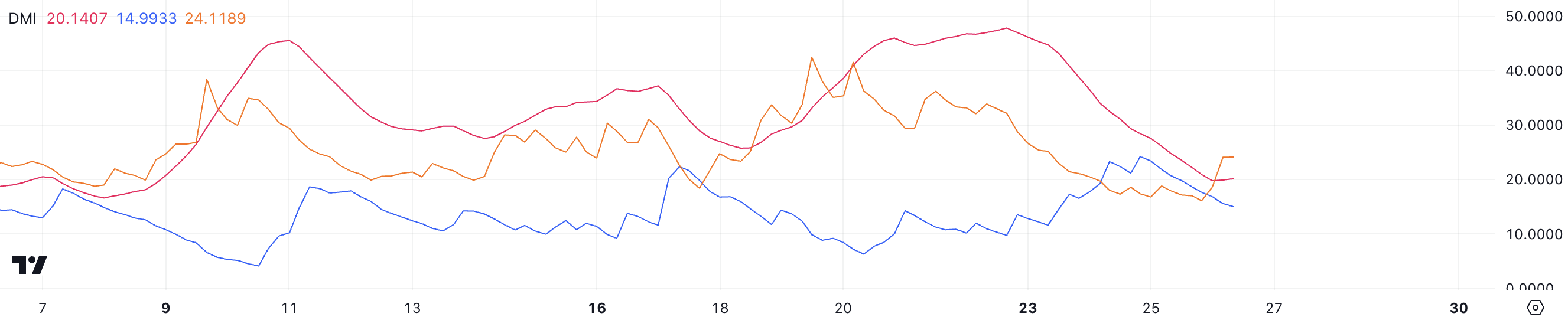

SOL’s Downtrend Is Not Too Strong, But It Can Recover

SOL’s Directional Momentum Index (DMI) chart reveals that the Average Directional Index (ADX) is now at 20.14, down sharply from nearly 50 just three days ago. This decline indicates a significant weakening in trend strength, although SOL is still in a bearish phase.

The positive directional index (D+) fell to 14.99 from 24 two days ago, signaling an easing of buying pressure. In contrast, the negative directional index (D-) rose to 24.11 from 17.3, reflecting increased selling activity. This combination suggests that sellers currently dominate the market, although the weaker ADX suggests the downtrend may be losing momentum.

ADX measures trend strength on a scale of 0 to 100, without specifying direction. Values below 20 suggest a weak trend, while values above 25 indicate a strong trend. With Solana’s ADX at 20.14, the current downtrend is gradually weakening, although selling pressure is still higher than buying activity.

In the short term, this could mean SOL’s price could stabilize or consolidate, as the lack of a strong trend could create an opportunity for buyers to return to the market. However, D-‘s continued dominance could still push prices down if sellers retain control.

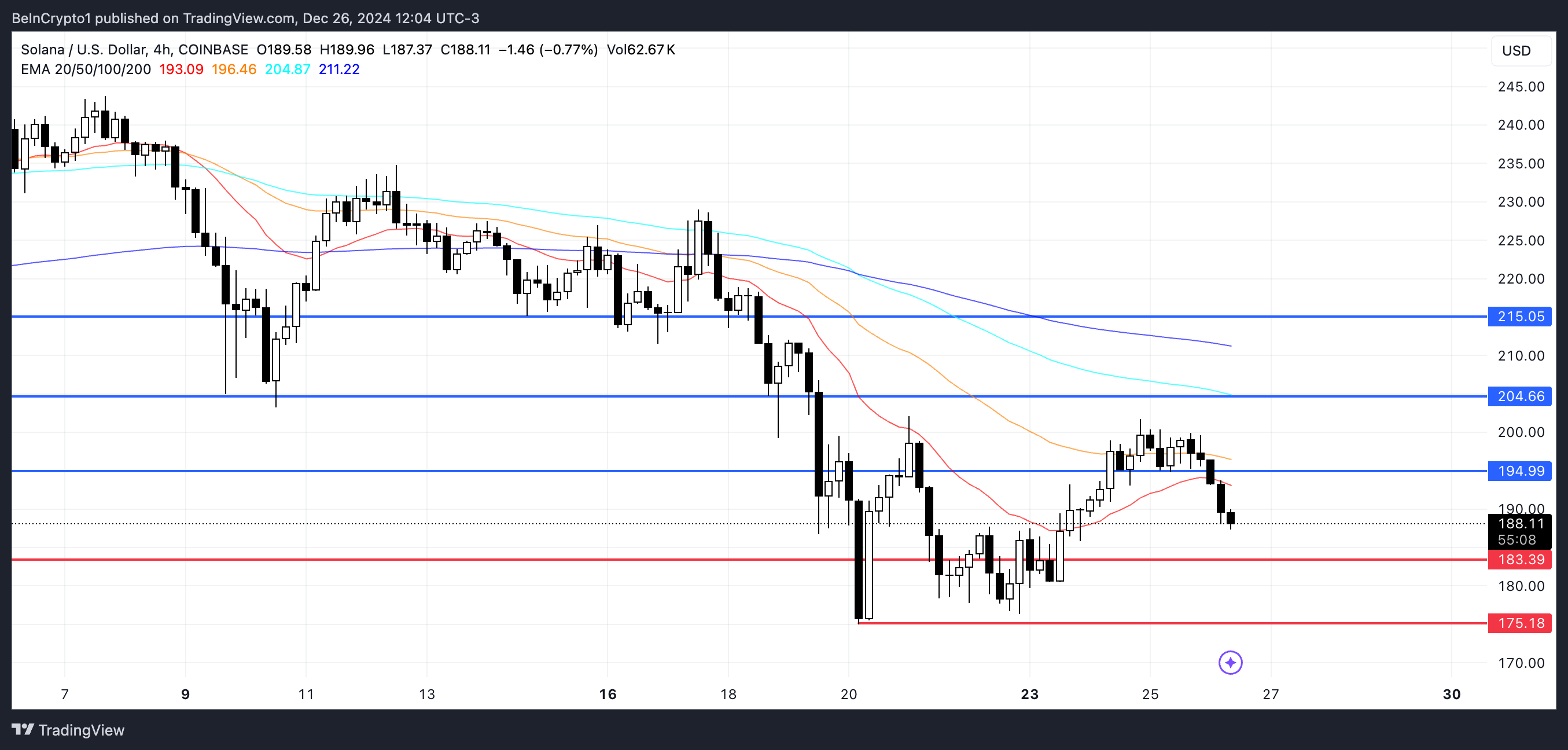

Solana Price Prediction: Can SOL Climb to $200 Soon?

Solana’s price is currently trading within a range defined by a support level at $183 and a resistance level at $194.99. If the $183 support fails to hold, SOL price could face further downside pressure and could drop to the next key level at $175.

This scenario would signal continued selling momentum, making the $183 support a key threshold to maintain short-term stability.

Conversely, if SOL price can regain positive momentum and clear the $194.99 resistance, it could open the door for further growth.

The next targets would be $204 and $215, marking a potential 14% upside from current levels.