XRP price remains stagnant, with the cryptocurrency having maintained a six-week correction and falling short of its all-time high (ATH) of $3.31.

Investors, feeling frustrated by the lack of motivation, chose to withdraw, signaling increased profit-taking. This trend could influence the altcoin’s price journey in the coming weeks.

XRP Investors Are Retreating

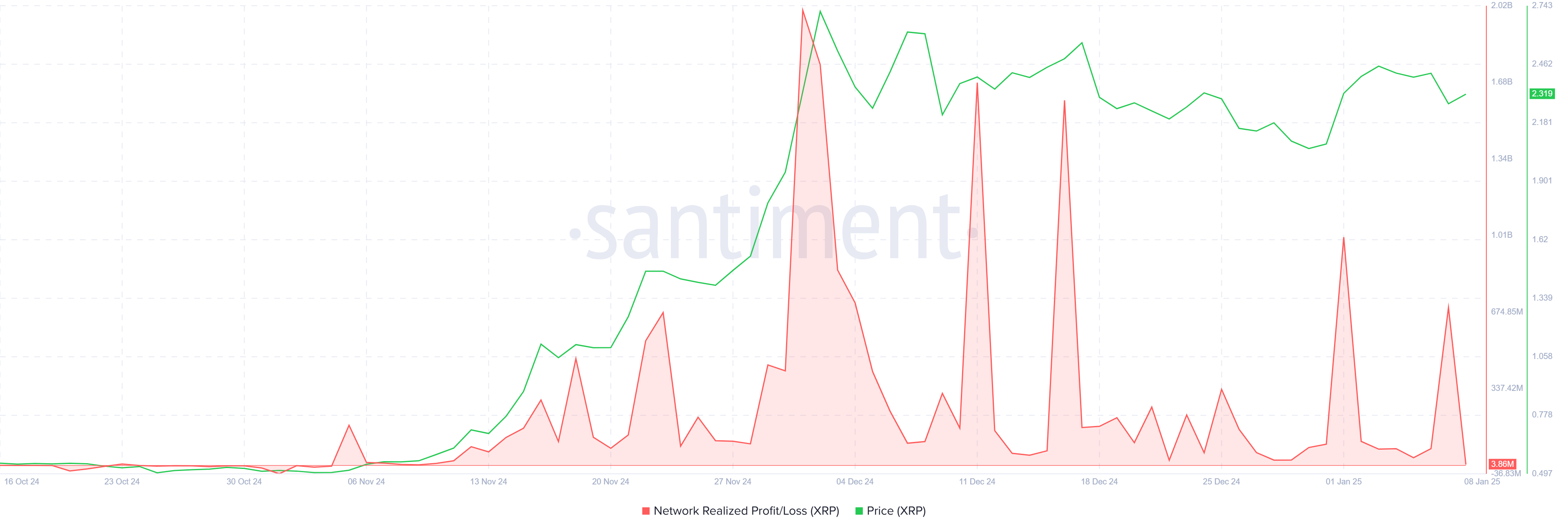

Real profits have spiked in the past 24 hours, with nearly 695 million XRP, worth more than $1.6 billion, sold. This increase in profit-taking reveals growing investor dissatisfaction with XRP’s flat price volatility. Similar behavior has been observed previously during extended correction periods and may increase selling pressure.

The current correction has caused minor sell-offs, keeping XRP from growing. As the frequency of sales increases, the Token’s price may face additional challenges, but the persistence of key support levels still offers hope for stability.

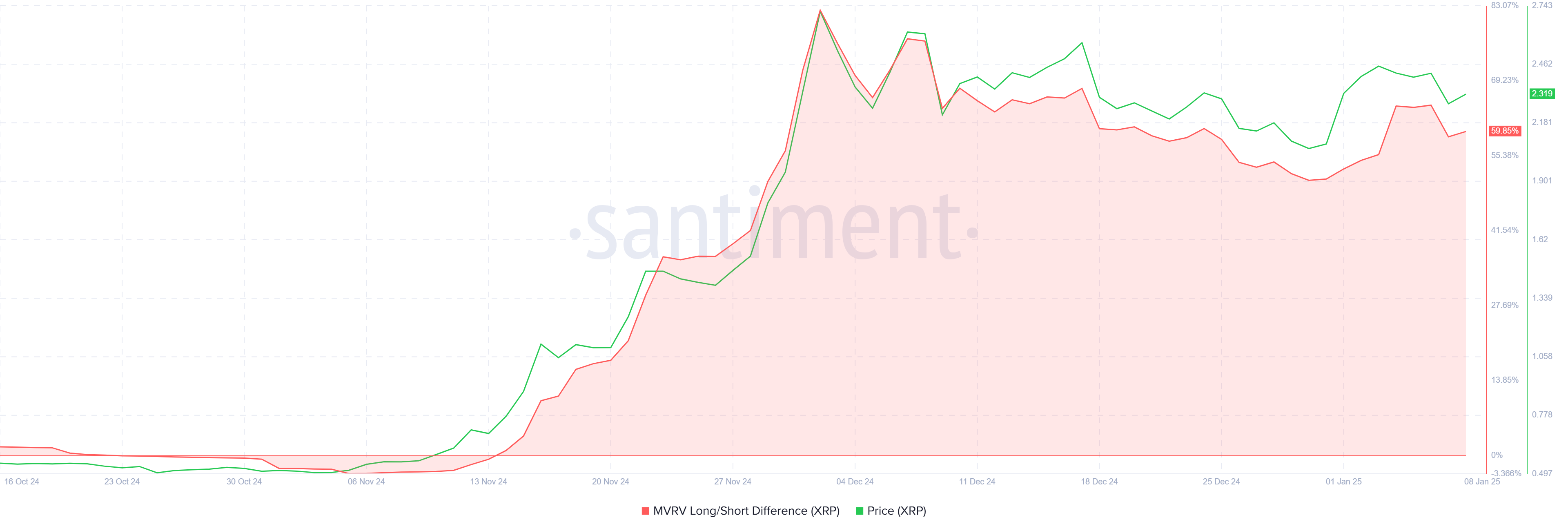

The long/short MVRV ratio shows that long-term investors are still in profit, helping to maintain the stability of XRP. These investors, vital to the health of any cryptocurrency, are proving resilient by holding their ground despite a stagnant market.

This resilience has helped XRP maintain support at $2.00, even amid increased profit taking. As long as these investors continue to support the asset, XRP is unlikely to experience a major price drop, barring a spike in selling activity.

XRP Price Prediction: No Escape

XRP is currently trading at $2.31, locked into a corrective range of $2.00 to $2.73. This correction, which lasted six weeks, hindered any significant price growth for the altcoin.

That prevented XRP from conquering the $2.73 resistance level and reaching its ATH of $3.31. Given current market conditions and investor sentiment, this trend of price stagnation is likely to continue in the short term.

However, an increase in selling pressure could threaten XRP’s $2.00 support level. Loss of this key level could result in a decline, potentially reaching $1.50 or lower. This scenario would invalidate the neutral-bullish stance, leading to significant losses for investors.