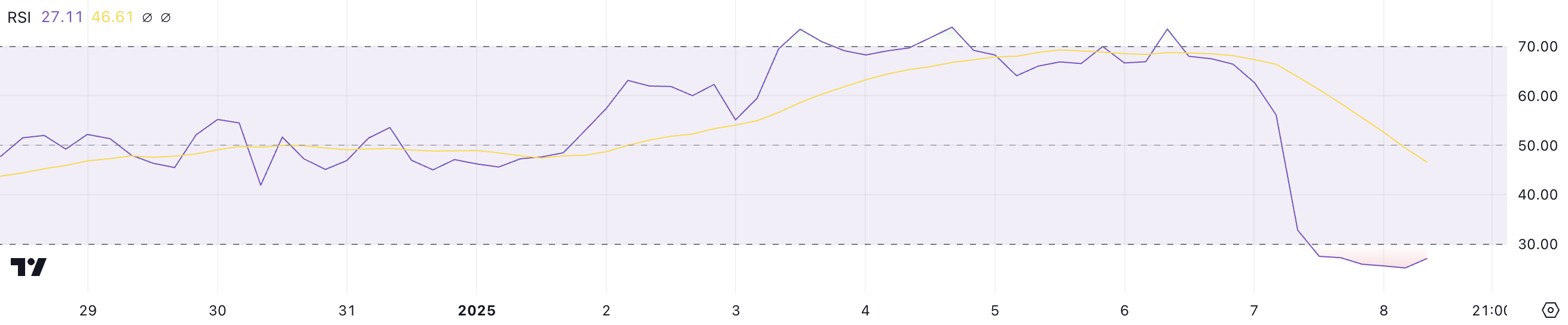

Ethereum (ETH) price has dropped nearly 8% in the past 24 hours, as it risks losing its $400 billion market capitalization. The sell-off pushed ETH’s RSI down to 27.1 – the lowest level since December 20, signaling oversold conditions and weak market sentiment.

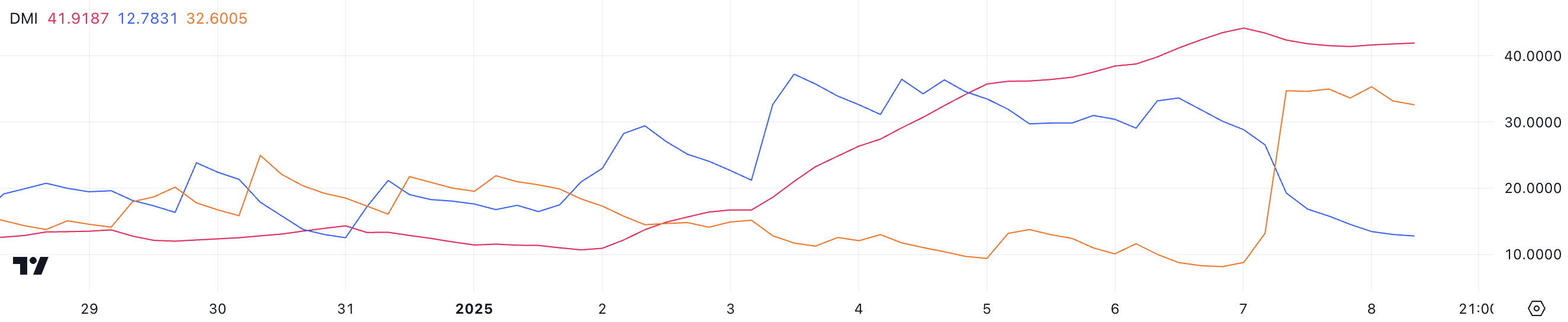

ADX indicates that the current downtrend is strong, with bearish momentum dominating as -DI surpasses +DI. If the downtrend continues, ETH could test key support levels, but a reversal could allow it to challenge resistance and restore bullish momentum.

Ethereum’s RSI Hits Lowest Level Since December 20

Ethereum’s relative strength index (RSI) fell to 27.1, a sharp drop from 66.3 in just one day. RSI is a technical momentum indicator that measures the speed and intensity of price movements on a scale of 0 to 100.

Typically, values above 70 indicate overbought conditions, suggesting a possible turnaround, while values below 30 indicate oversold conditions, often signaling a possible recovery. ETH’s current RSI level of 27.1 marks its lowest reading since December 20, reflecting sharp bearish momentum and heavy selling pressure in the market.

At such deeply oversold levels, ETH’s RSI suggests that the recent sell-off may have extended, setting the stage for a potential recovery if buying demand returns.

However, the sharp decline also indicates weak market sentiment, which could lead to continued downward pressure if the current trend continues.

ETH DMI Shows Strong Downtrend

Ethereum’s Average Directional Index (ADX) is currently at 41.9, reflecting a strong market trend. ADX is a technical indicator that measures the strength of a trend, independent of its direction, on a scale of 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggests weak or no momentum.

The steady growth of ETH’s ADX since December 3 suggests that the current market trend, although bearish, has gradually strengthened and remains stable.

+DI, which indicates buying pressure, fell sharply to 12.7 from 33.6 from the previous day, pointing to a significant weakening of bullish momentum. In contrast, -DI, which reflects selling pressure, increased to 32.5 from 8.7, highlighting the growing dominance of sellers.

This configuration confirms that ETH price is in a downtrend, with sellers retaining control. If this trend continues, ETH price could face a continued decline unless buying pressure increases again to counter the growing decline.

ETH Price Prediction: Sign of Doom Is Near as $3,448 Resistance Is Key

Ethereum’s EMAs show the possibility of a “death” signal, a bearish signal when short-term EMAs cross below long-term EMAs. If this formation occurs, it could intensify the correction already underway.

A fall below the key support levels of $3,297 and $3,096 could push ETH price lower to $2,723, which would mark an 18.8% drop.

Meanwhile, for the bulls, Ethereum price could restore momentum if it holds above key support levels and reverses the current trend. In this case, ETH could test the resistance at $3,448, and a successful breakout could lead to $3,546 and even $3,827.